Contributing Writer

Industry Eyes E-Axles

Tesla’s announcement in November that it will produce an all-electric Class 8 tractor by 2019 helped highlight the potential for electric power in commercial trucking. But while Tesla and others are electrifying the entire truck, some companies are focusing on the axles.

Hyliion’s 6X4HE electric axle, already in production, is a retrofit that adds 100 horsepower to the tractor’s rear axle — either by adding power to a 6×2 configuration or by swapping the diesel for an electric in a 6×4. According to the company, the axle will produce up to 15% fuel savings by automatically engaging as the vehicle travels uphill and then, on downhill slopes, capturing regenerative energy that will be stored in the battery pack.

“It’s really looking at when the diesel engine is working hard, and that’s when it will kick on and offset some of that power need,” Hyliion President Thomas Healy said.

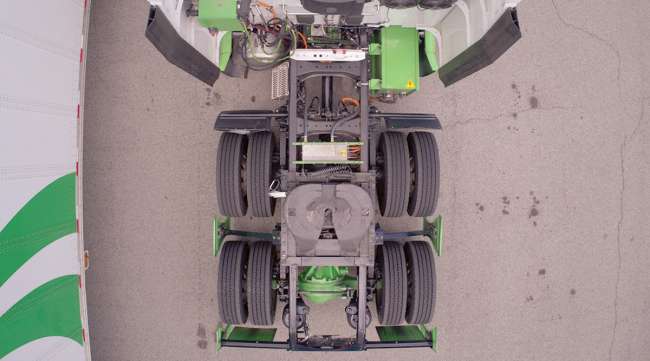

Hyliion says its entire system, which includes an auxiliary power unit, can reduce fuel consumption by 30%. The cost is $37,000 to $40,000. (Photo by Hyliion)

The axle is one of three components in a system the company says could reduce fuel consumption by 30%. Fifteen percent comes from the axle. An additional 12% comes from the system’s auxiliary power unit, and 3% comes from a FlowBelow aerodynamic component. However, the system does add 800 pounds to the weight of the truck.

Jeff Reed, president of Tennessee-based Skyline Transportation, saw the product at American Trucking Associations’ Management Conference & Exhibition in October. He’s interested in it and other electric technologies, but he’s also withholding judgment.

“It intrigues me, and I like that technology,” Reed said. “I want to see where that goes. I think it’s got potential. But it has to be weighed off with the cost, that’s for sure.”

The Hyliion product’s modular design has four connected components: a battery box, a control box, a thermal system and an electric drive axle. From a maintenance standpoint, if one component fails, then the entire system is swapped out, saving a technician from having to work on a high-voltage system.

Healy

Production began in November. Healy said the system costs $37,000 to $40,000, depending on the features, and has a two-year payback assuming fuel is $2.50 a gallon. The company also offers a leasing option of about $500 a month, which Healy said will be less than the fuel savings. The company has more than $20 million in orders, he said.

The e-axle initially was conceived as a trailer product, but fleets wanted it on the tractor for a faster payback. A trailer product will be available in the United States at the end of 2018.

The package was tested on trucks owned by Ryder System Inc., Mesilla Valley Transportation and PAM Transport Inc.

Paul Pettit, vice president of maintenance for PAM Transport, said it’s too early to gauge the technology’s effectiveness. The company’s one truck had been tested only with an early pre-production unit, mostly for mechanical hardware and software issues. At the time of the interview in November, it was in Pennsylvania being fitted with a more advanced unit.

The company needed to test the product on its freight runs, but the axles in the initial test functioned well, and the APU’s performance was “phenomenal,” Pettit said. PAM Transport ranks No. 68 on the Transport Topics Top 100 list of the largest for-hire carriers in North America.

Ryder System is the parent company of Ryder Supply Chain Solutions, which ranks No. 13 on the for-hire TT100, and Mesilla Valley Transportation is No. 72.

While Hyliion’s product will serve as a retrofit and be paired with a diesel engine, Bosch is working with startup Nikola Motor Co. to develop an e-axle for Nikola’s Class 8 electric truck powered by a fuel cell. That product is planned to hit the market in 2021.

Bosch Vice President Jason Roycht said e-axles could be used in a stand-alone powertrain or in a hybrid with a diesel, gasoline or fuel-cell power source.

He said the economic case for electrically powered vehicles may be easier to make for commercial applications than for passenger cars. Electric cars remain a luxury item in which it’s unlikely an owner will see a return on the investment. The equation is more favorable in the Class 8 market, particularly in applications with high idle time and stop-and-go driving, such as refuse trucks and buses.

“There are many cases where we are very close if not already there that compare to the traditional diesel engine,” Roycht said. “These electric powertrains can offer a lower total cost of ownership.”

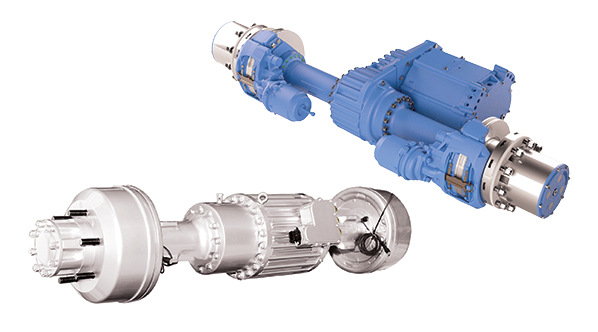

AxleTech International is developing an e-axle for shorter-haul applications that not only assists the engine or motor — it replaces it.

Jason Gies, AxleTech’s director of business development for electric powertrain systems, said the company’s axles are in development with “multiple customers” for a range of applications. He said they will provide all the necessary power for buses and for medium-duty applications of up to 11½ tons and 200 to 300 miles. A diesel or turbine range extender can extend the miles.

“Everything we’re doing can drive the vehicle,” Gies said. “What we’re accomplishing in the transit bus is a complete powertrain replacement. The bus is being driven by the axle itself. There is no diesel engine, no traditional transmission, no drive shaft.”

Prototypes are being tested, with production starting in 2018. The company also is working with Wrightspeed Powertrains on an e-axle that Gies said will be applicable to refuse trucks.

The technology could apply to longhaul applications in the long term as the technology improves and battery prices decrease.

Other companies are developing e-axles and other products.

In September, Meritor Inc. announced it was developing a platform of electric drive axles for various drivetrain configurations and applications, including hybrids and full electric systems. Production would begin as early as 2019.

Dana Inc. has announced it is developing electric axles for pure electric vehicles, though not yet for Class 8 trucks. Ryan Laskey, vice president of engineering, and Steve Slesinski, director of product planning for Dana’s commercial vehicle business, said the company’s focus currently is on city delivery and transit. The products will be installed at the manufacturing level.

Dana’s first e-axle for a commercial vehicle will be shipped in the first quarter of 2018 for the Chinese bus market. International customers, particularly in China and Europe, are driving the demand, they said. In China, the government is subsidizing the technology, leading to rapid increases in the number of electric buses there. Those technologies will have applications in North America.

(Top) AxleTech International’s 34000 axle. It is for electric vehicle applications. (Bottom) For Electric city bus applications, this Dana not-yet-named e-axle features an integrated motor and gearbox. (Images by AxleTech and Dana)

“It’s all going to come down to batteries’ storage capacity, size, weight, charging time,” Laskey said. “Those are going to be the critical attributes that are going to ultimately drive where these systems go.”

Truck manufacturers also are embracing electric power.

Daimler recently launched its all-electric Fuso eCanter medium-duty model and has unveiled its E-Fuso Vision One concept, a Class 8 truck with a range of 200 miles. Kelly Gedert, director of product marketing for Freightliner Trucks and Detroit Diesel, said the company did not have a position on e-axles.

Navistar will launch an electric bus and Class 6 vehicle as early as 2019, said Bill Distel, chief product specialist for on-highway products. Distel said the company sees electric vehicles being most applicable in urban environments. Navistar does not have plans for a Class 8, but it is trying to make a splash in the overall electric market.

“This isn’t a dabble,” he said. “We’re going through and launching two fully electric models in the 2019 timeframe.”

North American Council for Freight Efficiency Executive Director Mike Roeth said e-axles will provide extra power and traction, and perhaps reduce tire wear on the power axle by reducing torque. However, he questioned if hybrid systems would be worth the complexity they would add.

“It’s kind of belt and suspenders any time you try to do sort of hybrid,” Roeth said. “You end up with a main power source and then another one that’s augmenting. We looked at variable water pumps, electric variable power steering pumps in a study not too long ago, and it just adds complexity, adds costs. Fleet managers are worried about maintenance in some of these things.”

Rust and corrosion is another issue, said Robert Braswell, executive director of American Trucking Associations’ Technology & Maintenance Council. Electric axles will be located in the “hot zone” within three feet of the road surface, where most corrosion occurs, he said.

“The more electrified the vehicle, the more concern I would think a fleet manager would have with trying to mitigate that or fending that off,” Braswell said.

Other questions remain, such as how much weight the products add, Braswell said. On the plus side, they could reduce the need for emissions aftertreatment, which now exceeds the cost of tires for some fleets.

Braswell, who’s been with TMC for 25 years, has seen interest in alternative fuels rise and wane. So much of the interest is driven by fuel prices and emissions regulations, and California is always a wild card.

Will this time be different? It’s too early to tell, but Braswell said the industry may know soon.

“I have a feeling that when it comes to disruptive technology like this, if it works, you’re going to see rapid adoption of it because it just makes business sense — maybe at a pace that far exceeds the expectations of these so-called experts,” Braswell said. “If it doesn’t work, it’s just yesterday’s soup du jour.”

Among truck manufacturers, Volvo and Mack did not respond to requests for comment. Paccar declined to participate.