Senior Reporter

Freight Railroads Vow to Improve Service to Grow Intermodal

[Stay on top of transportation news: Get TTNews in your inbox.]

LONG BEACH, Calif. — Leaders of some of North America’s Class I freight railroads say they have learned the lessons of the COVID-19 pandemic when service slumped, causing freight backlogs, and shippers and government leaders said the carriers were concentrating too much on their operating margins and not nearly enough on service.

Speaking at the annual Intermodal Association of North America Expo Conference on Sept. 12, rail leaders said they must continue to improve service, especially to be competitive with the over-the-road trucking industry.

“If we want to give our customers an avenue to grow, our service needs to be reliable, it needs to be resilient and it needs to be done over a long enough time that we get out of the pendulum swing of win freight, lose freight, win freight back and lose it again,” Norfolk Southern Intermodal Group Vice President Andrew Lynch said. “We make service, we sell service, that’s the only product that we make.”

But intermodal’s market share of freight has been in decline, according to transportation analyst Larry Gross, the president of Gross Transportation Consulting. He told Transport Topics that in 2016 intermodal had a 6.7% domestic share and during the second quarter of 2023, it was 5.5%, resulting in a $4 billion loss in annual revenue. This took place even as several trucking companies, including J.B. Hunt and others, increased their activity in intermodal transportation.

“Intermodal has felt the impact probably deeper than over-the-road trucking side of the house,” Gross said. “Intermodal had a lot of service problems, a lot of congestion and as a result, intermodal has lost share.”

Gross says railroads have also lost market share because of the steep decline in container activity, especially at the major ports on the West Coast, which have seen year-over-year drops of more than 25%.

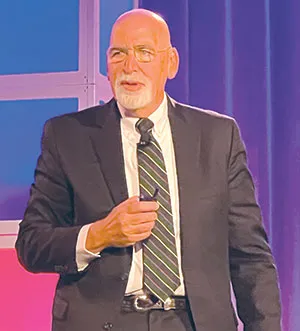

Larry Gross says intermodal needs to be as reliable as trucking. (Dan Ronan/Transport Topics)

He says intermodal carriers must improve their service and reliability in order to be more competitive with trucking.

“It’s all about the intermodal competitive product, versus direct over-the-road,” Gross said. “Intermodal is always going to be a little slower than trucking, we know that. But it needs to be as reliable as trucking and it needs to be cheaper than trucking.”

Several railroads including giants CSX, Norfolk Southern and BNSF have said they cut too deeply in 2020 when the global economy went into a tailspin during the early months of the COVID-19 pandemic. And they have said it has been difficult to recruit and train new workers to spin up operations as volume levels have picked up and they plan for future increases, later in the decade.

“We need to highlight what we’ve put into our operations to make the experience better for our customers; how we’re making intermodal more reliable, more consistent and show we’re now in a different place today,” BNSF Vice President of Domestic Intermodal Katie Hower said.

Gross says intermodal service is improving and he and the others pointed to figures that showed in the first week of September, year-over-year train speeds improved by 3.8% and on-time performance climbed by 12%.

Still, some of the panelists say there is a long way to go before levels for intermodal return to what they were before the pandemic.

“There is a shipper hangover because of the things that they had to put up with in that two-year period,” Director of Carrier Partnerships at ArcBest Steve Vicary said. “We’re suffering from that, and we’ve got to get past that.”

Railroads, including BNSF and CSX, say they are using technology including cameras in railyards and more drones to monitor trains and keep track of where freight is located in their system, especially as trains become significantly longer, some now 1.5 miles in length.

Cara Costa said, "Now we are looking at our projected growth rates over the net three years and focused on the terminals where we need to add move capacity." (Dan Ronan/Transport Topics)

“When we started running longer trains, we needed to do work in the terminals to handle the longer trains,” CSX Director of Sales for National Accounts Cara Costa said. “We’ve done that work. Now we’re looking at our projected growth rates over the next three years and focused on the terminals where we need to add more capacity.”

But some shippers said while they welcome the railroads’ improvements and promises of better days ahead, the trucking industry is more competitive because capacity has significantly tightened during the past 12 months because of bankruptcy filings, including LTL carrier Yellow, which went out of business in late July.

“If I had to put a presentation together to tell a shipper what is materially changed and why it won’t happen again, I don’t have the material,” DHL Supply Chain General Manager Lauren Henrich said. “If the same cargo surge happened again tomorrow, I don’t think it would be different.”

NFI Industries Vice President of Intermodal Mark McKendry told the audience the railroads are not providing an acceptable level of service and it needs to improve.

“We are not prepared for that next up cycle in intermodal. Trucking is better prepared right now if freight volumes were to increase dramatically,” McKendry said. “I, as an intermodal marketing company, do not have the power to tell railroads how to invest their money.

Want more news? Listen to today's daily briefing below or go here for more info: