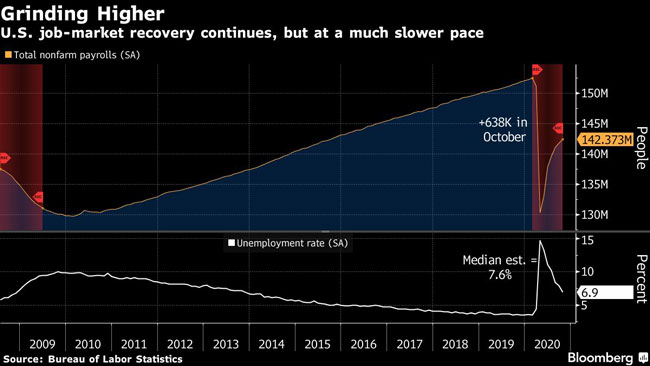

Labor Market Extends Gains, Jobless Rate Declines to 6.9%

[Ensure you have all the info you need in these unprecedented times. Subscribe now.]

The U.S. labor market strengthened in October, defying expectations for more subdued gains amid an intensifying pandemic and lack of additional fiscal relief.

Nonfarm payrolls increased by 638,000 after an upwardly revised 672,000 gain the prior month, according to a Labor Department report Nov. 6. That compared with the 580,000 median estimate of economists surveyed by Bloomberg, and reflected a decline of 147,000 in temporary Census workers.

While overall employment numbers showed strength, trucking analysts struck a more tepid tone. American Trucking Associations Chief Economist Bob Costello tweeted Nov. 6 that for-hire trucking added 9,600 workers, but employment remained behind its mark from last year. That gap is contributing to tight capacity in an industry that was grappling with a driver shortage even before the pandemic.

October payrolls came in a little stronger than expected, adding 638,000 with the unemployment rate falling a full percentage point to 6.9%. For-hire trucking added 9,600 workers, but employment was still off 66,000 from a year earlier, which is one reason capacity is tight. — Bob Costello (@ATAEconBob) November 6, 2020

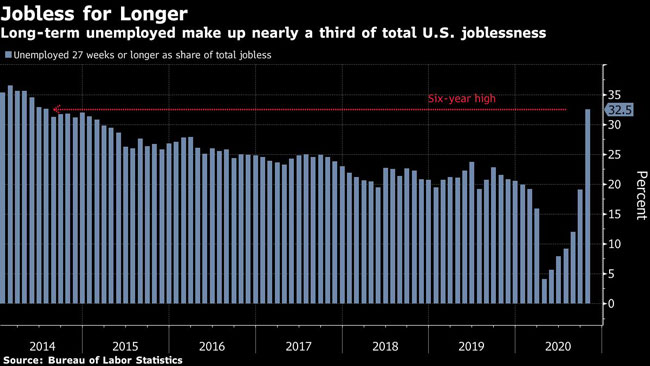

The unemployment rate overall fell by 1 percentage point to 6.9% — a bigger drop than economists projected and double the prior month’s decline — though the number of long-term jobless Americans surged and now makes up a third of those out of work.

Progress in the U.S. labor market is holding up as household savings help fuel spending and business investment rebounds, providing whoever wins the presidential election with an economy that’s in better shape than many analysts expected just six months ago.

The number of permanent job losers was little changed at 3.7 million in the month, a positive sign after two straight significant increases.

Yet jobs remain 10 million below pre-pandemic levels, and with coronavirus infections rising at a record rate this week, maintaining the pace of hiring may be difficult.

Other figures point to an increasingly fragile labor market beneath the headline numbers. The number of long-term unemployed — those jobless for 27 weeks or more — increased by 1.15 million to 3.56 million, the highest level since early 2014.

Colder weather will also challenge businesses like restaurants that have depended on outdoor dining when many Americans are fearful of gathering indoors, making the economy’s path highly dependent on the development and distribution of a successful vaccine, especially if virus restrictions re-emerge as they have in other parts of the world.

In addition, the congressional election results this week probably reduced the chances that any new stimulus will be as massive as Democrats sought, meaning limited cash for the unemployed and businesses most affected by the virus.

“It’s hard to look at months or weeks past because you know what’s lying ahead and that’s an increase in virus cases. That continues to be the dark cloud looming ahead,” said Jennifer Lee, senior economist at BMO Capital Markets. “But the fact that the jobless rate took such a big decline, that’s extremely encouraging.”

U.S. stocks fell at the open, while 10-year Treasury yields rose. The dollar fell to the lowest in more than two years.

Federal Reserve Chair Jerome Powell said Nov. 5 that “we’re sort of halfway there on the labor market recovery, at best,” while also signaling concern over the surge in COVID-19 cases.

Want more news? Listen to today's daily briefing:

Subscribe: Apple Podcasts | Spotify | Amazon Alexa | Google Assistant | More