Senior Reporter

Diesel’s High Cost Due to Refining Capacity Shortage, Exports, Experts Say

[Stay on top of transportation news: Get TTNews in your inbox.]

With record-high diesel and gasoline prices across the country, oil industry analysts told Transport Topics the runaway energy market isn’t being caused exclusively by higher crude prices or the U.S. economy driving demand for petroleum products.

Rather, it mostly is caused by a severe shortage of refining capacity, especially on the East and West Coasts, to produce oil into gasoline, diesel and other critical energy products.

Also complicating the supply chain for fuel is the export of more than 1 million gallons of diesel per day to Latin American nations and Europe to help that continent as it abruptly separates from buying energy from Russia because of Moscow’s invasion of Ukraine.

Kloza

“One of the things about capitalism is that you can make more money by sending diesel to Latin America and Europe and some other places, and we’re not getting many imports,” oil industry analyst and Oil Price Information Service founder Tom Kloza told Transport Topics. “I think we’ll muddle through. But it depends on how much fuel Europe has, and it could be very desperate there. I think 50% of the light-duty vehicles there run on diesel.”

Kloza pointed out that Latin America is the largest purchaser of U.S. refined products, and demand for American petroleum products is increasing.

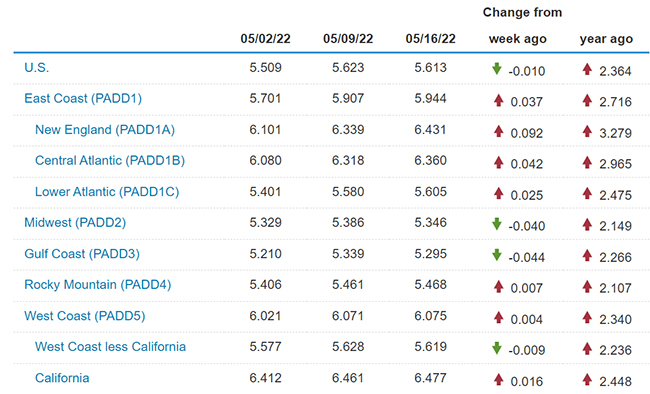

The national average price of diesel stands at $5.613 a gallon, one cent off its all-time high.

Since the beginning of the COVID-19 pandemic, at least 13 U.S. refineries shut down, significantly cut operations or switched to other petroleum products, including renewable diesel.

Six are in the West, including Hawaii. The other seven are spread across the country, but according to Dallas-based energy consulting company Turner-Mason, the supply-demand balance is tight. Along the Atlantic Coast, the situation is exacerbated by the recent loss of Russian product exports into Europe.

“Things are getting a bit constrained, but we have to keep in mind while we have closed refineries, during COVID, we are still exporting about 1 million barrels a day of diesel fuel,” Turner, Mason & Co. Vice President John Mayes told TT. “We are exporting fuel just at the time that U.S. demand is returning to pre-COVID levels.”

TMC pointed out the loss of the 13 refineries accounted for more than 1.4 million barrels of oil per day, or more than 7% of the country’s entire capacity of gasoline, diesel and jet fuel. The company said this is not just in the U.S., as worldwide refining production has declined by an additional 2.13 million barrels per day.

Most refineries generally produce 50% unleaded gasoline, 30% diesel, 10% jet fuel and 10% other fuels, including propane and general aviation gasoline.

EIA.gov

With demand for petroleum products falling by as much as 20% during the pandemic, Kloza and others said companies shuttered older, less profitable refineries permanently. Some had been impacted by explosions, fires and hurricanes. For others, maintenance and repairs had become too expensive, especially as the move toward cleaner, renewable energy increases. That contributed to making those refineries, some of them more than 80 years old, unprofitable.

Just last month, chemical maker Lyondell Basell Industries announced it will permanently close its 104-year old refinery, a 700-acre site along the Houston Shipping Channel, by the end of the 2023. That potentially could result in a reduction of 263,000 barrels of production a day.

The announcement came after two failed attempts to sell the plant and the closing of five U.S. refineries in the past two years.

U.S. average on-highway #diesel fuel price on May 16, 2022 was $5.613/gal, DOWN 1.0¢/gallon from 5/09/22, UP $2.364/gallon from year ago #truckers #shippers #fuelprices https://t.co/UwPfDgFUFV pic.twitter.com/spBNG3DWg3 — EIA (@EIAgov) May 17, 2022

A TMC executive believes this will give the company time to make a deal to sell the facility.

“It needs some maintenance, but with the tight supply we are in, somebody will buy it and make the investment,” Turner-Mason Executive Vice President John Auers said. “It’s too valuable in this environment.”

Still, even with oil companies and refineries reporting record profits during the first quarter, it appears few are eager to purchase some of the older refineries and spend the tens of millions that will be needed to comply with new environmental and safety regulations.

Host Michael Freeze discusses insurance coverage and costs with Jane Jazrawy of Carriers Edge and David Berno of Hub International. Tune in above or by going to RoadSigns.TTNews.com.

“We feel we’ve got higher returns, better uses for the capital to employ than buying a refinery that’s on the market at this point in time,” Valero Energy CEO Joe Gorder said in a conference call with analysts April 26.

It’s possible there could be some short-term relief in sight as data from the Energy Information Administration shows refineries running at 90% capacity earlier this month and some units are capable of running 10% to 20% above their normal capacity.

“The big picture on diesel is a slow-moving nightmare,” oil industry analyst Phil Flynn told TT. “We have closed a lot of refineries, and those were big producers. There is a global shortage of capacity, and we are losing the refining capacity faster than we can replace it. There is no easy answer here.”

Want more news? Listen to today's daily briefing below or go here for more info: