Fleets Add Record Number of Trailers in 2016, While Truck Registrations Fall, IHS Says

This story appears in the Feb. 27 print edition of Transport Topics.

While 2016 was a trying year for truck makers, U.S. fleets invested heavily in trailers and put more of them into business than ever before, according to a report on vehicle registrations from IHS Automotive.

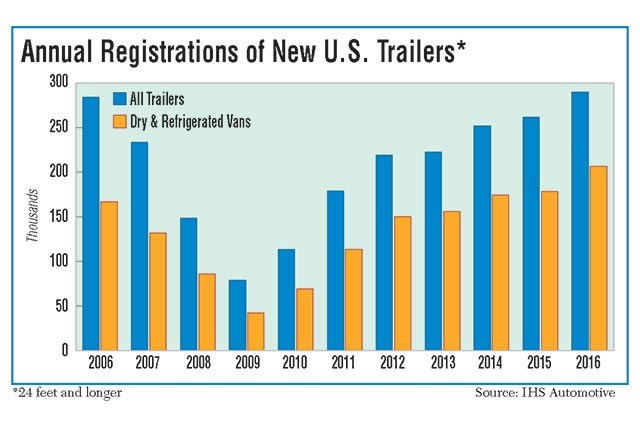

Demand for dry and refrigerated vans led the registration surge, IHS said in a Feb. 21 report. Fleets ran paperwork for 290,037 new trailers of all sorts through the 50 state motor vehicle administrations last year, breaking the 2006 record of 284,285 trailer registrations, IHS said.

The van component in 2016 was 206,509 units, up from 178,409 in 2015, which was the previous high point for that group. Examples of non-van trailers are flatbeds and other open-platform models and tank trailers.

The Great Recession beat down overall trailer registrations to a low point 79,188 units in 2009. They have grown every year since then. Van registrations have followed a similar pattern.

Gary Meteer Sr., IHS director of commercial solutions, said the divergence in trends between trailers and heavy-duty trucks might be due to caution among fleet buyers.

“A trailer is an easy, reasonable investment,” he said. “It’s cheaper to gamble on a trailer than a Class 8 power unit.”

Great Dane Trailers said 2006 remains the company’s best year for sales, but last year the company “had a solid year led by dry vans, reefers and flatbeds,” said David Gilliland, vice president of national accounts for Great Dane.

“Although our numbers were strong, our ability to build additional units was restrained by the challenge of ramping up numerous plants in a highly competitive labor environment,” he said.

Demand was broad-based. Asked what types of customers were buying, Gilliland said, “everybody, [less-than-truckload], truckload, private fleets.”

Flatbeds did have some problems, Gilliland said, because of retrenchment in the oil and gas industry, but he is hopeful that a federal infrastructure program could reinvigorate that market. Great Dane management expects a “better than average” year for trailer sales this year, he said.

Wabash National Corp. executives were not available for comment, but the company’s Jan. 31 earnings statement said that for all of 2016, the OEM shipped out 60,950 trailers of all types, down from 64,700 in 2015.

Guidance for 2017 calls for shipping 51,000 to 55,000 trailers, which was described as “meaningfully above replacement demand levels.” Wabash CEO Richard Giromini described the current market as “a healthy trailer demand environment generating a strong backlog.”

Wabash and Great Dane are North America’s two largest trailer makers.

On the truck side, U.S. vehicle registrations increased from 2015 to 2016 for each weight grouping from Class 3 to Class 7. Class 4 grew fastest, by 21.5%, while Class 7 was tepid, adding just 0.2%, IHS reported.

However, the growth in those five weight groups was erased by the collapse in heavy-duty Class 8, where annual registrations plummeted 20.4% to 206,000 new vehicles from 259,000 units in 2015. Broken down, annual registrations of highway tractors fell almost 29% to about 140,000 units from 190,000 in 2015, while registrations of new, heavy-duty straight trucks, such as dump trucks and cement mixers, remained steady at about 50,000 per year in 2016, the same as the two prior years.

Looking at Classes 3-8 combined, 2016 registrations dropped 4% from the year before to 688,000 commercial vehicles, IHS said.

Besides new vehicle data, IHS tracks the total for all trucks with proper registrations, regardless of vehicle age. The tally for U.S. Class 8 vehicles in operation inched up by just 2,000 trucks from Sept. 30 to Dec. 31, rising to 4,036,000 units — the highest level ever, Meteer said. If a vehicle is scrapped or demolished and the registration vanishes, the figure can go down.

Data was specific on who backed out of the heavy-duty market and where, Meteer said: Large, Midwestern, over-the-road fleets largely kept their checkbooks sealed.

Annual Class 8 registrations fell 26.4% in 13 Midwestern states, whereas the nation’s other three big regions saw declines of 12% to 19% each, from 2015 to 2016.

As for fleet size, carriers with more than 500 trucks cut back their registrations of new Class 8s by 27% from 2015. Looking at timing, Meteer said the cutback in heavy-duty registrations became more severe as the year progressed.

“It doesn’t give me a warm feeling,” Meteer said of the contracting truck market.

The Canadian truck market was similar, IHS reported. Class 8 annual registrations dropped by 19% to 25,187 new vehicles, much more sharply than the Classes 3-8 combined decline of 6.5%.

The recession has changed Canadian truck preferences. In 2006, Canadian Class 8s were 48% of the new vehicle market, Class 3 trucks were 30% and Classes 4-7 combined were 22%.

For last year, Class 3 trucks took the top market spot with 43%, Class 8 fell to 34.5% and Classes 4-7 combined were about the same at 22.5%, IHS said.