Senior Reporter

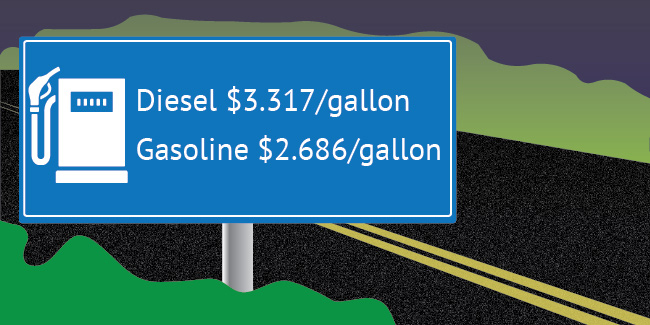

Diesel Slips 2.1 Cents to $3.317 a Gallon Amid Oil’s Steep Drop

The U.S. average retail price of diesel dropped 2.1 cents to $3.317 a gallon Nov. 13 as the price of West Texas Intermediate crude oil fell to an 11-month low. Investors see demand softening, supplies building and potential global tensions.

It marked the fourth consecutive weekly decline in the price of trucking’s main fuel.

Still, diesel costs 40.2 cents a gallon more than it did a year ago, when the price was $2.915, the Department of Energy said a day after Veterans Day.

Average prices fell in all regions of the country, and by the most in California — 2.8 cents a gallon to $4.04.

The national average price for regular gasoline plunged 6.7 cents to $2.686 a gallon, DOE’s Energy Information Administration said. The average is 9.4 cents higher than it was a year ago.

West Texas Intermediate crude futures on the New York Mercantile Exchange closed at $55.23 per barrel Nov. 12 compared with $62.85 on Nov. 5.

But prices will climb next year, according to EIA’s Short-Term Energy Forecast issued in November.

WTI will average $65 a barrel in 2019, which is $5 a barrel less than EIA previously forecast.

EIA’s weekly summary for the period ending Nov. 9 found U.S. commercial crude oil inventories increased by 10.3 million barrels compared with the week of Nov. 2. At 442.1 million barrels, inventories are about 5% above the five-year average for this time of year.

Meanwhile, one small fleet operator posted online that his fuel-efficient truck, at one point, actually made the cost of fuel free on a recent run.

He went 495 miles, fueled up for $140.04 and got 10.31 mpg.

“Twenty-nine cents to run per mile and the surcharge pays 40. Not only is fuel cost-free, I made 11 cents a mile back, that’s where the easy money is, kids,” Jamie Hagen wrote.

Started raining but I managed a family photo of the Hell Bent Xpress three. Ozzy, Sharon and Kelly #EasyMoneyMacks pic.twitter.com/og2Cf31haH — MACK LOVIN (@hellbenthagen) August 3, 2018

He owns Stratford, S.D.-based Hell Bent Xpress, which operates three trucks and food-grade tankers to haul commodities including vegetable oils, milk, molasses, fructose, corn syrup and tallow.

“That was a particularly hot day, and it was virtually windless as I headed south down Interstate 29 from Wahpeton, N.D., to Sioux City, Iowa, where I fueled. I was actually loaded for 90% of those miles. Talk about a best-case scenario,” Hagen told Transport Topics.

His truck is a 2016 Mack Pinnacle outfitted with the Super Econodyne MP8 engine set to 445 horsepower. It has a single overdrive mDrive transmission and a 2.67 ratio single rear end with tag axle chaser, he said.

“We run all over the U.S. and Canada. The bulk of our miles is Midwest, though, as most of our shippers are there,” Hagen said. “Just out, then back to get another one. I’m typically loaded on average 72% of all miles. With bulk, that means I’m 80,000 pounds or empty — no light loads as it were.”

His latest average fuel mileage over 90 days is 8.63 mpg.

For 30 days, it’s 8.33 mpg.

“Since it’s been getting colder out, the mileage has started declining, which is common for winter,” Hagen said.

RELATED: OPEC Considers 2019 Oil Production Cuts in Yet Another U-Turn

In the meantime, OPEC, in its latest monthly report on conditions in the oil market, noted 2019 prospects point to higher supply growth than global requirements, which could have repercussions for global oil demand and lead to “widening the gap between supply and demand” next year.

OPEC Secretary General Mohammad Barkindo said Nov. 12 that the resurgence of non-OPEC supply was beginning to look “alarming,” Bloomberg News reported.

He added that he saw the need for the group and its allies to agree on a cut of 1 million barrels a day when the cartel meets next month. While no decision to reduce supply was taken over the weekend, this month’s report will add to the chorus of views within the group, pushing for new cuts.

Saudi Arabia, the world’s biggest crude exporter, also unveiled a plan to reduce its own shipments by about 500,000 barrels a day next month.

Oil’s unprecedented decline deepened as investors fled a market hammered by swelling excess supplies, a darkening demand outlook and President Donald Trump’s Twitter critique of the world’s biggest crude exporter, according to Bloomberg.

Trump admonished Saudi Arabia for planning to curb output and lamented prices that settled below $56 a barrel.