Senior Reporter

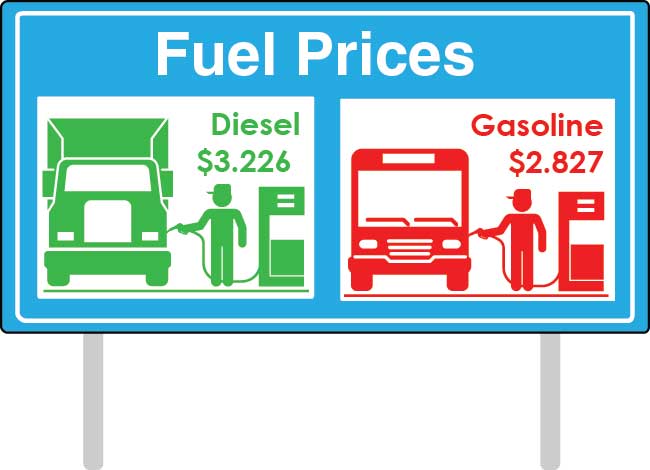

Diesel Jumps 1.9¢ to $3.226

The U.S. average retail price of diesel jumped 1.9 cents to $3.226 a gallon, while crude oil prices rose amid supply concerns.

Trucking’s main fuel costs 62.1 cents a gallon more than it did a year ago, when the price was $2.605, the Department of Energy said Aug. 27.

Average prices rose in all regions, too.

The national average price for regular gasoline rose 0.6 cent to $2.827 a gallon, DOE’s Energy Information Administration said. The average is 42.8 cents higher than it was a year ago.

Average gasoline prices rose in four regions and fell in five others.

Meanwhile, the 2018 Annual Fleet Fuel Study, released by the North American Council for Freight Efficiency, reported that 20 fleets operating 71,844 tractors and 236,292 trailers saved more than $600 million in 2017 by adopting several fuel-efficiency technologies compared with the average trucks on the road.

Combined, these fleets in the study reached an average fuel economy of 7.28 miles per gallon compared with the average U.S. fleet number of 5.91 mpg. This marked a 2% increase over 2017 and represents a return to the 2% eight-year average gain, according to NACFE, which first issued its annual study in 2011.

The overall adoption rate for the 85 technologies studied in the report has grown to 44% in 2017 from 17% in 2003. Not all technologies could be applied to a single tractor-trailer, as some are clearly an either-or decision.

The findings of this report should prove invaluable to efforts to improve fuel economy, according to NACFE Executive Director Mike Roeth.

One trailer maker said taking weight out of the trailer is the only sure way to reduce fuel burn in all circumstances.

“Empty [trailer] weight burns fuel every mile traveled, irrespective of speed or distance traveled. The only question is when does the lighter weight spec compromise trailer life and/or public safety?” Strick Group Chief Sales Officer Charles Willmott said.

The standard 53-foot sheet and post dry van is about 13,700 pounds, he said.

“You only want to shave this down to 10,900 [which is the weight of Strick’s custom trailer being used with the Shell Starship high fuel-efficiency truck] if the operating circumstances justify,” Willmott said.

The Shell Starship concept Class 8 truck is sponsored by Shell Lubricants and built by the AirFlow Truck Co. of Newington, Conn.

Strick sees more interest in weight savings every year. But there is a delicate balance among weight, cost, maintenance and longevity that needs to be considered for each carrier, he said.

“The economic value of aerodynamic features on trailers like side skirts and boat tails depends on the fuel saved at speeds above 45 miles per hour and the frequency and duration of time spent at or above those minimum speeds versus the initial cost of those devices and the additional fuel burned by the weight added,” Willmott said.

Other recent initiatives also underscored the role of the right equipment and components in achieving the best possible miles per gallon.

Diesel engine emissions regulations and growing demand for improved fuel economy are driving development of new engine and aftertreatment technologies, according to Eaton Corp.

The ability to heat up the aftertreatment system quickly during cold cycles and low-load operating modes is key to reducing nitrogen oxide emissions, and Eaton’s variable valve actuation technologies are intended to manage exhaust temperature and improve fuel economy.

Eaton also is developing dedicated exhaust gas recirculator pump technology, enabling high-efficiency turbochargers for lower engine pumping losses and improved fuel economy. Utilizing an EGR pump allows the removal of expensive components such as variable geometry turbochargers and EGR valves.

The role of commercial vehicle power management technologies will be underscored at the 67th IAA Commercial Vehicles show in mid-September in Hanover, Germany.

Crude oil futures trading on the New York Mercantile Exchange closed Aug. 27 at $68.87 per barrel, the highest in more than three weeks, compared with $66.43 on Aug. 20.

Later in the week, oil closed in on $70 a barrel on slowing American drilling and investor optimism after a breakthrough in a trade standoff between the United States and Mexico, according to Bloomberg News.

Slowing American output growth and pipeline bottlenecks are adding to supply risks as President Donald Trump is set to impose sanctions on oil exports from Iran in early November at a time when stockpiles are shrinking, Bloomberg reported.