Logistics Spending on an Upward Trend

Senior Features Writer

This story appears in the Nov. 17 print edition of Transport Topics.

Spending on logistics services is expected to accelerate in 2014 as the economy in the United States continues to expand and more companies outsource transportation management to third-party logistics companies.

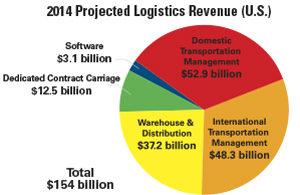

Gross revenue for U.S.-based 3PLs increased 3.2% to $146.4 billion in 2013 from $141.8 billion in 2012. It is projected to reach $154 billion in 2014, an increase of 5.2%, according to a report by market research firm Armstrong & Associates in Stoughton, Wisconsin.

Domestic transportation management, which consists primarily of freight brokerage, is the fastest-growing segment of logistics spending, reflecting continued expansion in the number of customers and additional service offerings, said Richard Armstrong, chairman of Armstrong & Associates.

“It is common now for customers with as little as $3 million in transportation spending to use at least one 3PL,” Armstrong said.

LIVEONWEB: Watch experts analyze rankings

CHANGES APLENTY: Surprises, fast movers, new No. 1

THE LIST: See which companies make the cut

QUIZ: Test how well you know the Top 50

The business of freight brokerage also has expanded beyond load matching to include transportation management and information systems, he noted.

“Systems-based enterprise accounts constitute a significant part of the business for all major domestic transportation managers,” Armstrong said.

International transportation management is projected to grow 4.5% to $48.3 billion in 2014 from $46.2 billion in 2013.

Growth will be hampered by a slowdown in U.S.-Asia trade, Armstrong said, with ocean-freight container movement growing by single digits and airfreight volumes generally flat.

Dedicated contract carriage continues to grow modestly. Gross revenue is projected to increase 4.1% to $12.5 billion in 2014 from $12 billion in 2013.

“Driver shortages are keeping demand solid,” Armstrong said. “A heat-up in the economy and consumer spending could lead to dramatic increases in dedicated contract carriage as shippers struggle to manage capacity.”

Spending on warehousing and distribution is projected to increase 3.6% to $37.2 billion in 2014 from $35.9 billion in 2013.

Retailing is the largest industry sector that uses logistics services, accounting for $28.7 billion in spending in 2013, based on an analysis of data on more than 6,300 3PL customer relationships in the United States by Armstrong & Associates.

Technology firms ranked second with $25.5 billion in spending, followed by automotive ($12.8 billion), food and groceries ($11 billion), elements ($10.5 billion), industrial ($9.3 billion), health care ($8.6 billion) and consumer goods ($5.8 billion).

The global market for logistics, according to Armstrong’s estimates, reached $703.8 billion in 2013, up 9.5% from $642.8 billion in 2012.

The Asia-Pacific region remains the largest market for logistics services, with spending estimated to be $255.6 billion in 2013, up 22.2% from $209.1 billion in 2012. China accounts for nearly half of all logistics spending in the region, followed by Japan, India and South Korea.

North America extended its lead over Europe as the second-largest market for logistics services. Spending rose to $176.2 billion in the United States, Canada and Mexico in 2013, up 5% from $167.8 billion in 2012. The United States accounts for 83% of logistics spending in North America.

In Europe, logistics spending rose a meager 1.2% to $158.1 billion in 2013 from $156.2 billion in 2012. Germany is the largest market, followed by France, the United Kingdom and Italy.

Spending on logistics in South America, while much smaller in size, is growing rapidly with revenue increasing 11.4% to $44.9 million in 2013 from $40.3 billion in 2012.