Senior Reporter

Diesel Rises 2.5¢ to $3.367 a Gallon

[Stay on top of transportation news: Get TTNews in your inbox.]

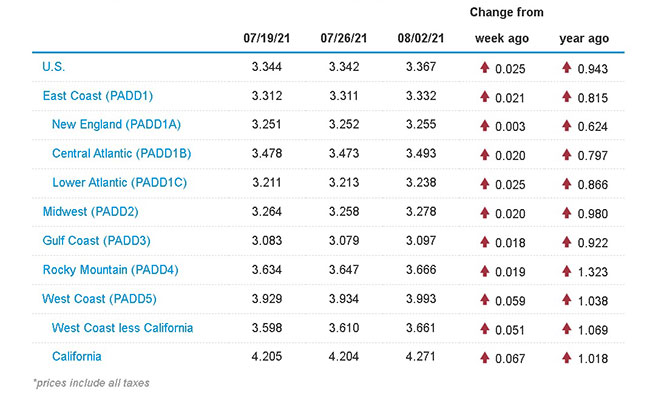

The national average price for a gallon of diesel climbed 2.5 cents to $3.367, according to Energy Information Administration data released Aug. 2.

The cost increase was the 13th in the past 14 weeks, interrupted only by a 0.2-cent dip July 26.

This week marked the biggest gain since a 3.1-cent rise to $3.331 a gallon July 5.

U.S. average on-highway #diesel fuel price on August 2, 2021 was $3.367/gal, UP 2.5¢/gallon from 7/26/21, UP 94.3¢/gallon from year ago https://t.co/hMtDMWiWA9 #truckers #shippers #fuelprices pic.twitter.com/DJmx41MYbR — EIA (@EIAgov) August 3, 2021

The price of trucking’s main fuel rose in all 10 regions of EIA’s survey, with the largest gain being 6.7 cents in California. The West Coast and West Coast less California were the only other regions with increases of more than 5 cents.

EIA noted uncertainty for both the West Coast and Rocky Mountain regions in how or whether their diesel supplies will be affected from the previously announced refinery closures because of their conversion to renewable diesel production.

Likewise, the average price of a gallon of gasoline also increased, by 2.3 cents to $3.159, which is 98.3 cents per gallon more expensive than a year ago.

Gasoline production increased for the week ending July 30, averaging 10.2 million barrels per day. Distillate fuel — primarily ultra-low sulfur diesel used in transportation and to a lesser degree as heating oil — production increased, averaging 4.9 million barrels per day.

At the same time, President Joe Biden wrote on Twitter: “The future of the auto industry is electric — and made in America.” His Build Back Better plan calls for 50% of all passenger vehicles to be zero emissions by 2030.

The future of the auto industry is electric — and made in America.

Today I'm signing an executive order with a goal to make 50% of new vehicles sold by 2030 zero-emission — and unveiling steps to reverse the previous administration’s short-sighted rollback of vehicle standards. — President Biden (@POTUS) August 5, 2021

“This represents a dramatic shift from the U.S. market today that can be achieved only with the timely deployment of the full suite of electrification policies committed to by the administration,” Ford Motor Co., General Motors Co. and Stellantis NV said in a joint statement. “Our recent product, technology and investment announcements highlight our collective commitment to be leaders in the U.S. transition to electric vehicles.”

Separately, truck makers are beginning to take a trickle of initial orders for electric commercial vehicles.

The CEO of one medium- and heavy-duty diesel engine maker, with multiple efforts underway to also develop alternative electric powertrains, however, said during a recent earnings call “the tail end of diesel will be a lot longer than people expected.”

“And that’s not because we sit around and hope for the preservation of diesel. It’s because the diesel market is so complicated. There’s so many applications, 100 years of applications,” Cummins CEO Tom Linebarger said.

“Right now, we can produce hybrid diesel engines and hybrid and natural gas engines at significantly lower cost than either battery-electric vehicles or fuel cell powertrains and that are significant improvements in both carbon and criteria pollutants,” he added, with the intent of getting customers to actually use them and not delay purchases.

U.S. average price for regular-grade #gasoline on August 2, 2021 was $3.159/gal, UP 2.30¢/gallon from 7/26/21, UP 98.3¢/gallon from year ago https://t.co/AtvvSa2pvi #gasprices pic.twitter.com/qF9UENS3KM — EIA (@EIAgov) August 3, 2021

Customers know how to fuel and operate those hybrid engines that are a lot cheaper to buy, he said. “So that’s why I think we’re trying to make sure that we stay at the forefront of all these and not just plop down in one big pile on one place that’s not a winning strategy in this market.”

Meanwhile, West Texas Intermediate crude futures on the New York Mercantile Exchange closed at $71.26 per barrel on Aug. 2 compared with $71.91 on July 26.

In related news, the truck stop association Natso was joined by Sigma, the association representing fuel marketers, and Nacs, representing convenience and fuel retailing, on Aug. 2 in asking lawmakers considering the bipartisan infrastructure bill to oppose any amendments that would detract from the industry’s ability to make forward-looking investments.

“The mix of transportation energy that our members sell is changing,” the groups wrote in a letter to Senate Majority Leader Charles Schumer (D-N.Y.) and Senate Minority Leader Mitch McConnell (R-Ky.).

“The industry is making investments in a range of alternatives including electricity, hydrogen, biofuels, natural gas and more options. Investment in alternative forms of transportation energy is critical for the future growth of our industry. We appreciate that senators from across the ideological spectrum as well as Biden administration officials are willing to work with us on policies to support and encourage investments in alternative transportation energy,” they wrote.

“Building the transportation infrastructure we want for the future of the nation will only be successful if the private sector has incentives to invest its funds in that infrastructure. Our industry supports this legislation because it recognizes the essential role our members must play in lowering the carbon intensity of transportation energy in the United States.”

Also, August is proving to be tough for crude, Bloomberg News reported. Tightened controls in some Asian nations to curb the spread of the coronavirus risk eroding oil demand at a time when the Organization of Petroleum Exporting Countries and its allies are gradually increasing supply.

U.S. On-Highway Diesel Fuel Prices

EIA.gov

Want more news? Listen to today's daily briefing below or go here for more info: