Diesel Slips 0.7¢ to $2.564, Gas Rises to $2.414

This story appears in the June 12 print edition of Transport Topics.

U.S. diesel and gasoline prices each made modest moves during the week ended June 5 but in different directions. Diesel slipped 0.7 cent a gallon and gas rose 0.8 cent, while crude oil dropped toward this year’s low point below $46 a barrel.

A Department of Energy agency also forecast that U.S. oil production will make up for any OPEC cuts, leaving petroleum users enjoying largely stable markets through 2018.

The retail diesel average price declined for the sixth time in seven weeks, to $2.564, although the week before was a heftier 3.2-cent increase, DOE’s Energy Information Administration said. A year ago, the average was $2.407, or 15.7 cents lower.

The gasoline average price increased for the third straight week, to $2.414. A year ago, the price was $2.381, or 3.3 cents lower.

On the New York Mercantile Exchange, crude oil futures dropped 11.2% in 10 trading days to $45.72 a barrel June 7 from $51.47 on May 23.

Although OPEC met in May with other major oil-producing nations and agreed to limit crude production in an attempt to stabilize or raise prices, EIA issued its Short-Term Energy Outlook on June 6 and said domestic oil production should hit 10 million barrels per day by next year’s second quarter, topping “the previous record level of 9.6 million barrels per day set in 1970” — 47 years ago.

The current pace for U.S. production is 9.2 million barrels per day, EIA said in the short-term report.

EIA last published an outlook May 9. During the four-week interval, agency forecasters reviewed new data and said U.S. retail diesel would be higher in this year’s third quarter than previously expected, $2.73 a gallon instead of $2.67.

In each of the next five quarters, though, through the end of 2018, the agency is estimating diesel will be a little cheaper than previously expected — rising to $2.90 during the final quarter of next year from $2.74 in this year’s last three months. The earlier projections were higher for each quarter in that time span by 1 cent to 7 cents per gallon.

Badger Underwood, president of his family’s dry bulk carrier in Spruce Pine, N.C., said, “Prices have moderated some; over the last couple of years, they’ve been pretty stable.”

He grew up around trucking as his father was one of the two founders of Underwood & Weld Co., and since 1985, he’s been company president.

Underwood said he depends upon a fuel surcharge to keep his 42 tractors running, but customers have balked somewhat recently.

“When fuel was over $4 per gallon [in 2008], everyone was in the same boat,” he said, “but people are scrutinizing this more after prices came down, saying the fuel surcharge should go away.”

“The last couple of years, I’ve had more customers wanting to tell me what my cost is,” Underwood said.

U&W deploys its tractors as needed, he said, but trailers often are dedicated to specific shippers. He hauls flour, food-grade salt and plastic pellets used to make food wrapping or containers. There’s also white cement, which, incidentally, should never be mixed with Portland cement.

The company’s need for specialized equipment means U&W has a deadhead rate of 50%, whereas dry van carriers usually seek to limit empty miles to less than 10%.

The company uses 10,000 to 12,000 gallons of fuel per week, so Underwood said he has a discount arrangement with a major truck stop chain, governs his 13-liter engines’ speed to a maximum of 65 mph and uses single wide-base tires.

The company tried auxiliary power units, but the devices did not pass muster. APUs weigh too much, Underwood said, meaning he had to cut back the weight ceiling for a load.

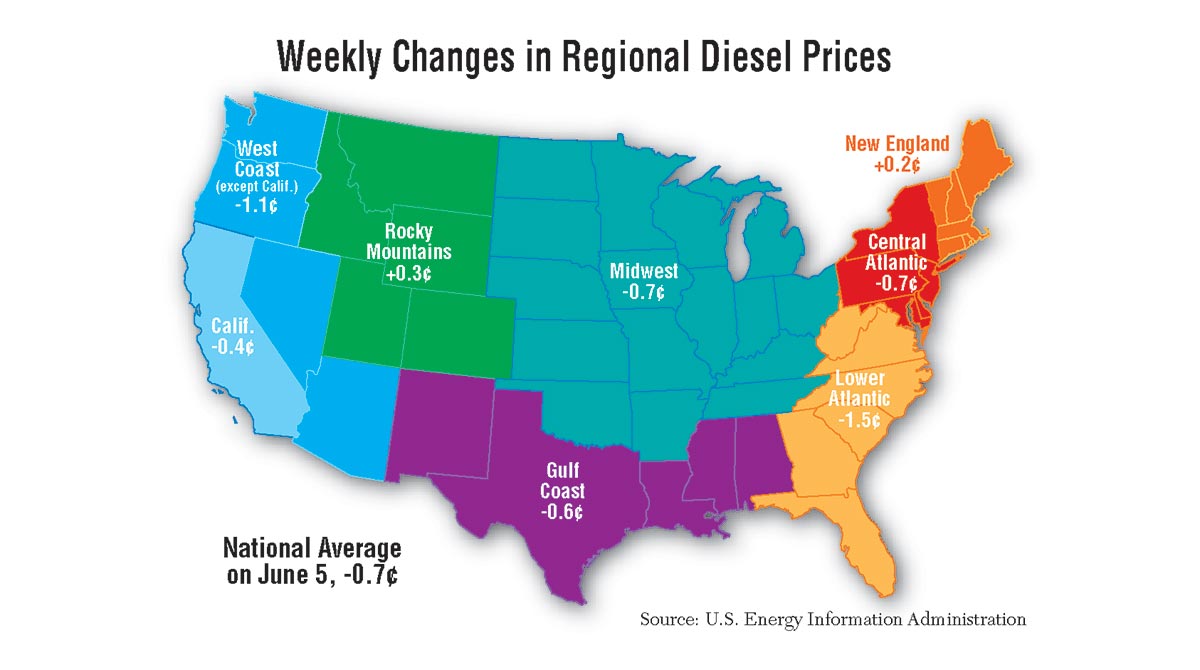

Among the nation’s regions, six experienced diesel price declines for the week, while diesel in New England and the Rocky Mountain states increased. All regions are higher relative to a year ago.

The 12-month low for diesel fuel is $2.31 a gallon on Aug. 15, and the highs are $2.597 on Jan. 9 and April 17.

An oil analyst said the drop in crude prices caught him off guard.

“This is really unexpected,” Gene McGillian, market research manager at Tradition Energy in Stamford, Conn., told Bloomberg News. “It really looks as if fears of oversupply is what’s driving the market.”