Senior Reporter

Medium-Duty Sales in April Fall, but Some Positives Seen in Lighter Segments

[Stay on top of transportation news: Get TTNews in your inbox.]

U.S. retail sales of medium-duty trucks were supported in an otherwise abysmal April by a modest gain in the lighter segments. Overall sales fell 29% compared with a year earlier, WardsAuto.com reported.

Sales of Classes 4-7 trucks in the month dropped to 15,686 compared with 22,080 a year earlier, according to Wards. For the first quarter, sales were off 14.4% as they fell to 66,957 compared with 78,246 in the 2019 period.

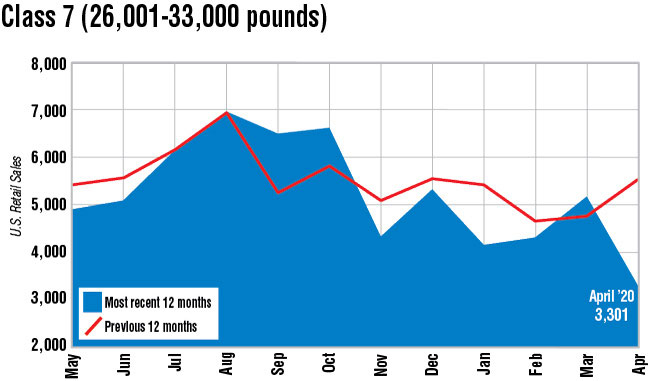

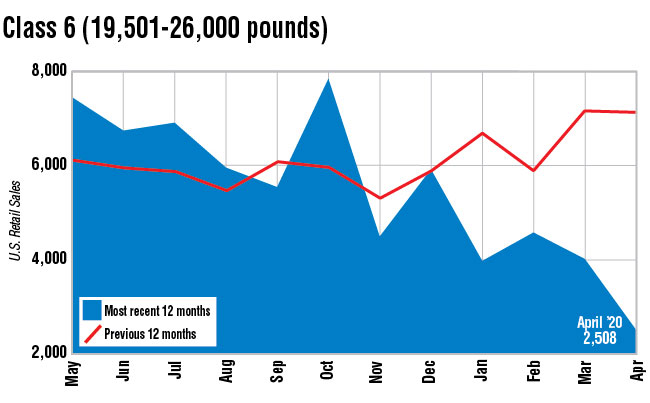

In Class 7, sales fell 40%, and for Class 6 the plunge was 65%.

Those two segments are the core of the leasing market, ACT Research Vice President Steve Tam said. “I continue to think that those guys in the lease/rental business are going to behave much like large for-hire fleets in that they have sufficient capacity to meet whatever customer demand they may have right now.”

The novel coronavirus pandemic also has companies cutting back more on otherwise typical capital expenditures, Tam added.

Class 7 sales fell to 3,301 compared with 5,505 a year earlier.

Freightliner, the segment’s leader, saw its sales drop 54% to 1,263.

Class 6 sales fell to 2,508 compared with 7,169 in the 2019 period.

Despite fewer sales, the segment remained competitive as Hino Trucks, with 523 sales, and Ford Motor Co. with 497, stayed on the heels of Freightliner, which had leading sales of 697 trucks.

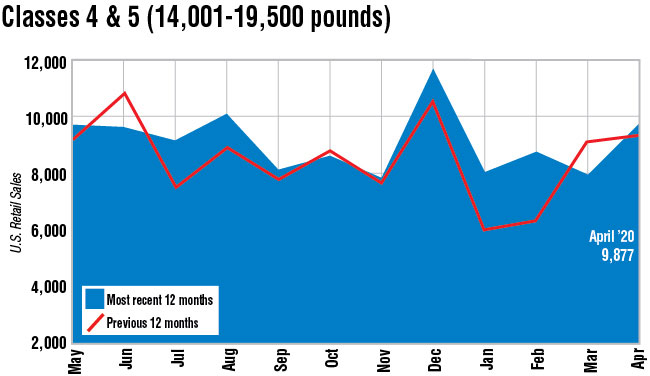

Classes 4-5 sales were up 5% at 9,877 compared with 9,406 a year earlier.

In Class 5, Freightliner surged to 3,166 sales compared with 412 a year earlier.

Ford retained its lead in the segment with 3,478 sales compared with 4,596 a year earlier.

Fiat Chrysler Automobiles saw sales fall to 538 compared with 1,414 a year earlier.

In Class 4, General Motors increased sales to a leading 854 trucks compared with 227 a year earlier.

Sales by Isuzu Commercial Truck of America, typically the segment’s leader, fell to 591 compared with 1,463 in the 2019 period.

In related news, automakers shut down U.S. operations, including truck plants, and some dealerships, temporarily in mid-March amid workplace health concerns related to the pandemic.

On May 7, Michigan Gov. Gretchen Whitmer gave them the green light to resume production in her state.

Ford was targeting a May 18 reopening date for its truck plants, and others, the company reported May 7. Ford parts distribution centers were scheduled to resume full operations in North America on May 11 to support Ford dealers in providing service to keep vehicles on the road.

GM and FCA were reported to be on a similar reopening schedule, but that could not be verified on their respective websites.

Want more news? Listen to today's daily briefing: