Manufacturing Shrinks at Slower Pace in February, Prices Gauge Jumps

[Stay on top of transportation news: Get TTNews in your inbox.]

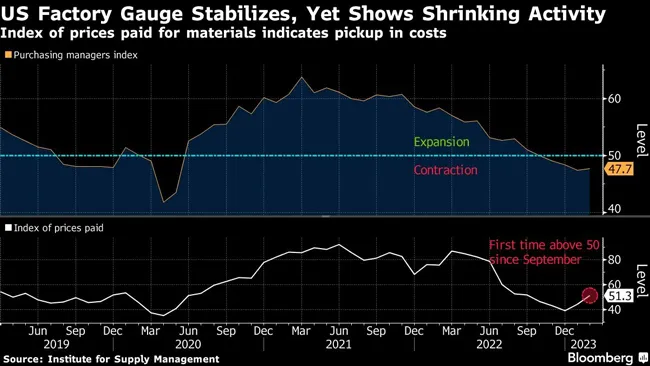

A gauge of manufacturing improved for the first time in six months, though activity remained in contraction territory amid fragile demand and growing inflationary pressures.

The Institute for Supply Management’s gauge of factory activity ticked up to 47.7 in February from the weakest print since May 2020. The median estimate in a Bloomberg survey of economists was for 48. Readings less than 50 indicate contraction.

The latest data, released March 1, highlights a manufacturing sector that’s struggling for a foothold. While household demand rebounded at the start of the year, rising interest rates, higher input costs and looming concerns of an economic downturn remain persistent headwinds.

Fourteen industries reported contraction in February, led by the printing, paper and wood products industries. Four sectors expanded.

“New order rates remain sluggish due to buyer and supplier disagreements regarding price levels and delivery lead times; the index increase suggests progress in February,” Timothy Fiore, chair of ISM’s Manufacturing Business Survey Committee, said in a statement. “Panelists’ companies continue to attempt to maintain headcount levels through the projected slow first half of the year in preparation for a stronger performance in the second half.”

The group’s measure of prices paid for materials rose for a second month. At 51.3, it was the first time since September that the figure indicated rising costs. The share of respondents reporting they paid higher prices rose to about 25%, also the highest in five months.

The step-up in input prices comes on the heels of data last week that showed the Federal Reserve’s key inflation gauges accelerated at the start of the year. Stubborn price pressures are expected to lead policymakers to pursue several more interest rate hikes in the coming months.

ISM’s new orders index rose in February by the most since 2020, while the production gauge slipped to 47.3. Even with the improvement, the gauge of bookings remained below 50, indicating orders continued to shrink in the month. Inventories were little changed.

Want more news? Listen to today's daily briefing below or go here for more info: