Senior Reporter

Diesel Reverses Course, Rises 8¢ to $4.604 a Gallon

[Stay on top of transportation news: Get TTNews in your inbox.]

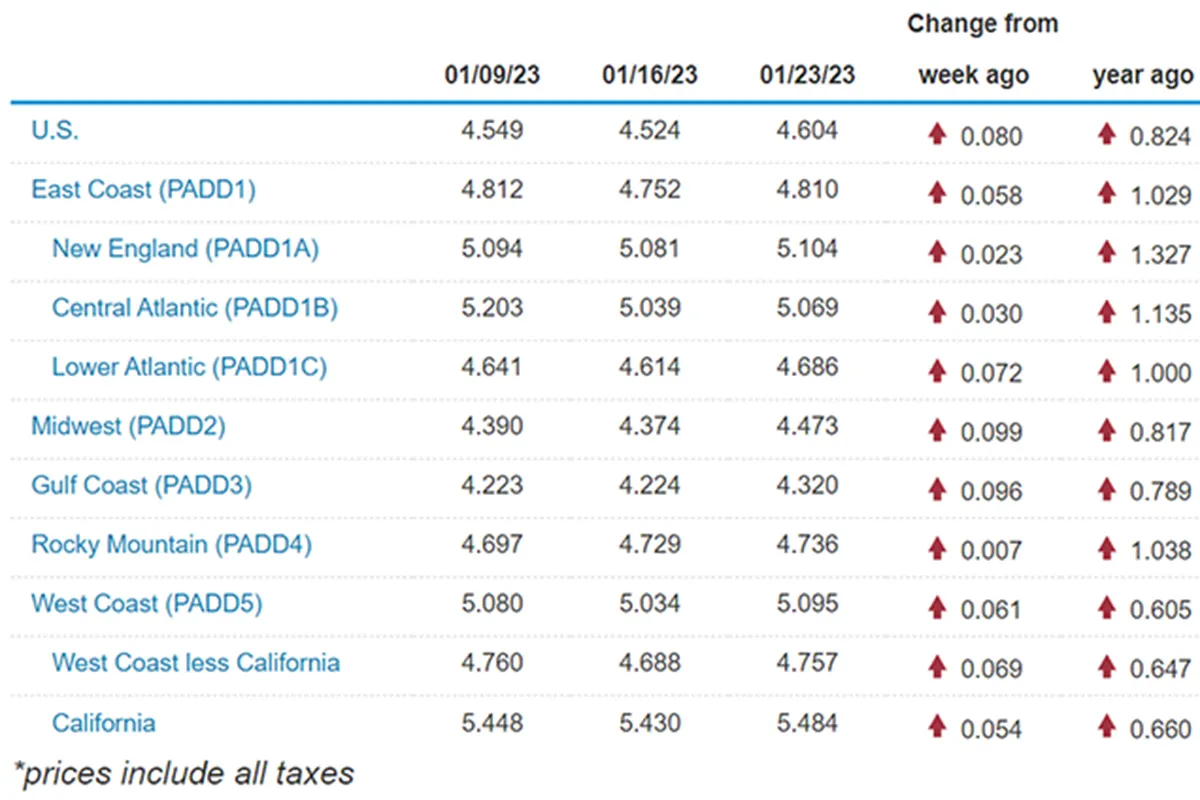

The national average price for diesel reversed its trend and climbed 8 cents to $4.604 a gallon, according to Energy Information Administration data for the week ending Jan. 23.

The average price for a gallon of diesel had dropped in nine of the previous 10 weeks, totaling 83.3 cents. The only increase in that time was a 4.6-cent gain three weeks ago.

A gallon of diesel now costs 82.4 cents more than it did at this time in 2022.

Trucking’s main fuel rose in all 10 regions in EIA’s weekly survey, ranging from a high of 9.9 cents in the Midwest to seven-tenths of a cent in the Rocky Mountain area.

Gasoline’s price followed suit, surging 10.5 cents a gallon on average to settle at $3.415. That marks a 9.2-cent increase from a year ago.

U.S. average price for regular-grade #gasoline on January 23, 2023 was $3.415/gal, UP 10.5¢/gallon from 1/16/23, UP 9.2 ¢/gallon from year ago #gasprices https://t.co/jZphFa0hDF pic.twitter.com/X8dRjaZ1kF — EIA (@EIAgov) January 24, 2023

Oil industry analyst Phil Flynn believes gas and diesel prices will continue to creep upward. Supplies will tighten when peak driving season nears, and the markets are being influenced by news that the Chinese economy is starting to reopen and more manufacturing goods are being produced.

“I think this is really the China reopening,” Flynn said. “That’s going to tighten the global supplies. Big picture, looking at a situation where demand is going to hit a record high this year and supplies are going to be limited, I think the market is anticipating some tightness on the product side.”

Flynn

Flynn also pointed out that for more than the past three months U.S. oil refineries have been running at more than 90% capacity, and in 60 to 90 days many of those facilities will shut down for maintenance. In the case of gasoline production, operations must change to summer-blend gasoline, which takes time to transition.

“We’re starting to get into refinery maintenance which I think is going to be a big deal because they’ve been running around the clock, for a long time,” he said. “That will put us into a bit of a situation later this year.”

EIA said in its most recent report that refinery utilization dipped at the end of December to 89.3% from November’s average of 93.8%. That was due in part to a cold snap that impacted a wide section of the southern U.S., including Texas and Louisiana, where several major refineries are located.

U.S.. On-Highway Diesel Fuel Prices

EIA.Gov

“Despite this decrease in December, overall refinery utilization in 2022 was high,” the EIA report said. “We estimate annual average utilization in 2022 averaged 91.7%, up more than 5 percentage points from 86.6% in 2021. We forecast refinery utilization will reach 91.5% in 2023 and will decrease slightly to 91% in 2024.”

Meanwhile, the weekly Baker Hughes Rig Count survey of North American and International energy drilling shows that the industry is rapidly recovering from the pandemic, when energy demand declined by nearly 20% as tens of millions of people began isolating and working from home.

According to Baker Hughes, 771 rigs were in operation for the week ending Jan. 20, an increase of 167 from the year-ago period.

Canadian oil officials said the number of rigs in operation increased to 241, up 29 from in the same week in 2022.

Host Seth Clevenger speaks with Waabi's Vivian Sun and Apex.ai's Jan Becker about how autonomous trucks can fit into the freight transportation industry. Hear the program above and at RoadSigns.TTNews.com.

First of a three-part series on autonomous vehicles. Part II coming Jan. 26. Part III coming Feb. 2.

The Baker Hughes Rig Count acts as a leading indicator of demand for products used in drilling, completing, producing and processing hydrocarbons.

One factor that hasn’t impacted fuel prices yet, but still could, is the weather. While parts of North America and Europe have had snowstorms and cold snaps, it generally has been a mild winter. Thus, natural gas and home heating oil demand has been moderate.

According to Gas Infrastructure Europe, nations on that continent have significantly increased their liquefied natural gas storage capacity the past several years. They were 81.7% full Jan. 14 at a time when energy often is being utilized at a high rate to heat homes and businesses.

Several nations that were purchasing energy from Russia before its invasion of Ukraine are topping off their LNG tanks, lessening the demand for Russian fuel; Spain, Poland, Denmark and Germany are above 90% full.

Earlier this year, EIA forecast that U.S. households would consume about 520 gallons of heating oil this winter, up 9% compared with last winter.

Want more news? Listen to today's daily briefing below or go here for more info: