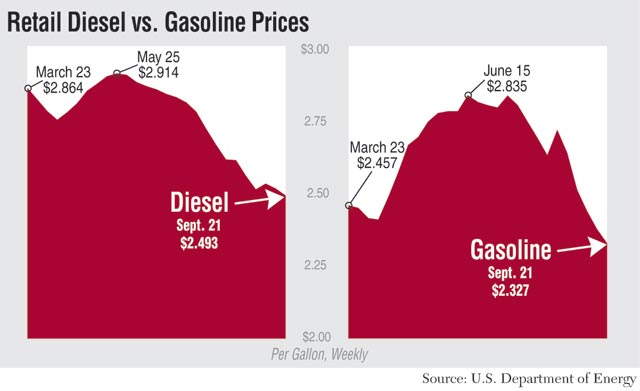

Diesel Price Declines 2.4¢ to $2.493, Lowest Level in More Than Six Years

The average price of diesel fuel in the United States fell 2.4 cents a gallon to $2.493, the lowest level since June 2009, according to the Department of Energy.

The price decrease follows a 1.7-cent dip the prior week, the agency reported Sept. 21.

Trucking’s main fuel is now cheaper by $1.285 a gallon from the comparable week a year ago, DOE’s Energy Information Administration said after its weekly survey of fueling stations.

All major regions of the country logged a drop in retail prices for the fuel, with the largest a 4-cent decline in New England.

“A cheap fuel price is great. I’ll take them in a good economy or a bad economy,” said Daniel Bost, president of Murphysboro, Illinois-based Bost Trucking. “I think it’s good for everybody. How it flushes out after supply and demand comes into more normalcy, we’ll see — maybe it’s a $75 price for oil, or $85 for a barrel of oil and maybe closer to a $3 price for diesel fuel. But right now, we’ll take what we can get.”

Likewise, the average gasoline price dropped 4.8 cents to $2.327 a gallon. The decline follows a 6.2-cent drop the prior week. The price of gas also fell in every region, with the West Coast’s 8.1-cent drop the largest.

“We’re trying to play catch-up, to be frank,” said Van Swafford, president of Swafford Transport and Warehouse Inc., based in Greer, South Carolina. “We’re trying to save it back to make up for what we’ve been dealing with the last several years with the [high] cost of fuel.”

At Edge Transportation, a 10-truck car-hauling fleet in Burlington, Kentucky, Operations Manager Mike Sestito wants the price of diesel to remain low.

“I’d like it to stay down, stay where it’s at,” he said. “It increases your profit margin. When it goes back up, it’s got a monopoly on us, and we just got to go with the flow.”

West Texas Intermediate crude for November delivery fell $1.88 to settle at $44.48 a barrel on the New York Mercantile Exchange on Sept. 23, according to DOE, and Brent crude for November settlement dropped $1.33, or 2.7%, to close at $47.75 a barrel on the London-based ICE Futures Europe exchange, Bloomberg News reported.

Kenny Vieth, president and senior analyst of ACT Research Co., in Columbus, Indiana, said he expects lower energy prices to continue into 2016.

With the price of oil down to about $50 a barrel from $95 a year ago, “there is another 20 cents in decline in diesel prices in the pipeline,” Vieth said last week during the fall meeting of American Trucking Associations’ Technology & Maintenance Council in Orlando, Florida.

Inventories of distillate fuel, a category that includes diesel and heating oil, decreased 2.09 million barrels to 151.9 million, according to the news agency.

Meanwhile, U.S. crude output rose 19,000 barrels a day to 9.14 million for the week ended Sept. 18, EIA said. Crude imports dropped 13,000 barrels a day to 7.18 million, the least since June.

But crude stockpiles dipped 1.93 million barrels to 454 million in the week ended Sept. 18, EIA said. “The crude inventory drop was near what was expected, so it came as no surprise,” John Kilduff, a partner at Again Capital, a New York-based hedge fund that focuses on energy, told Bloomberg.

Separately, Wex Inc. announced it signed an agreement with BP to accept its fleet card at 200 BP-supplied Arco stations in parts of Washington and Oregon.

“We are dedicated to helping our customers streamline their payments, and this relationship with BP Arco will help us extend that to customers fueling in the Pacific Northwest region,” said Brian Fournier, vice president of merchant and channel partner at Wex.

“Wex has one of the largest proprietary fuel networks in the country, with acceptance at more than 90% of service stations,” he said, noting the agreement provides convenience and security.

The addition follows 146 stations in Washington that began accepting the Wex fuel card last year. The company said it expects the remaining 54 BP Arco sites in Oregon to begin accepting its card by early 2016.

The price of diesel declined 2.1 cents a gallon in the West Coast excluding California, according to DOE.

“Wex’s credit and fuel card acceptance will improve the fueling experience in Washington and Oregon, and it will provide regional fleet managers with additional tools and insights to make better business decisions,” Donna Sanker, head of BP’s West Coast retail business, said in a statement.

Editorial Director Neil Abt contributed to this article.