Bloomberg News

Jobless Claims Fall More Than Forecast to Pandemic Low

[Ensure you have all the info you need in these unprecedented times. Subscribe now.]

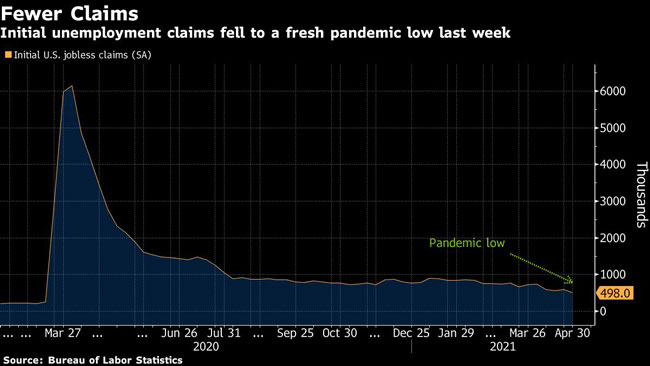

Applications for U.S. state unemployment insurance fell last week to a fresh pandemic low as labor market conditions continued to improve and the economy reopened more broadly.

Initial claims in regular state programs fell by 92,000 to 498,000 in the week ended May 1, Labor Department data showed May 6. The median estimate in a Bloomberg survey of economists called for 538,000 claims. The prior week’s figure was revised up to 590,000.

The job market is strengthening as employers look to fill positions left empty by the pandemic. The May 7 employment report is expected to show that the U.S. added about 1 million jobs in April, a sign that fewer business restrictions are bringing more Americans back to work.

Claims fell broadly across the U.S., with the biggest drops in Virginia and New York.

Continuing claims for ongoing state benefits rose slightly in the week ended April 24. Applications for Pandemic Unemployment Assistance for self-employed and gig workers decreased.

Separate data May 6 showed productivity rebounded in the first quarter as the pace of output exceeded a pickup in hours worked. Nonfarm business labor productivity increased at a 5.4% annualized rate in the first quarter, the second fastest pace since 2009, after a revised 3.8% decline in the prior quarter. The gain in productivity helped restrain unit labor costs, which fell an annualized 0.3%.

Want more news? Listen to today's daily briefing below or go here for more info: