Managing Editor, Features and Multimedia

May Truck Sales Jump 20%

This story appears in the June 15 print edition of Transport Topics.

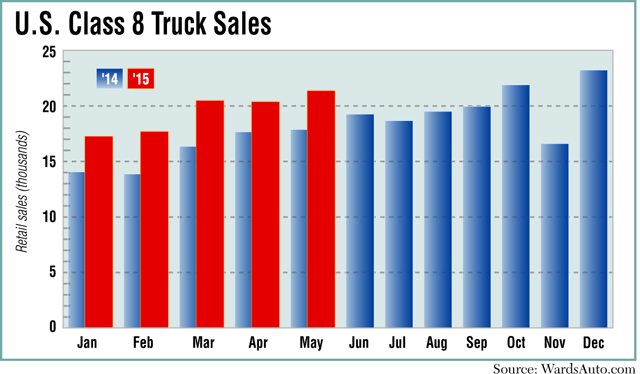

Heavy-duty truck sales in the United States continued their upward trajectory, topping 20,000 units for a third straight month in May and climbing 20% from a year earlier, WardsAuto.com reported.

Retail sales of Class 8 trucks increased to 21,501 last month, up from 17,990 in May 2014 and a 5% gain from 20,509 in April, Ward’s figures showed.

May’s volume was the highest total this year and marked the 21st consecutive month of year-over-year sales growth.

Through five months of 2015, sales volumes easily have outpaced 2014 levels, even though that was the industry’s best year since 2006. Cumulative sales have risen to 97,819 units, up 22% compared with the same timeframe last year.

“The combination of a slightly improving economy, strong financial results of many carriers and the desire to improve fuel economy with the latest technologies is powering the stronger year-over-year sales,” said Jason Skoog, assistant general manager for sales and marketing at Kenworth Trucks Co.

The majority of new sales represent replacement purchases, but there also is fleet expansion, he said.

“For 90% of the deals out there, it’s one-for-one trades,” Skoog said. “For the others, we are seeing single-digit fleet growth for the most part.”

Markus Pfeifer, director of marketing operations and planning at Daimler Trucks North America, said 2015 continues to be a “robust” year for the manufacturer.

“Stable sales and consistent growth continue to be the overarching theme,” he said. “We continue to see a strong desire from fleets to replace old vehicles with new, more driver friendly, and fuel-efficient vehicles that will add to their bottom line.”

Navistar Inc. CEO Troy Clarke recently said the current business environment continues to support demand for new equipment.

“The U.S. economic outlook remains optimistic, as does the outlook for the transportation industry,” Clarke said June 4 on the company’s fiscal second-quarter call.

He cited improving freight rates, lower energy costs, aging fleets, better fuel economy and safety as factors supporting the new truck market.

“We continue to believe that these conditions will remain favorable,” Clarke said.

Magnus Koeck, vice president of marketing and brand management for Volvo Trucks in North America, also pointed to a good operating environment for trucking.

“Strong Class 8 sales in May reflect positive conditions within the trucking industry and the broader economy, including low fuel prices and a strong labor market,” he said.

Koeck said trucking operations are continuing to replace aging and less efficient trucks, “but we also are seeing the expansion of some Class 8 fleets.”

John Walsh, vice president of marketing at Mack Trucks, agreed.

“Several factors are driving Class 8 sales, including strong freight demand, reduced fuel prices, increased freight prices and strong fleet profitability, leading some fleets to expand,” Walsh said. “Replacement demand also remains a factor as fleets look to upgrade to newer, more fuel-efficient models.”

Ronald Remp, president of Wheeling Truck Center Inc., a Volvo dealer in Wheeling, West Virginia, said he expects sales to remain strong in the second half of 2015 based on the number of trucks that already have been ordered.

“The order board gives us every indication that things are going to continue to go forward for us for the balance of the year,” he said.

ACT Research recently estimated that North American truck manufacturers had a combined backlog of 169,000 orders on their books at the end of May, leaving only about 45,000 open build slots for the remainder of this year.

Incoming truck orders for future production have declined on a year-over-year basis for three straight months, but ACT attributed that downturn to the scarcity of remaining 2015 build slots rather than softness in the market.

Remp also said improvements in fuel economy and aerodynamics have lifted the appeal of new truck models.

“It seems to be making the purchase decision just a little easier because of all the improvements we’re seeing,” he said.

Six of the seven major U.S. Class 8 nameplates reported sales gains last month.

DTNA’s Freightliner brand captured 38.4% of the U.S. Class 8 market in May with 8,254 trucks sold, a 31% jump from the same month last year.

DTNA also sold 391 Western Star trucks last month, compared with 316 a year ago.

Kenworth’s sales climbed 24% to 3,140 trucks, which represented 14.6% of the total market.

Peterbilt Motors Co. sold 2,894 trucks during the month, a 22% gain from a year ago. Its monthly market share stood at 13.5%.

Kenworth and Peterbilt are operating companies of Paccar Inc.

Navistar sold 2,401 of its Class 8 International trucks in May, a 3% gain from a year earlier. The brand’s monthly market share, however, declined to 11.2%, from 13% a year ago.

Volvo Trucks’ monthly sales volume rose 14% to 2,799, representing 13% of the market.

Sales at Mack Trucks, however, slipped 3% to 1,618 units, or 7.5% market share.

Volvo and Mack are part of the Volvo Group.