Senior Reporter

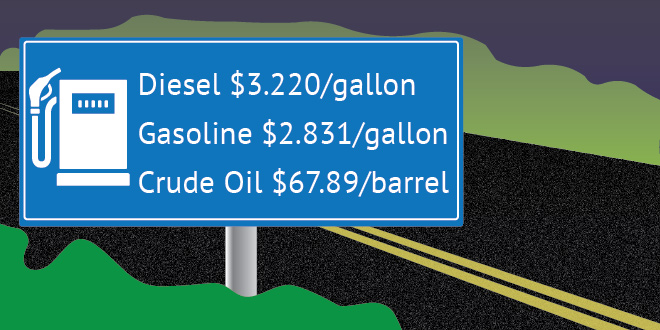

Diesel Creeps Up 0.6¢ to $3.226

The U.S. average retail price of diesel crept up 0.6 cent to $3.226 a gallon while crude oil prices jumped higher as Middle East tensions continued.

Diesel fuel costs 69.5 cents a gallon more than it did a year ago, when the price was $2.531, the Department of Energy said July 30.

Averages rose in all regions except the Rocky Mountains, where the average fell by 0.8 cent to $3.361 a gallon.

The national average price for regular gasoline rose 1.5 cents to $2.846 a gallon, DOE’s Energy Information Administration said. The average is 49.4 cents higher than it was a year ago.

Average gasoline prices fell in the Rocky Mountains and West Coast but rose elsewhere.

Meanwhile, demand for distillate fuel — primarily ultra-low-sulfur diesel used in transportation and to a lesser degree as heating oil — was 190,000 barrels a day or 5% higher in the first half of 2018, when demand hit 4.12 million barrels a day compared with the 2017 period, EIA reported.

Surging demand for freight-hauling services was the key reason for the rise in diesel use, according to EIA.

“Demand for trucking services tends to be closely correlated to economic growth and industrial activity, both of which have been higher in the first half of 2018 compared with the first half of 2017,” EIA reported.

Real gross domestic product increased at an annual rate of 4.1% in the second quarter of 2018, according to the advance estimate released July 27 by the Bureau of Economic Analysis. In the first quarter, real GDP increased 2.2%.

Two trucking executives from less-than-truckload fleets took note, respectively, of the rising fuel costs.

“Fuel expense in the quarter rose 55% over last year. National average diesel prices increased 26% compared with second quarter last year, and our miles in the quarter were up 11.3%,” Saia Inc. Chief Financial Officer Frederick Holzgrefe said during the company’s latest earnings conference call.

Saia, based in Johns Creek, Ga., ranks No. 27 on the Transport Topics Top 100 list of the largest for-hire carriers in North America.

Holzgrefe added the fuel surcharge revenue in the quarter was 13.8% of the record total revenue of $429 million.

At Old Dominion Freight Line, “Our operating supplies and expenses increased 150 basis points due to the rising cost of diesel fuel and other petroleum-based products,” Adam Satterfield, CFO of the Thomasville, N.C., carrier, said during an earnings conference call.

Old Dominion Freight Line ranks No. 11 on the for-hire TT100.

On the supply side, EIA estimated refinery production of distillate fuel in the United States averaged 5 million barrels a day in the first six months of 2018, which was 30,000 barrels a day, or 1% higher compared with the same period last year.

Inventories of distillate fuel were 117.7 million barrels at the end of June, the lowest end-of-June level since 2004.

Distillate fuel inventories crept up for the week ending July 27, rising by 3 million barrels, and are about 11% below the five-year average for this time of year.

Crude oil futures trading on the New York Mercantile Exchange closed July 30 at $69.96 per barrel compared with $67.81 on July 23.

“Geopolitical risk rose the week of July 27 from left and right of the Arab Peninsula” with the attack on Saudi tankers and growing tensions between the United States and Iran, Tamas Varga, an analyst at PVM Oil Associates Ltd. in London, told Bloomberg News. “An escalation of either of the conflicts would have a devastating impact on global oil supply.”

A report from Goldman Sachs Group Inc. noted crude oil prices are poised to retest $80 a barrel later this year.

While OPEC and its allies could discuss an oil-supply increase higher than the 1 million barrels a day agreed at the group’s June meeting, there are no current talks on that, Russian Energy Minister Alexander Novak said recently in Johannesburg, according to Bloomberg.

“OPEC could bring back 1 million barrels a day, but any barrels brought back by Saudi, Russia, Kuwait, those might just offset barrels lost from Iranian sanctions,” Noah Barrett, an energy research analyst at Janus Henderson Investors, told Bloomberg.