Senior Reporter

Medium-Duty Gains in September Led by Class 7

[Stay on top of transportation news: Get TTNews in your inbox.]

U.S. retail sales of Class 4 through Class 7 trucks rose 5.8% in September compared with a year earlier, and included large gains in Freightliner sales of Class 7 vehicles.

Overall sales reached 20,278 compared with 19,173 in the year-earlier period, WardsAuto.com reported.

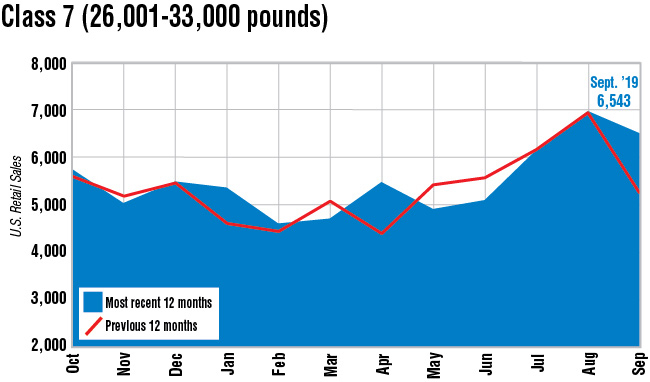

Class 7 sales rose a leading 25.2% to 6,543, or a gain of 1,319 trucks compared with a year earlier. And 66% of the gain came from Freightliner alone, as its year-over-year sales increased by 878 to 2,912.

International, a brand of Navistar Inc., Ford Motor Co., and Peterbilt Motors Co. and Kenworth Truck Co., both brands of Paccar Inc., also reported year-over-year gains in Class 7.

Freightliner is a brand of Daimler Trucks North America, which reported supply constraints are easing, and more trucks are being delivered now.

In a recent survey of Freightliner dealers by analyst Neil Frohnapple with The Buckingham Research Group, several dealers responded that strong demand this year from construction, utility and government customers is driving their year-over-year increase in medium-duty sales.

“Overall, dealers expect medium-duty truck sales to increase low single-digits on average in 2019, which is in line with their outlook in our prior [quarterly] survey,” Frohnapple wrote. “Notably, a few dealers had customers report that the fuel economy for DTNA’s proprietary DD8 engine is impressive.”

Meanwhile, Steve Tam, vice president of ACT Research, said he expected production next year to slow down, as “we [will be] burning off inventory as we roll through 2020.”

Production started abating in July, according to ACT.

“So demand is softening and I think that is the bigger issue, and that’s just in line with the general economic tenor of what is going on right now,” Tam said. “It’s not a concrete slowing in that portion of the business, as it is a sentiment. You have a higher concentration of small business owners in the medium-duty marketplace, and I think they are just unsure what the near-term future holds.”

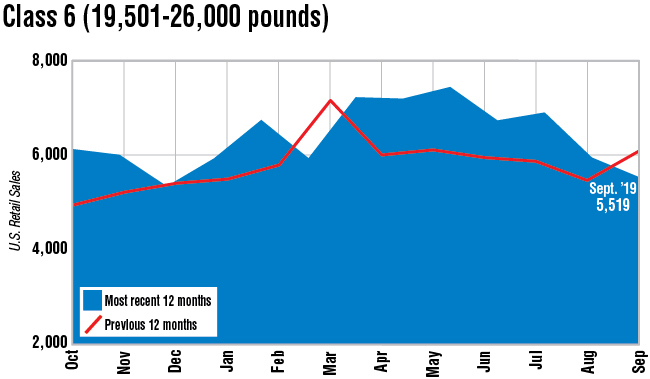

Class 6 sales fell 9.7% to 5,519 compared with 6,110 a year earlier, according to Wards. That included a nearly 1,000-truck decline in sales at Ford.

“We had a lot of demand from the lease-rental fleets in the 2017 and 2018, and that diminished in 2019, and will likely in the 2020 time frame, too,” Tam said.

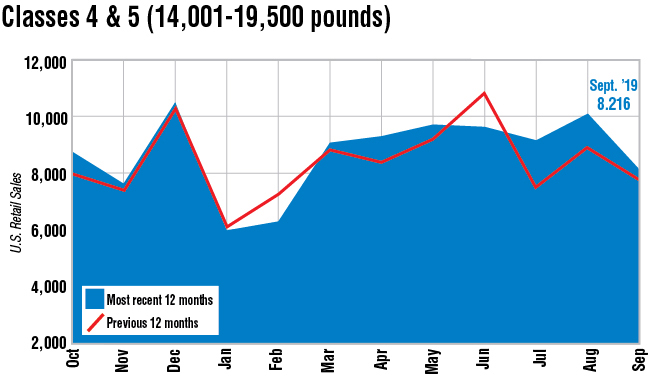

Sales of Class 4 through Class 5 trucks climbed 4.8% to 8,216.

Want more news? Listen to today's daily briefing: