OPEC Considers 2019 Oil Production Cuts in Yet Another U-Turn

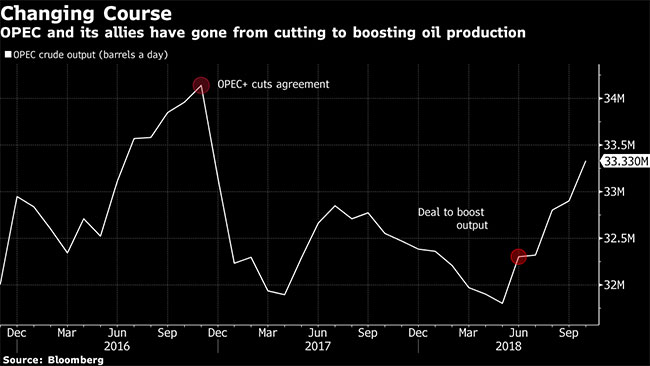

The wind changed again in a stormy oil market as OPEC signaled it will consider a return to cutting output next year, potentially making the second production U-turn this year.

Amid a summer of rising prices and unprecedented political pressure from President Donald Trump, Saudi Arabia, Russia and other producers had opened the taps. Now, with the U.S. midterm elections over and crude futures wilting in the face of another historic shale oil surge, the cartel will discuss a change of course this weekend.

RELATED: Diesel Continues to Slide, Drops 1.7 Cents to $3.338 a Gallon

“The message from OPEC looks like: Fasten the seat belts,” said Bob McNally, president of Rapidan Energy Advisors, a consultant in Washington. The cartel looks set to “put pedal to the metal to boost production and then immediately slam the brakes pretty hard and talk about cutting supply.”

Ministers from the Organization of Petroleum Exporting Countries and its allies will meet in Abu Dhabi on Nov. 11 and discuss scenarios including the possibility of cutting production again next year, according to delegates. Some members are concerned that inventories are rising, they said, asking not to be named because the discussions are private.

If the group, led by Saudi Arabia, does ultimately decide fresh cutbacks are necessary, there are a number of challenges. It will need to once again secure the support of rival-turned-partner Russia, which has less need for high oil prices. There’s also the risk of antagonizing Trump, who repeatedly accused the group on Twitter of inflating prices.

Another reversal would seem to be a far cry from the usual OPEC mantra of preserving stability and careful market stewardship. Yet it does reflect the level of uncertainty in a market experiencing huge shifts in supply and demand.

Earlier in the summer, prices began to surge as the risk of production shortfalls from sanctions on Iran and Venezuela’s economic collapse rattled the market. Losses from those two OPEC members threatened the biggest supply disruption since the start of the decade, and Brent crude eventually peaked above $86 a barrel last month.

Since then, big things have happened on the other side of the supply equation. OPEC has been in “produce as much as you can mode” to reassure consumers, according to Saudi Energy Minister Khalid Al-Falih. The kingdom has lifted output close to record levels, while Libya is pumping the most in five years. Unexpected waivers for buyers of Iranian crude have blunted the impact of U.S. sanctions.

Then there’s the small matter of American production growing at the fastest rate in a century, just as fuel demand is at risk from the slowdown in emerging economies and the U.S.-China trade war.

Crude prices already reflect a much weaker outlook for 2019. Brent for January delivery has retreated about 15% from a four-year high reached in early October. Prices jumped 1.3% to $73.02 at 1:38 p.m. in London on Nov. 7.