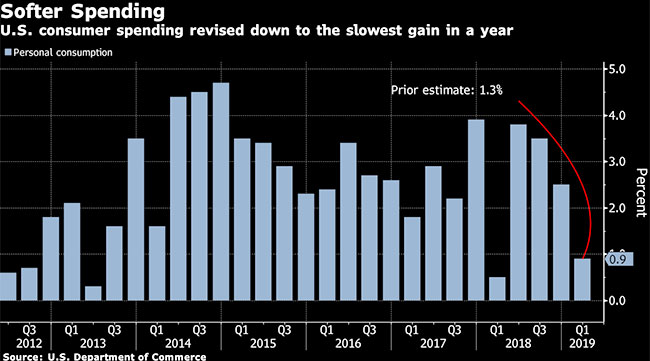

First-Quarter Consumer Spending Revised Down to 0.9% Gain

[Stay on top of transportation news: Get TTNews in your inbox.]

U.S. consumer spending in the first quarter was even weaker than previously reported on lower outlays for services while business investment was revised higher, leaving the pace of economic growth at a still-solid 3.1%.

Consumer spending, the biggest part of the economy, grew at a 0.9% annual pace, according to a Commerce Department report June 27, the slowest in a year and missing projections to remain at the prior estimate of 1.3%. Nonresidential fixed investment rose at a 4.4% rate, almost double what was previously reported, as spending on intellectual property was revised sharply higher to a 12% gain.

The data indicate consumers had less momentum ahead of trade tensions that have weighed on investment and led the Federal Reserve to consider cutting borrowing costs. At the same time, the figures may ease some concern about a slowdown in business investment at the start of the year.

The pace of growth remained well above what most experts see as the economy’s potential, and the U.S. expansion next month will become the longest in the nation’s history. But analysts surveyed by Bloomberg project that gains in gross domestic product will cool to 1.8% in the second quarter, a two-year low, as President Donald Trump’s trade policies and slower global growth make companies more hesitant to hire and spend.

Excluding the trade and inventories components of GDP, which gave a substantial boost to growth, final sales to domestic purchasers increased at a 1.6% pace that was revised from 1.5%. Economists monitor this measure for a better sense of underlying demand, and Fed Chairman Jerome Powell said last week that first-quarter growth reflected “components that are not generally reliable indicators of ongoing momentum.”

Inflation was subdued in the first quarter, with Trump citing slow price gains as a rationale for Fed interest rate cuts — and the Fed also concerned that inflation is too far below its 2% goal. But the report had slightly better news than before, as the personal consumption expenditures price index excluding food and energy rose at a 1.2% pace in the quarter, revised from 1%.