Senior Reporter

Medium-Duty Sales Lose Ground in March

U.S. retail sales of medium-duty trucks overall dropped nearly 20% in March as only Class 7 posted a gain compared with a year earlier, WardsAuto.com reported.

Sales of Classes 4-7 trucks fell to 17,244, down 18.3% compared with 21,105 in the 2019 period, according to Wards.

Year-to-date sales were off 8.7%, falling to 51,271 compared with 56,166 a year earlier.

ACT Research had been whittling down its medium-duty forecast since late last year, eyeing a 25% to 30% year-over-year decline, as it became clear big customers weren’t coming to the marketplace. “Now you throw COVID-19 on top, and the medium-duty buyer is just getting punched in the nose,” ACT Vice President Steve Tam said. “This is all about the consumer, with the retail and restaurants shutting down, and all the services.”

ACT’s forecast as of April 14 for North American Classes 5-7 medium-duty build, was 125,000. That’s down 56% from 281,400 a year earlier.

“We expect to see second-quarter GDP down somewhere between 25% and 30%, with full-year GDP down 5%” as consumers have to withdraw from the economy, he said.

Getting ahead of the virus will begin to bring consumers back, Tam said. But with what changes in routine behavior, and testing and where would that be done, and requiring how much use of personal protection equipment?

“[We have now] basically the prospect of hope. A cure, or vaccine, is too far away,” he added.

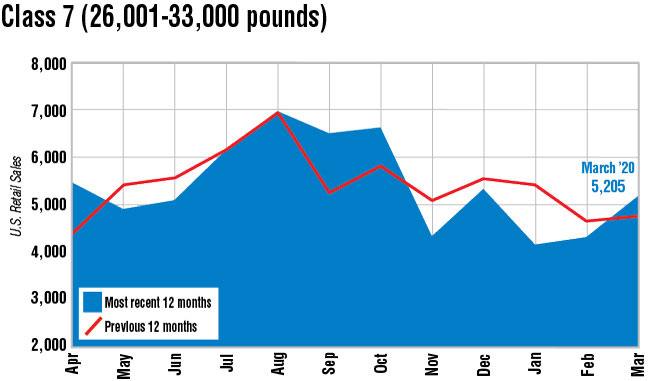

In the meantime, Class 7 sales rose 10% to 5,205 compared with 4,731 a year earlier. The combined brands of Paccar Inc., Peterbilt Motors Co. and Kenworth Truck Co. accounted for much of the gain.

Compared with a year earlier, Peterbilt’s Class 7 sales hit 1,033, up from 605. Kenworth posted sales of 650 compared with 385. Together, the brands improved sales by 693 units.

While still the market leader in Class 7, Freightliner, a brand of Daimler Trucks North America, saw sales dip to 1,929 compared with 2,041 in the 2019 period.

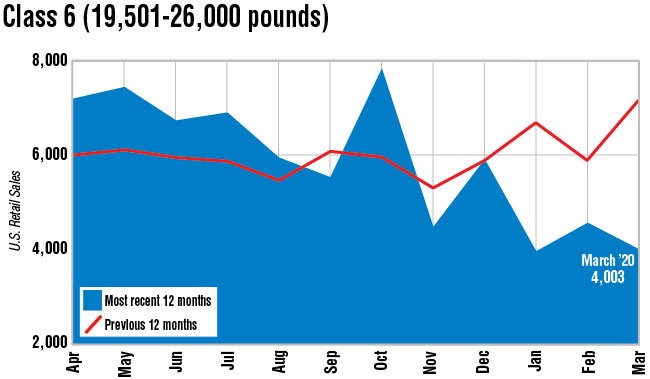

Class 6 sales plunged 44.4% to 4,003 compared with 7,199 a year earlier in this tightly contested segment.

Sales at segment leader Freightliner exceeded sales of Navistar Inc.’s International brand by three trucks, 1,019 to 1,016.

At Ford Motor Co., sales fell to 922, down 49% from its Class 6 sales a year earlier when they were 1,820.

“Looking at the quarter, it started out really well,” Mark LaNeve, Ford vice president of U.S. marketing, said in a release, referring to overall sales. “March was actually going really good until the 10th, and then as we started getting states going to shelter in place, then we started feeling a much more profound impact.”

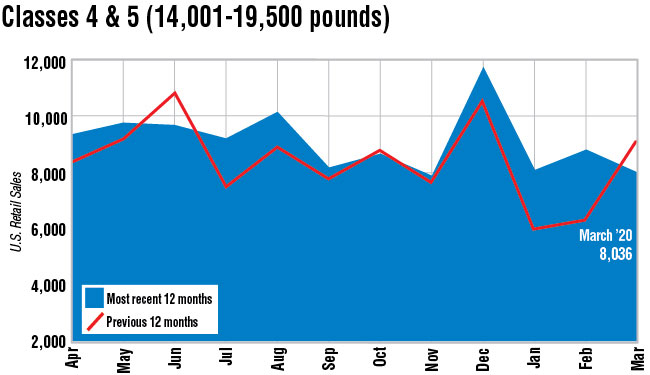

Sales in Classes 4-5 fell 12.4% to 8,036 after registering the only increased demand over the year’s first two months.

Want more news? Listen to today's daily briefing: