Senior Reporter

Kansas City Southern Reports Mixed Q3 Earnings

[Stay on top of transportation news: Get TTNews in your inbox.]

Kansas City Southern reported mixed third-quarter financial results on Oct. 19, as the Class I freight railroad saw a 13% jump in revenue to $744 million, compared with $659.6 million a year earlier. However, net income dipped to $156.5 million or $1.72 per share, compared with $190.2 million, $2.02, in 2020.

The company’s operating ratio also slumped to 66.1 from 58.8 a year ago.

Operating ratio measures a company’s operating expenses as a percentage of revenue and determines efficiency. The lower the ratio the more ability the company has to make a profit.

Ottensmeyer

The company’s earnings missed expectations from Wall Street analysts who had expected the company to earn $2.04 per share, according to figures compiled by Thomson Reuters.

On a conference call with reporters and financial analysts after the results were announced, KCS said quarterly carload volumes dropped by 3% because of auto manufacturing plant shutdowns in both the U.S. and Mexico, driven by the global shortage of computer microchips.

KCS transports vehicles and parts to 16 auto plants in Mexico alone.

“We continue to operate in a challenging commercial environment with auto plant shutdowns caused by the global microchip shortage that everyone is very well aware of,” CEO Patrick Ottensmeyer said. “These results have fallen short of our previous expectations.”

KCS is also seeing its operations in Mexico being interrupted at Lázaro Cárdenas because of right-of-way disruptions resulting from a series of teachers’ strikes in that area.

Mexican teachers have been protesting working conditions in a dispute that is unrelated to the railroad and freight industry and they have blocked railroads and ports as part of their labor strategy.

The railroad said the ongoing labor dispute has disrupted operations in Mexico for 75 consecutive days.

Research shows that 41% of technicians leave the industry within the first two years. Host Michael Freeze asks, how can technician recruiters and maintenance leaders decrease that percentage? We talked with Ana Salcido of Navistar and Stacy Earnhardt of TMC. Hear a snippet above, and get the full program by going to RoadSigns.TTNews.com.

Company officials also said after seven months of a high-profile, multibillion-dollar back-and-forth competition to acquire Kansas City Southern, there now appears a path forward for KCS to merge next year with Canadian Pacific Railroad.

“We continue to make very good progress with closing the transaction with Canadian Pacific,” Ottensmeyer said. “We and Canadian Pacific have filed with the Securities and Exchange Commission a registration statement and proxy statement for use in connection with the shareholder votes for this transaction.”

Ottensmeyer said he expects the special shareholder meeting for both railroads to take place by the end of 2021. At that time it’s expected KCS will be operated by what’s called a voting trust, which will be in place while regulatory agencies review the transaction during 2022.

Since March, KCS has been at the centerpiece of an often bitter takeover struggle by rivals Canadian National and Canadian Pacific that it now appears Canadian Pacific won, after the U.S. Surface Transportation Board turned down, by a 5-0 vote, Canadian National’s proposal for a voting trust, effectively killing the $33 billion bid.

KCS said its year-over-year head count increased by 3.4% to 6,684 compared with 6,463 a year ago.

“Our head count is up year-over-year and we’ve brought back our crews from furlough and we have added in key and select locations to meet the current demand, for volume purposes,” Executive Vice President for Operations John Orr said on the conference call. “I believe we are well positioned from a resource and capacity perspective to have a very successful peak season.”

Because of the well-publicized crunch on the nation’s supply chains, both trucking and railroads say their capacity has been limited. But KCS officials believe with the added employees and other changes it is well positioned to move freight.

“Our network is running about as good as we’ve seen in a long time,” Chief Financial Officer Mike Upchurch said.

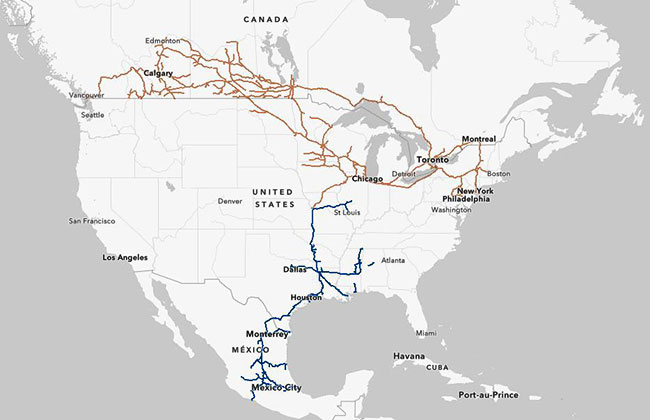

Map of railroad network. (Bloomberg)

By sector, KCS said quarterly revenue from chemical and petroleum shipments increased 6% to $204.1 million from $191.9 million a year ago.

Industrial and consumer product revenue increased 26% to $159 million from $126.4 million.

Agriculture and minerals rose 12% to $139.8 million from $125.3 million.

Energy revenue increased 59% to $74.6 million from $46.8 million. In the energy sector, utility coal shipment revenues increased 58%. Sand used for energy fracking jumped 74% and oil shipments moved up 122%.

Intermodal revenue dipped by 2% to $86.9 million from $89.1 million.

Automotive shipment revenue declined by 17% to $40.1 million from $48.5 million.

While KCS is the smallest of the Class I railroads, it is the only one that operates deep into Mexico with links to rail lines in Texas and the upper Midwest.

The new United States-Mexico-Canada trade agreement is designed to increase cross-border trade and manufacturing among the three nations. About $2.6 billion of KCS’ annual revenue is attributable to its Mexico operations.

Want more news? Listen to today's daily briefing below or go here for more info: