Senior Reporter

Diesel Reverses Course, Shoots Up 38.8¢ to $5.224 a Gallon

[Stay on top of transportation news: Get TTNews in your inbox.]

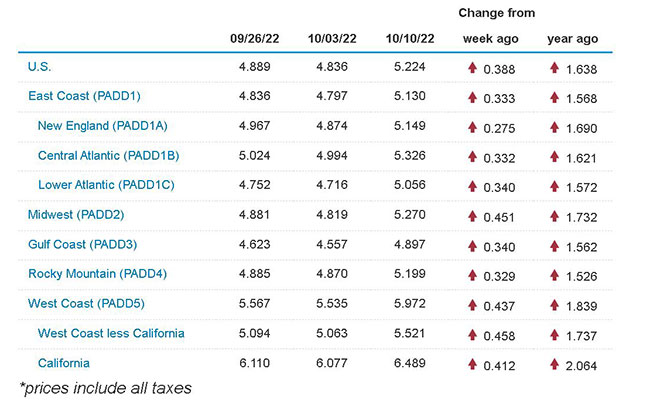

The national average price of diesel ended its five-week run of declines by skyrocketing 38.8 cents to $5.224 a gallon, according to Energy Information Administration data on Oct. 10.

The increase lands as several U.S. refineries are down for seasonal maintenance, limiting fuel production, according to reports.

A week earlier, diesel had fallen to $4.836 a gallon — its lowest price since reaching $4.104 on Feb. 28. On March 7, diesel surged a record 74.5 cents.

The average price of trucking’s main fuel now costs $1.638 more than it did at this time in 2021.

U.S. average retail prices for October 10, 2022:

Regular grade #gasoline: $3.91/gal

On-highway #diesel: $5.22/gal#gasprices https://t.co/dsfxiPAGLR — EIA (@EIAgov) October 12, 2022

Diesel posted steep increases in all 10 regions in EIA’s survey. New England showed the smallest gain at 27.5 cents. The West Coast less California and the Midwest had price hikes of 45.8 and 45.1 cents, respectively.

The national average price for a gallon of gasoline also took a noteworthy jump of 13 cents to reach $3.912 a gallon.

Rising prices also follow the OPEC+ alliance’s Oct. 5 announcement of a crude oil production cut.

EIA reported the West Texas Intermediate crude oil futures price reached $89.35 a barrel Oct. 11, which was up $2.83 compared with a week earlier.

Inflated fuel prices do not affect all of trucking in the same way, one carrier executive said.

Ragan

“I wish I could provide better commentary regarding how we handle diesel price fluctuations but, with the exception of fuel conservation programs, driver bonuses, etc., it really is the customer fuel surcharges that we utilize,” Melton Truck Lines Chief Financial Officer Robert Ragan told Transport Topics.

“In our case, a vast majority of our freight is contract loads as opposed to spot market freight,” he said. “The carriers that play more heavily in the spot market feel more pain when fuel prices rise [and spot freight rates trend downward, as is happening compared with a year earlier].

“When fuel prices rise rapidly, our surcharges cannot keep up and our net costs rise. Conversely when they fall, we benefit. If you look at our net cost over time, the fluctuations even out.”

U.S. On-Highway Diesel Fuel Prices

EIA.gov

The Tulsa, Okla.-based carrier operates about 1,200 tractors. Melton ranks No. 86 on the Transport Topics Top 100 list of the largest for-hire carriers in North America. It ranks No. 9 on the TT list of the largest heavy-haul/flatbed carriers in North America.

Meanwhile, “The global diesel market is very strong at the moment,” Mark Williams, research director for short-term oils at WoodMackenzie Ltd., told Bloomberg News on Oct. 12. “Higher diesel prices have the potential to create even stronger inflationary pressures, especially if the current price spike is sustained, adding significant downside risk to demand and increasing the chances of a global recession.”

TT's Eugene Mulero joins host Mike Freeze to discuss the midterm elections, and what the fight for control of Congress will mean for trucking. Tune in above or by going to RoadSigns.ttnews.com.

At the same time, diesel’s greenhouse gas emissions profile, though improving with the engines in newer trucks, continues to prompt the search for alternative fuels.

In October, used truck dealer and parts distributor Vander Haag’s Inc. announced a partnership with ClearFlame Engine Technologies to begin installing in heavy-duty trucks engines that have been converted with ClearFlame’s technology to operate on clean, lower-cost E98 ethanol fuel instead of diesel.

Vander Haag’s, an 80-year-old company with nine locations in the Midwest, noted it will serve as the vehicle integrator, reinstalling the ClearFlame engines into Class 8 trucks. In addition, Vander Haag’s will leverage its parts distribution network to provide components for the initial integration, as well as ongoing parts support.

ClearFlame, an Illinois-based engine technology company founded in 2016 by two Stanford University graduates, noted taking diesel fuel out of internal combustion engines empowers rapid decarbonization for what it sees as hard to electrify segments such as trucking, agriculture and power generation.

“One of the things we are doing with the early fleets is getting them [fuel] contracts, dropping an extra tank in their fuel depot if they need it, getting over that early chicken-or-egg hump. We are talking to all the truck stops as well,” ClearFlame CEO BJ Johnson told TT at ACT Expo in May.

Blumreiter

Chief Technology Officer Julie Blumreiter added at the time how this happens.

“There are some adjustments to the way the plumbing is done for the air and exhaust that just manage the heat differently,” she said, “and that’s what lets us have that behavior where ethanol will light up right away as if it were diesel fuel.”

In 2021, the company received $17 million in Series A financing, which will enable commercialization of the company’s engine technology. The financing was led by Breakthrough Energy Ventures with participation from commodity trader Mercuria, John Deere and Clean Energy Ventures.

Want more news? Listen to today's daily briefing below or go here for more info: