Bloomberg News

Job Growth Surges Most in 10 Months, Jumping Past Forecast

[Ensure you have all the info you need in these unprecedented times. Subscribe now.]

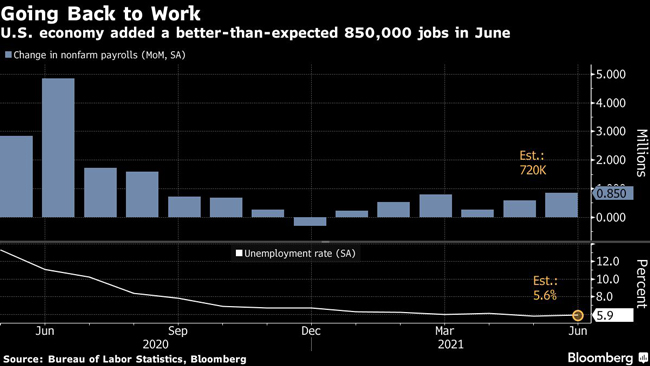

U.S. job growth accelerated in June, with payrolls gaining the most in 10 months, suggesting firms are having greater success recruiting workers to keep pace with the broadening of economic activity.

Nonfarm payrolls increased by 850,000 last month and the unemployment rate edged up to 5.9%, a Labor Department report showed July 2. May payrolls were revised up to a 583,000 gain. The labor force participation rate held steady and remained well short of pre-pandemic levels.

The median estimate in a Bloomberg survey of economists was for a 720,000 rise in June payrolls. S&P stock index futures climbed and Treasury securities fluctuated after the report.

Demand for labor remains robust as firms strive to keep pace with broader economic growth, fueled by the lifting of restrictions on business and social activity, mass vaccinations and trillions of dollars in federal relief.

At the same time, a limited supply of labor continues to beleaguer employers, with the number of Americans on payrolls still well below pre-pandemic levels. Coronavirus concerns, child care responsibilities and expanded unemployment benefits are all likely contributing to the record number of unfilled positions.

Those factors should abate in the coming months though, supporting future hiring. Wage growth is also picking up. A report July 1 showed small companies are raising compensation to attract workers, consistent with similar developments at larger firms such as FedEx Corp. and Olive Garden parent Darden Restaurants Inc.

The June jobs report showed a 2.3% month-over-month increase in average hourly earnings in the leisure and hospitality industry. Overall average earnings rose 0.3% last month.

“Job gains should pick up in coming months as vaccinations rise, easing some of the pandemic-related factors currently weighing them down,” Federal Reserve Chair Jerome Powell told Congress on June 22.

Labor Churn

While net job creation has been lower, actual hiring is high, offset by elevated levels of quits and retirements, Powell said. That underscores elevated churn in the labor market.

Over the course of the downturn the Fed has emphasized its commitment to the maximum employment part of its dual mandate, but inflation concerns paired with a steady stream of solid employment reports may influence how soon policymakers tighten monetary policy.

The Labor Department’s figures showed a 343,000 increase in leisure and hospitality payrolls, a sector that’s taking longer to recover because of the pandemic.

Job growth last month was also bolstered by a 188,000 gain in government payrolls. State and local government education employment rose about 230,000, boosted by seasonal adjustments to offset the typical declines seen at the end of the school year.

Even with the latest advance, U.S. payrolls are still 6.76 million below their pre-pandemic level, underscoring how the labor market is far from fully recovered.

The overall participation rate was unchanged at 61.6%. The employment population ratio, or the share of the population that’s currently working, was also unchanged.

The unemployment rate edged up because more people voluntarily left their jobs and the number of job seekers rose.

Average weekly hours decreased to 34.7 hours from 34.8.

Want more news? Listen to today's daily briefing below or go here for more info: