Senior Reporter

February Medium-Duty Sales Paint Mixed Picture

[Stay on top of transportation news: Get TTNews in your inbox.]

U.S. retail sales of Classes 4-7 trucks in February were off 1.3% compared with a year earlier, as only the two lightest segments posted gains. The other two segments fell by double digits, Wards Intelligence reported.

Sales in February dropped to 17,355 compared with 17,580 a year earlier.

Meanwhile, truck makers continue to shift compatible items, such as semiconductors, from their medium-duty models and put them instead in their higher-margin heavy-duty trucks.

Other vehicle manufacturers are taking from their lighter classes to supply their higher-margin medium-duty trucks, ACT Research Vice President Steve Tam said. “That’s why I think you’re seeing [Classes] 4-5 pop up, and the 6-7 is becoming a little bit of a vacuum.”

Class 7 sales dropped the most, 11.4% to 3,177 compared with 3,584 a year earlier.

Freightliner, a brand of Daimler Truck North America, earned a 54.8% share with sales of 1,743. International, a brand of Traton SE’s Navistar Inc., was next with 799 sales for a 21.1% share.

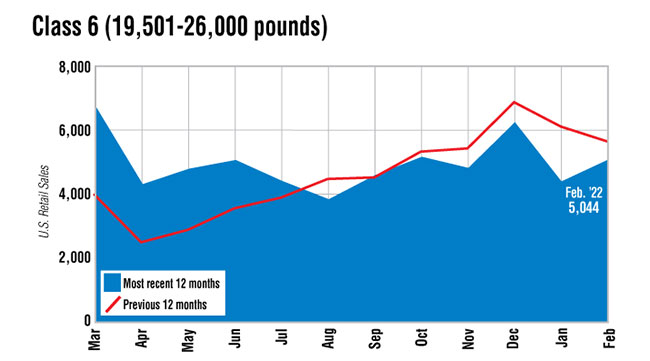

Class 6 sales fell similarly, down 11.2% to 5,044, according to Wards. Freightliner led again, with a 52.2% share on sales of 2,635.

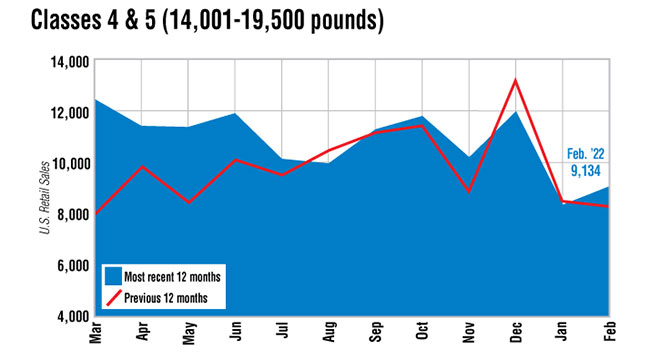

Classes 4-5 sales rose 9.8% to 9,134 vehicles compared with 8,316 a year earlier.

Both portions of this segment increased.

Class 5 sales were 6,970 compared with 6,689 a year earlier. Ford Motor Co. sold 3,112 units, good for a 44.6% share The Ram brand from Stellantis was next with 2,448 and a 35.1% share.

Class 4 sales were 2,164 compared with 1,627 a year earlier. Ford led with 648, Freightliner was next with 561, followed by Isuzu Commercial Truck of America with 540.

At the same time, February’s total Classes 4-7 sales rose compared with the 15,934 in January.

Year-to-date sales fell 8% to 33,288 compared with 36,182 in the 2021 period.

In related news, the Biden administration recently announced federal agencies now are able to acquire 38 different models of medium- and heavy-duty zero-emission vehicles through the General Services Administration — more than double the offerings in fiscal 2021 — as GSA moves toward 100% zero-emission vehicle acquisitions by 2035.

Learn about real-world adoption strategies for self-driving trucks with Robert Brown of Spartan Radar and Charlie Jatt of Waymo. Hear a snippet above, and get the full program by going to RoadSigns.TTNews.com.

At the same time, the U.S. Department of Energy released a study showing zero-emission vehicles will tend to become cost-competitive compared with diesel for smaller trucks before 2030 and for shorthaul (less than 500 miles) heavy-duty trucks before 2035.

Assuming economics drive adoption, ZEV sales could reach 42% of all medium- and heavy-duty trucks by 2030, reflecting lower combined vehicle purchase and operating costs — using real-world payback periods, the agency reported.

DOE also noted with continued improvements in vehicle and fuel technologies, zero-emission vehicles can reach total-cost-of-driving parity with conventional diesel vehicles by 2035 in all medium- and heavy-duty vehicle classes — without incentives.

Want more news? Listen to today's daily briefing below or go here for more info: