Senior Reporter

Diesel Bumps Up 0.2¢ to $5.341 a Gallon

[Stay on top of transportation news: Get TTNews in your inbox.]

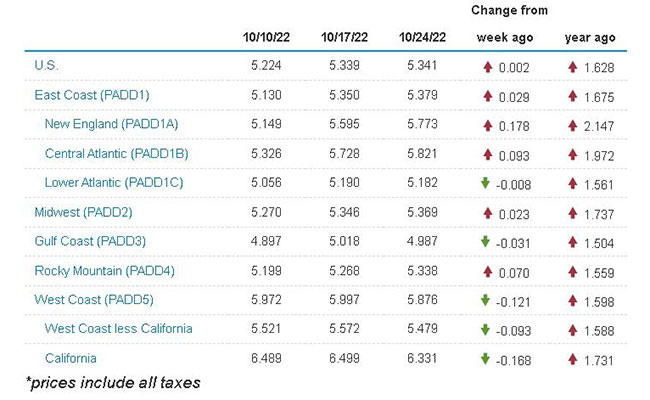

The national average price of diesel remained essentially flat, nudging up two-tenths of a cent to reach $5.341 a gallon, according to Energy Information Administration data released Oct. 24.

Diesel’s average price has risen 50.5 cents a gallon over the past three weeks after five consecutive weeks of declines.

A gallon of trucking’s main fuel now costs $1.628 more than it did at this time in 2021.

Diesel’s price went up in five of the 10 regions in EIA’s survey and down in five. The biggest gain was 17.8 cents in New England; the largest drop was 16.8 cents in California.

Gasoline went down by 10.2 cents a gallon nationally, sitting at $3.769 a gallon now.

U.S. On-Highway Diesel Fuel Prices

EIA.gov

Gasoline prices are falling ahead of the midterm U.S. elections, easing the pressure on Democrats grappling with high fuel prices in key swing states and elsewhere across the country, Bloomberg News reported. The national average price for a gallon of gasoline is now in its third week of declines and has fallen by $1.25 since the June peak of more than $5.

At the same time, the federal government put more oil into the market from the Strategic Petroleum Reserve in an attempt to bring down fuel prices further and continue to address the ongoing market disruption caused when Russia invaded the Ukraine Feb. 24.

On Oct. 18, the Department of Energy said it would sell as much as 15 million barrels of crude oil from the SPR. This sale will complete the 180 million barrel sale of crude oil from the SPR that President Joe Biden announced in the spring of 2022.

Shortly after DOE’s announcement, the American Transportation Research Institute, the trucking industry’s not-for-profit research organization, released its 18th annual Top Industry Issues report that included 4,200 participants and identified high fuel prices as the No. 1 industry concern, dropping concern over the driver shortage to the second spot.

“This year’s survey had the highest number of responses to date, showing how committed our industry is to identifying the most critical concerns, and more importantly, figuring out how we collectively deal with each issue,” said ATRI President Rebecca Brewster.

The report noted ATRI’s 2022 Operational Costs of Trucking found year-over-year increases in fuel costs per mile were over 35%, with fleets operating in the West experiencing the highest fuel costs per mile at 43.1 cents.

It was the second year in a row owner-operators ranked fuel prices as their No. 1 issue, according to ATRI.

Also, 54.7% of respondents believed federal action was the best way to stabilize the fuel supply — including by expanding refining capacity, increased domestic drilling or continuing to tap the SPR.

EIA reported Oct. 14 the SPR held 405 million barrels of crude oil, the lowest inventory level since June 1984. The reserve was designed to hold up to 714 million barrels of crude oil across four storage sites along the Gulf of Mexico, where much of the U.S. petroleum refining capacity is located.

Measures such as state fuel tax holidays were seen as more problematic because of lost funds for bridge and road construction.

Also, only 6.8% of respondents believe the best approach for addressing high fuel costs is by increasing alternative and renewable fuels. Only 7% of respondents in ATRI’s 2022 Operational Costs of Trucking analysis used some form of alternative fuel, primarily in local and regional delivery operations.

FOR IMMEDIATE RELEASE FROM ATRI: Fuel Costs Top the List of #Trucking Industry Issues https://t.co/jhc6FfFV9n #FuelCosts #TopTruckingIssues #TruckingResearch — ATRI (@Truck_Research) October 22, 2022

But U.S. truck makers are moving ahead steadily in pursuit of zero emissions.

Recently, at the Green Transportation Summit and Expo in Tacoma, Wash., executives from Daimler Truck, Navistar, Paccar Inc. and Volvo Group outlined a shared vision for an industrywide transition to medium- and heavy-duty zero-emission vehicles.

The four truck makers are founding members of the coalition Partners for a Zero Emission Vehicle Future that considers ZEVs to be the future of commercial transportation.

“In the early stages of the industry’s transition to zero emissions, grants and incentives are essential to help operators and owners offset initial higher purchase costs and encourage deployment of these vehicles on our nation’s roads,” Alec Cervenka, zero emissions sales manager at Paccar’s Kenworth Truck Co. brand, said at the event.

As volumes increase and the industry brings to bear economies of scale, Cervenka said, “we eventually expect ZEV technology to provide a total cost of ownership on par or better than the current diesel truck.”

The ideal scenario for trucking’s fleet future, said Allen Schaeffer, executive director at Diesel Technology Forum, is a mix; “a balanced investment portfolio of liquid and low-risk, solid performing investments with good returns — advanced diesel, renewable biofuels, natural gas — along with longer-term higher-risk, higher-yield options, like hydrogen and electrification.”

Want more news? Listen to today's daily briefing below or go here for more info: