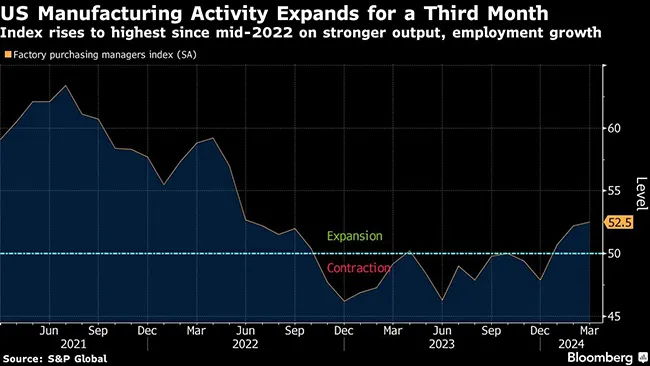

Manufacturing Activity Expands by Most Since June 2022

[Stay on top of transportation news: Get TTNews in your inbox.]

U.S. manufacturing activity expanded by the most since mid-2022 as production and factory employment growth accelerated along with measures of inflation.

The S&P Global flash March factory purchasing managers index edged up 0.3 point to 52.5, marking the third straight month above a level of 50 that indicates expansion.

Manufacturing output growth was the strongest since May 2022, driven by improving demand both at home and abroad, while the employment gauge reached an eight-month high.

The group’s composite measure of prices received by manufacturers and service providers rose to an almost one-year high on the back of continued wage growth and higher fuel costs, suggesting stubborn inflation.

“The steep jump in prices from the recent low seen in January hints at unwelcome upward pressure on consumer prices in the coming months,” Chris Williamson, chief business economist at S&P Global Market Intelligence, said in a statement.

S&P Global’s measure of prices charged by manufacturers climbed to a more than one-year high, while an index of prices received by service providers rose to the highest since July.

The price data helps explain the Federal Reserve’s cautious approach to cutting interest rates. After policymakers kept rates unchanged for a fifth meeting on March 20, Chair Jerome Powell said “it’s going to be a bumpy ride” to the Fed’s inflation goal.

Want more news? Listen to today's daily briefing above or go here for more info

While there were signs of improving demand for services, there were also reports that elevated price pressures were prompting customers to hold off committing to new projects, according to S&P Global. As a result, new business growth at services softened.

The overall measure of business activity at service providers showed the slowest growth in three months. That, combined with the pickup in manufacturing, left the S&P Global Composite Index little changed at 52.2.

To be sure, service providers were the most upbeat about the outlook since May 2022.