Senior Reporter

May Class 8 Sales Climb 18.1%; Analysts Expected More

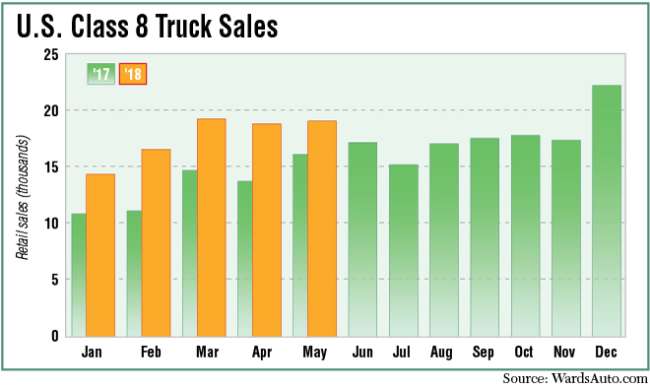

U.S. retail sales of Class 8 trucks in May topped 19,000 and were the fourth-highest in the past 26 months, WardsAuto.com reported. However, analysts said a severely challenged supply chain has stalled even higher sales and added to truck makers’ production-related expenses.

Sales reached 19,195, an increase of 18.1% from 16,248 a year earlier, according to Ward’s.

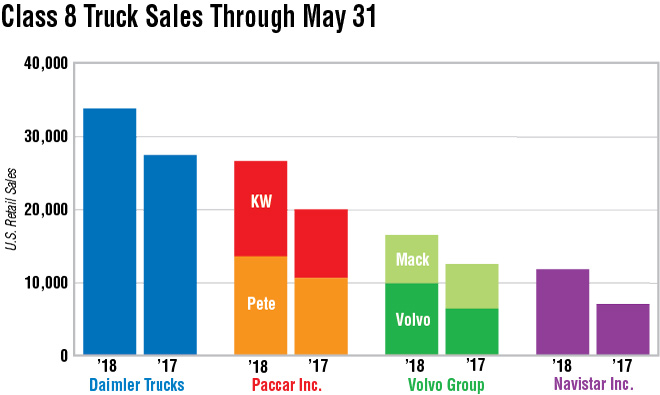

For the first five months of the year, sales rose 32.3% to 88,674 compared with the 2017 period.

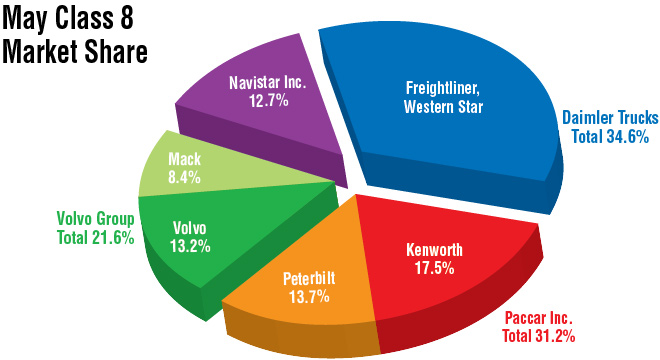

Freightliner remained the market share leader at 31.5%, selling 6,050 trucks, down 12.3% from a year earlier.

Freightliner is a brand of Daimler Trucks North America.

ACT Research Co. Vice President Steve Tam said the industry was up against supply chain constraints now, as there are an increasing number of red-tag, not completely built trucks still waiting on a needed component.

“If it’s not going to be built, you can’t sell it,” Tam said. “Typically, we see almost a 10 percentage point increase from April to May. And in this environment, with white-hot demand, this was a surprising number, sequentially,” he said.

Sales in April were 18,950, leaving May with a 1% gain.

Sales are still not tracking with increases in orders or production, Tam added. “We need to see them start moving.”

[Truck makers] can’t find drivers to deliver the [finished] trucks to the dealers. The industry problems are affecting the industry itself. It’s ironic.

FTR's Don Ake

Class 8 orders in May reached 35,600, according to ACT’s preliminary data, and were more than double those from a year earlier.

ACT has lowered its North American production forecast in 2018 by about 3,500 units to 324,400, but shifted those units to 2019, he said. “So it’s just, in essence, a realization of the strong demand that is in the marketplace.”

One recent survey by a financial analyst of Freightliner dealers noted some dealers were concerned potential customers will turn to competitors that have shorter lead times since they do not want to wait until 2019 for trucks; and some customers are buying late-model used trucks instead of waiting for a new one.

Don Ake, vice president of commercial vehicles at the research company FTR, agreed that the supply chain was “messed up.”

In addition to shortages of components, truck makers “can’t find drivers to deliver the [finished] trucks to the dealers. The industry problems are affecting the industry itself,” Ake said. “It’s ironic.”

Meanwhile, Volvo Trucks North America saw sales soar 87.7% to 2,536, good for a 13.2% share.

“Strong freight demand and rates, in conjunction with high interest in our new VNR and VNL models, are driving very strong demand,” said Magnus Koeck, VTNA’s vice president of marketing and brand management. “Carriers are understanding the value of new connectivity, uptime and active safety innovations and seeking those features to enhance the performance and efficiency of their operations.”

Mack Trucks posted a 36.6% gain on sales of 1,607, good for an 8.4% share.

“Customers continue to place a heavy emphasis on improving fuel efficiency, particularly now, as we see fuel prices steadily climbing,” said Jonathan Randall, Mack Trucks senior vice president, North American sales and marketing.

VTNA and Mack are brands of Sweden-based Volvo Group.

International, a brand of Navistar Inc., saw sales leap 58.2% to 2,431, earning it a 12.7% share.

“The growth in Class 8 market share is due to positive reaction to the LT series on-highway truck and the 12.4-liter A26 engine. Thanks to the A26, the company’s share of 13-liter heavy registrations nearly doubled in the first five months of fiscal 2018. This growth has not been at the expense of 15-liter market share,” Troy Clarke, chairman and CEO of Navistar International Corp., said during a conference call June 5 to discuss second-quarter earnings.

Clarke added: “Our suppliers are running flat-out. What we — and I think the balance of the industry is experiencing to keep from losing an increment in capacity in the plan — we’re all using premium shipping, premium transportation, less-than-truckload [shipments] rather than full loads, and such like that.”

At Kenworth Truck Co. sales rose 39% to 3,355, good for a 17.5% share.

Peterbilt Motors Co. posted sales of 2,632, up 7.3% compared with a year earlier, and earned a 13.7% share.

Kenworth and Peterbilt are brands of Paccar Inc.

Western Star, also a brand of DTNA, sold 584 trucks compared with 405 a year earlier.