Fed Hikes Rates 75 Basis Points, Intensifying Inflation Fight

[Stay on top of transportation news: Get TTNews in your inbox.]

The Federal Reserve raised interest rates by 75 basis points — the biggest increase since 1994 — and Chair Jerome Powell signaled another big move next month, intensifying a fight to contain rampant inflation.

Slammed by critics for not anticipating the fastest price gains in four decades and then for being too slow to respond to them, Powell and colleagues on June 15 intensified their effort to cool prices by lifting the target range for the federal funds rate to 1.5% to 1.75%.

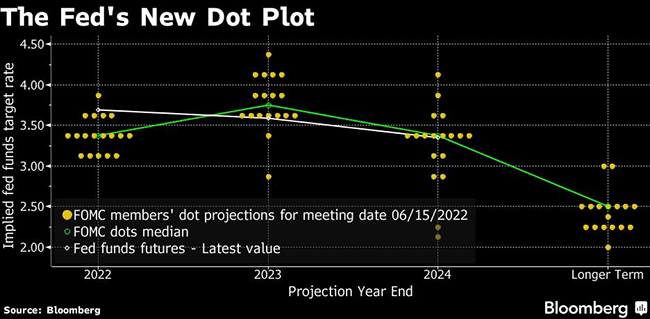

He said another 75 basis-point hike, or a 50 basis-point move, was likely at the next meeting of policymakers, who forecast interest rates would rise even further this year, to 3.4% by December and 3.8% by the end of 2023.

Powell by Jacquelyn Martin/Associated Press

“Clearly, today’s 75 basis point increase is an unusually large one and I do not expect moves of this size to be common,” he told a post-meeting press conference in Washington, remarks that were cheered in financial markets as he took the risk of a string of super-sized increases off the table.

Even so, the move was more hawkish than the 50 basis point shift previously signaled by the chair, who explained the change in tack by pointing to a run of data showed inflation and expectations for it accelerating.

Late last week, an early-June survey from the University of Michigan showed consumer inflation expectations pushing higher. Respondents anticipated inflation rising 5.4% in the year ahead, the highest since 1981. Longer-term price expectations also picked up.

The preliminary June readings were “quite eye-catching, and we noticed that,” Powell said. “One of the factors in our deciding to move ahead with 75 basis points today was what we saw in inflation expectations” in addition to the hotter-than-expected rise in the consumer price index for May.

Officials projected raising it to 3.4% by year-end, implying another 175 basis points of tightening this year. The median prediction of officials was for a peak rate of 3.8% in 2023, and five forecast a federal funds rate above 4%; the median projection in March was for 1.9% this year and 2.8% next. Traders in futures markets were betting on a peak rate of about 4% ahead of the release.

The Fed reiterated it will shrink its massive balance sheet by $47.5 billion a month — a move that took effect June 1 — stepping up to $95 billion in September.

The Federal Open Market Committee “anticipates that ongoing increases in the target range will be appropriate,” it said in a statement after a two-day meeting in Washington. “The committee is strongly committed to returning inflation to its 2% objective.”

The central bankers also revised their outlook for the economy from the soft-landing scenario of March to a bumpier touchdown, underscoring the tough task Powell faces as he tries to tame inflation running about three times the Fed’s 2% target without causing a recession.

Having just won Senate confirmation to a second four-year term, Powell must also re-establish the Fed’s inflation-fighting credibility with investors and with Americans who are furious over the soaring cost of living.

Want more news? Listen to today's daily briefing above or go here for more info

He dismissed the suggestion that the Fed was trying to induce a recession, saying he saw “no sign” of a broader slowdown while assuring Americans that higher rates could be borne.

“It does appear that the U.S. economy is in a strong position, and well positioned to deal with higher interest rates,” he said.

The Fed aims for 2% inflation measured by the Commerce Department’s personal consumption expenditures price index, which rose 6.3% in the 12 months through April, near a 40-year high. Policymakers now forecast the gauge to advance 5.2% this year, up from 4.3% in the March projections, based on the median estimate of Fed governors and regional presidents.

— With assistance from Sophie Caronello, Vince Golle and Catarina Saraiva.