Diesel Rises 0.3¢ to $3.730 a Gallon

[Stay on top of transportation news: Get TTNews in your inbox.]

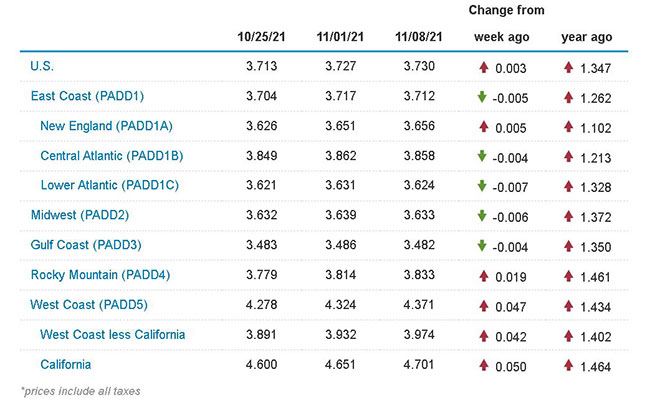

The national average for diesel barely budged, nudging up three-tenths of a cent to $3.730 a gallon, according to Energy Information Administration data released Nov. 8.

The current price reflects the second consecutive modest increase after a 1.4-cent rise Nov. 1. Prior to that, trucking’s main fuel spiked 30.7 cents a gallon from Sept. 27 to Oct. 25.

A gallon of diesel now costs $1.347 more than it did at this time in 2020. Activity was mixed in the 10 regions in EIA’s survey, as the price rose in five and dropped in five. The largest increase was 5 cents in California, and the biggest decline was seven-tenths of a cent in the Lower Atlantic.

U.S. On-Highway Diesel Fuel Prices

EIA.gov

The national average for the price of a gallon of gasoline increased by 2 cents to reach $3.41, which is $1.314 more than a year ago.

EIA reported demand for petroleum, in the United States and globally, this year has largely returned to the pre-pandemic levels in 2019.

“Demand has grown faster than supply, reducing inventories and contributing to higher prices for crude oil and petroleum products,” the agency said.

#TodayInEnergy - Crude #oil demand returns faster than supply, increasing prices and reducing inventories https://t.co/lirQH3zT39 #oilprices pic.twitter.com/OCIjW5TXkI — EIA (@EIAgov) November 9, 2021

The price for WTI reached $84 per barrel on Nov. 1, up $37 since the beginning of the year.

EIA noted for the latest data, 50% of the retail price of a gallon of diesel stems from the price of a barrel of oil. For gas, it is 53%.

Meanwhile in Washington, the U.S. House of Representatives passed the $1 trillion infrastructure bill. Analysts see the bill as providing another upside for oil on the horizon.

In related news, a major oil company said it is entering the fuel card business to serve truckers now at thousands of locations, and possibly with alternative fuels to diesel at a later date.

Shell Oil Co.

Shell Oil Co. announced Nov. 5 it acquired MSTS Payments and its Multi Service Fuel Card business from Multi Service Technology Solutions Inc. Terms were not immediately available.

Founded in 1978 by a former over-the-road truck driver who envisioned a better way to pay for fuel, Multi Service Fuel Card served as the first fuel card for trucking companies that provided real-time transaction authorization, according to Shell.

The fuel card’s acceptance network and transaction processing platform now provide Shell with a closed-loop payment network used by commercial road transport companies at thousands of truck stops in North America, the company noted.

Murray

“Historically, Shell has been heavily focused on the consumer side not as much on the business-to-business side,” Tim Murray, general manager of Shell commercial road transport, sectors and decarbonization, told Transport Topics. “It has three different platforms in the U.S. And so this was partly a natural progression to get into the over-the-road trucking space.”

He added, “It is a first step, for sure. There is a lot of opportunity coming, a lot of things we have to figure out when you consider low-carbon fuels and the sustainability goals of our partners and customers.”

A goal at Shell is to have the card platform’s “good, practical applications” bring payments of different fuel types into one place, he added.

“We already have authorization strings for biodiesel and bio blends, for example. We are already looking at investigating what does that mean for other low-carbon fuels, like hydrogen, compressed natural gas and electricity,” Murray said. “I think this is pretty exciting, but with a lot more learning and opportunity to explore down the road.”

For Veterans Day, host and Navy veteran Michael Freeze sits down with Army veterans James Rogers, owner of Spartan Direct Trucking Co. and 2020 Transport Topics Trucking's Frontline Hero, and John Baxter, equipment columnist. Hear a snippet above, and get the full program by going to RoadSigns.TTNews.com.

Shell also sees opportunities to create synergies with other product offerings. Shell said it plans to add services to enhance the customer experience and leverage its heavy-duty diesel engine oil brand, Shell Rotella, to offer trucking fleets what it called fuel-economy savings, extended-drain capability, enhanced engine cleanliness and excellent wear protection.

Fuel accounts for 24% of the cost per mile for heavy-duty trucks, second to labor at 42%, according to American Transportation Research Institute.

ATRI wrote in “An Analysis of the Operational Costs of Trucking: 2020 Update” that fuel costs are dependent on a number of complex factors beyond simple oil market economics.

“Fleet size can be an important factor in fuel expenses, as firms with more market power can negotiate better pricing contracts with petroleum suppliers. Larger fleets also tend to operate newer, more fuel-efficient trucks, further decreasing the cost of the fuel per mile. As expected, the cost per mile for diesel has an inverse relationship with the size of the respective fleet.”

Want more news? Listen to today's daily briefing below or go here for more info: