EV Maker VinFast Soars in Nasdaq Debut

[Stay on top of transportation news: Get TTNews in your inbox.]

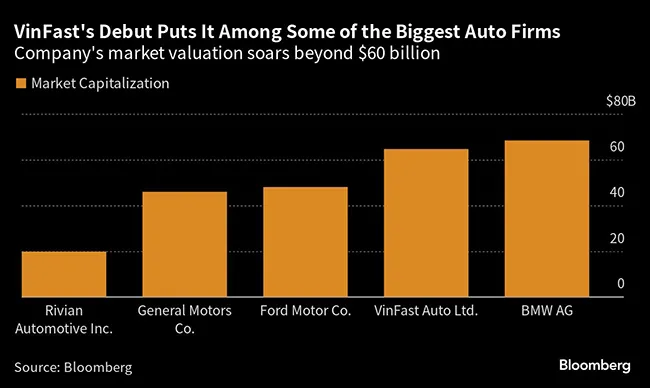

VinFast Auto Ltd. soared in its debut as a public company, vaulting its market capitalization beyond that of General Motors Co. and Ford Motor Co., as traders flipped shares of the electric vehicle maker.

The Vietnamese company, which went public after a SPAC deal, is worth about $65 billion as shares held onto gains Aug. 15, rising to $28.11 in New York — up nearly 190% from the SPAC’s IPO price and more than doubling the deal’s $23 billion implied equity value.

VinFast debuted on the Nasdaq Global Select Market under the symbol VFS to a flurry of trading and volatility halts after completing a merger with special-purpose acquisition company Black Spade Acquisition Co. The 170% surge from the closing price of the SPAC on Aug. 14 makes the company the top performing de-SPAC to debut this year on a U.S. exchange.

The eye-popping valuation makes VinFast worth more than GM, alone, and roughly the same as Ford and Rivian Automotive combined on paper in terms of market capitalization, just lagging BMW AG’s market value.

However, it should be noted that VinFast is a low-float company. There’s a small amount of shares available for trading — just 1.3 million shares of the SPAC remain after redemptions — which means the stock’s move and value are prone to large swings.

Regulatory filings show Pham Nhat Vuong, Vietnam’s wealthiest man and VinFast’s founder, controls about 99% of the entity, partly via shares held by his wife and Vingroup JSC. That means the vast majority of shares are locked up and unavailable to investors who would have gained from the Aug. 15 rally.

Additionally, companies that merge with blank check firms tend to experience rallies that fizzle out a few trading sessions after a deal closes, when social media buzz subsides. De-SPACs that have made their debut this year have seen a median slump of about 45%, with 18 of them wiping out more than 70% of their value, according to data compiled by Bloomberg.

Want more news? Listen to today's daily briefing below or go here for more info: