Staff Reporter

Diesel Nudges Up 1.4¢ to $3.727 a Gallon

[Stay on top of transportation news: Get TTNews in your inbox.]

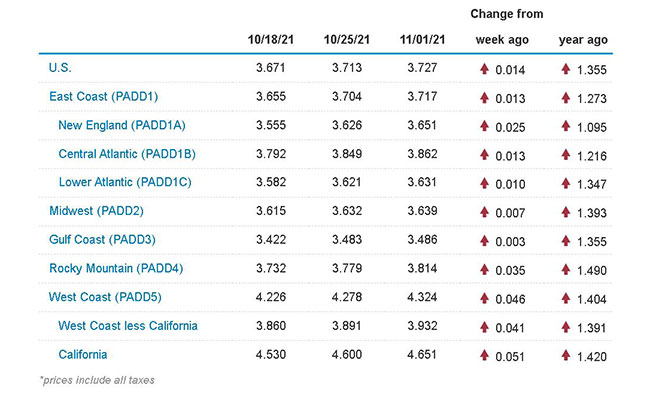

The national average price for diesel rose 1.4 cents to $3.727 a gallon, according to Energy Information Administration data released Nov. 1.

Although the cost of diesel continued its upward trajectory, the rise was marginal compared with recent increases, such as the 10.9-cent spike Oct. 11. It now costs $1.355 more than it did at this time in 2020.

Gasoline was up 0.7 cent, reaching $3.39 a gallon for the national average.

The EIA found that diesel prices increased in all 10 regions in its weekly survey. California saw the largest increase at 5.1 cents to $4.651 — also the most expensive diesel from any region. The Gulf Coast region experienced the smallest increase at three-tenths of a cent to $3.486.

“Two big factors at work here in the diesel price trends,” Allen Schaeffer, executive director at the Diesel Technology Forum, told Transport Topics. “Biggest factor in diesel price increases is the effects of higher crude prices in past months.”

U.S. On-Highway Diesel Fuel Prices

EIA.Gov

Schaeffer added that since late last year crude oil went from about $40 a barrel to $85 a barrel. But he noted that it looks like crude oil supply is increasing and crude prices are going back down again. He is hopeful that will trickle down to pump prices in the coming weeks. But he warned crude prices also have to contend with some unique global factors as economies start to inch back toward pre-COVID levels.

“Global factors include the well documented case of a diesel shortage in China,” Schaeffer said. “There have been those issues in the UK in past weeks — higher prices, shortages of petrol and diesel. So, lots of global influences. And also, domestically we are in the home heating season build-up.”

China, he said, relies on imports for 70% of its supply. Constraints on coal for electricity made some people run diesel fuel in generators to meet factory and other industrial demands.

Schaeffer

“Surging diesel prices make a difficult time in the trucking industry more difficult,” Riley Larson, general manager at JMS Transportation, told TT. “The ongoing driver shortage has worsened and with supply chain issues, equipment is hard to come by. While freight volumes are steady and even growing, keeping up with that growth is tough when there aren’t enough drivers for the scarce number of trucks that are getting more expensive to fuel by the week.”

Larson added that each issue has its own causes but that the pandemic has certainly not helped any of it. He suspects that the high diesel prices are likely here to stay for the foreseeable future. He said that trucking companies need to expect it, plan for it and manage it as best they can.

“Diesel prices appear to be taking a temporary break from its recent rally as diesel futures pulled back about 3% last week,” Ryan Marx, senior manager of fuel and product supply at the Ryder Energy Distribution Corp., told TT. “However, as winter approaches, it is anticipated that fuel prices will likely continue its trend higher as we close out the year. Despite last week’s build in refined product inventory, fuel demand remains strong and supply is tight. All signs are pointing to higher fuel prices in the months ahead.”

Mike Barnthouse, chief financial officer at Groendyke Transport, pointed to political factors that could be driving cost.

In this episode, host Michael Freeze asks, how are companies saving money by leasing trucks rather than owning? For answers, we speak with Jim Lager of Penske Truck Leasing and Al Barner of strategic fleet solutions at Fleet Advantage. Hear a snippet above, and get the full program by going to RoadSigns.TTNews.com.

“Diesel and gasoline prices seem to be on the rise due to supply and demand, as well as inflation,” Barnthouse told TT. “Demand has rebounded from the pandemic shutdown, with volumes now at or above pre-COVID-19 levels. Meanwhile, the Biden administration’s successful curtailing of domestic production has reduced supply.”

He said that it’s not surprising that moving away from energy independence has caused a price surge given that it creates more reliance on imports from the Organization of the Petroleum Exporting Countries.

“Everything that goes into a gallon of fuel has been infected by inflation,” Barnthouse said. “Labor, equipment, insurance and supplies have all increased significantly over the past 12 months, and these additional costs have been passed all the way down the supply chain to the consumer.”

Groendyke ranks No. 96 on the Transport Topics Top 100 of the largest for-hire carriers in North America.

Want more news? Listen to today's daily briefing below or go here for more info: