Senior Reporter

Eighth-Straight Weekly Drop Brings Diesel to $4.128 a Gallon

[Stay on top of transportation news: Get TTNews in your inbox.]

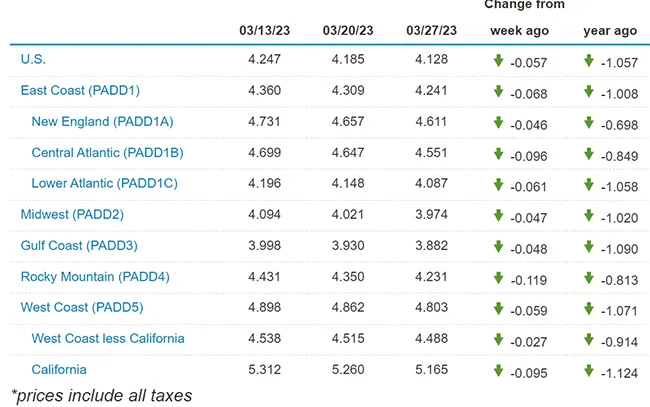

The national average price for diesel is drawing nearer to the $4-a-gallon mark after its eighth consecutive weekly drop that saw it shed another 5.7 cents to $4.128 a gallon, the Energy Information Administration reported.

Since Jan. 31, diesel has fallen from $4.622 for a total drop of 49.4 cents.

The average price fell in every one of EIA’s 10 regions, and dipped below $4 in the Midwest, joining the Gulf Coast as the two regions where diesel is the cheapest. The Gulf Coast region is at $3.882 a gallon, down 4.8 cents more than a dollar lower than a year ago when diesel was $4.972 a gallon.

Even with the prices for gasoline and diesel falling, the Gulf Coast region has had some of the least expensive fuel in the country for the past year. Much of the nation’s oil refining capacity is concentrated in Texas and Louisiana and that area is also the starting point for the 5,500-mile Colonial Pipeline. It originates in Houston and terminates in New Jersey. With its three tubes, the pipeline moves gasoline, diesel and other refined petroleum products to communities and businesses throughout the South and eastern United States.

U.S. average on-highway #diesel fuel price on March 27, 2023 was $4.128/gal, DOWN 5.7¢/gallon from 3/20/23, DOWN $1.057/gallon from year ago #truckers #shippers #fuelprices https://t.co/lPvRNZFztg pic.twitter.com/PcdAt2LD4q — EIA (@EIAgov) March 28, 2023

The Rocky Mountain region saw the week’s biggest decline at 11.9 cents a gallon.

Diesel is now only above $5 a gallon in one of the EIA’s 10 regions, California, where it stands at $5.165 a gallon, compared with $5.26 a week before and $6.289 a gallon a year ago.

Nationally, the EIA said diesel is now $1.057 a gallon cheaper than a year ago.

Meanwhile, the price of gasoline remained essentially flat, dropping one-tenth of a cent to $3.421 a gallon. Gasoline is 81 cents a gallon cheaper than a year ago.

The lower price of oil is keeping prices in check at the pump, for both gasoline and diesel.

One of the reasons why prices have moderated for diesel, trucking’s main fuel, is that in most parts of the country the winter has been very mild. Diesel and home heating oil are from a molecular standpoint the same fuel and in much of the Northeast that fuel is the primary home-heating oil.

According to the National Oceanic and Atmospheric Administration, in the Northeast the average temperature in January was 35.2 and that’s 5.1 degrees above normal, making the month the sixth warmest on record.

New Hampshire, Vermont, Massachusetts, Rhode Island, Connecticut, New Jersey and Maine each had its warmest January on record.

NOAA’s report said the warmer than normal temperatures also contributed to the sixth warmest January on record for the lower 48 states. Five of the six warmest Januaries on record have occurred since 1990 in the contiguous states, and four of those have been since 2012.

The lower price of oil is keeping prices at the pump, for both gasoline and diesel, in check.

The price of a barrel of the industry’s benchmark oil, West Texas Intermediate, opened at just over $74 a barrel on March 29, but it has seen a steady and steep decline of 38% since last summer’s high of $121.5 a barrel on June 9.

U.S. average price for regular-grade #gasoline on March 27, 2023 was $3.421/gal, DOWN 1.0¢/gallon from 3/20/23, DOWN 81.0¢ from year ago #gasprices https://t.co/jZphFa0hDF pic.twitter.com/KVKuG7i6jn — EIA (@EIAgov) March 28, 2023

Oil industry analyst Phil Flynn says in recent weeks the price of oil dipped even lower, to $67 a barrel, because of concerns about the global economy and the collapse of Silicon Valley Bank and Signature Bank. But he believes those concerns may be fading and oil will find its price range in the coming weeks, especially as the peak summer driving season begins.

“The demand for oil didn’t just drop overnight. The drop in oil prices was tied to the financial crisis,” Flynn said. “Now cooler heads are prevailing. We’ve seen the purchase of Silicon Valley Bank, which started the crisis, there seems to be a growing sense there is stability in the banks in Switzerland and Germany where we had concerns over Deutsche Bank. So even through you don’t want to declare it ‘mission accomplished,’ the initial threat of a global banking meltdown has gone away and now the market is focusing on the oil supply and demand fundamentals.”

Flynn says even with the lower prices oil supplies remain very tight, especially in the U.S. where he pointed to March’s refinery utilization rate of 86%, compared with 87.9% in February and down from 89.3% in March 2022. Typically many refineries undergo scheduled maintenance in the late winter and early spring months.

“I think we could see a big reversal in prices in the next couple of months,” Flynn said. “If the panic goes away in the banking sector, then oil is undervalued.”

EIA.gov

Want more news? Listen to today's daily briefing below or go here for more info: