Staff Reporter

Driver Shortage Linked to Lifestyle Considerations, Costello Says

[Stay on top of transportation news: Get TTNews in your inbox.]

The persistent truck driver shortage is a complicated issue that is tied in part to quality-of-life considerations, according to American Trucking Associations Chief Economist Bob Costello.

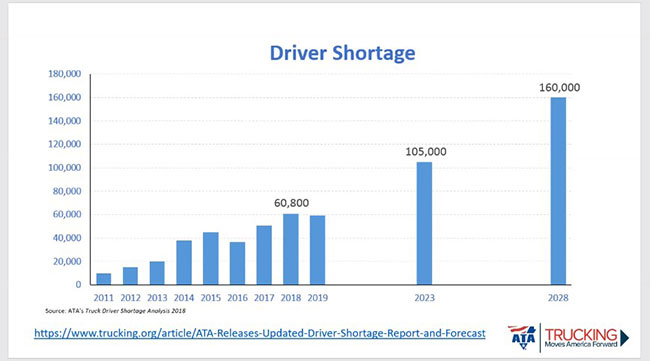

Costello reported the trucking industry needed an additional 60,800 truckers in 2018, a shortfall that is expected to grow to 105,000 drivers by 2023 unless recruitment efforts improve. Costello delivered a presentation at the Federal Motor Carrier Safety Administration’s Motor Carrier Safety Advisory Committee meeting on July 20.

He identified various factors that are exacerbating the driver shortage, ranging from lifestyle issues to the pandemic’s limiting effect on departments of motor vehicles and driver schools. Anecdotally, he said he hears from fleets that companies can pay drivers less as long as they get them home every other night.

Motor Carrier Safety Advisory Committee

“Maybe there’s more to this story,” Costello said. “Maybe it’s also about lifestyle. I think this really gets to the lifestyle issue.”

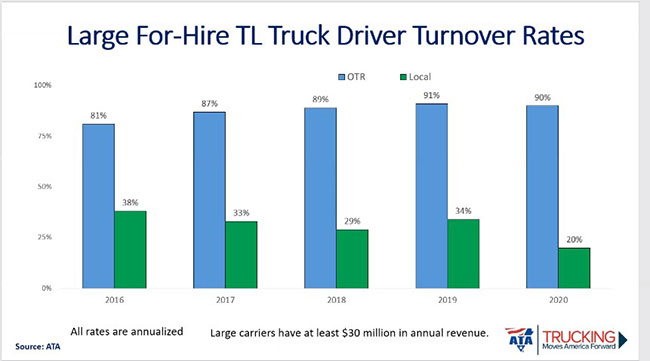

Route length — and the ability for drivers to get home regularly — has a connection to driver turnover, Costello indicated. Truck driver turnover rates generally are higher for over-the-road fleets than local ones. According to Costello, large for-hire truckload driver turnover rates were 90% for OTR operations and 20% for local operations in 2020.

Turnover can be impacted by a variety of other factors, including driver treatment by shippers, receivers and fleets. Also, Costello said fleets will try to recruit each others drivers, sometimes offering recruits the opportunity to drive new trucks.

RESEARCH NEEDED: MCSAC reaches out on burning issues

ACROSS THE POND: U.K. battles driver shortage too

Another factor associated with the driver shortage is FMCSA’s Drug and Alcohol Clearinghouse, a database containing information on commercial driver license holders’ drug and alcohol violations. ATA supports FMCSA’s Drug and Alcohol Clearinghouse, but Costello noted it is having an effect on the driver pool. Many truckers who have been issued drug violations have not started the procedures necessary to re-enter the industry.

“It has gotten rid of a number of drivers who should not be driving,” Costello said. “That is a good thing, but the reality is we now need to backfill those jobs. That has added to the shortage, for good reason, but it has.”

In terms of equipment, Costello pointed out a declining trend in for-hire carrier power units despite the solid freight market.

Motor Carrier Safety Advisory Committee

In the large truckload sector, for-hire carrier power unit fleet trends are down 6% year-to-date in 2021, a substantial drop from the 0.4% decline this sector recorded in 2020.

The small truckload sector’s power unit fleet trends revealed a 3.3% drop in 2020, which has plunged to a 4.9% decline so far this year.

“In today’s market, freight is good,” Costello said. “There’s a lot of freight out there. Rates generally are up. I don’t know of a trucking company that doesn’t want to grow their fleet in that environment. They’re actually contracting.”

Costello pointed to a few factors to explain this contraction in fleet equipment. He suggested fleets are having difficulty adding drivers and selling parked trucks. Also, he said equipment has been leased on independent contractors going to the spot market.

Want more news? Listen to today's daily briefing below or go here for more info: