Senior Reporter

Diesel Average Rises 6¢ to $2.357

This story appears in the May 30 print edition of Transport Topics.

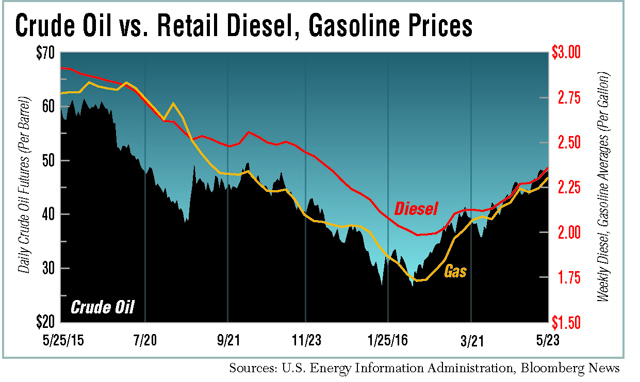

As crude oil prices continued to advance, the U.S. retail average price of diesel and gasoline rose with it, both jumping about 6 cents per gallon.

The U.S. Department of Energy said May 23 that diesel, trucking’s main fuel, was up 6 cents at $2.357, which marked the 13th time it increased in 14 weeks.

It was diesel’s highest price since Dec. 7, when it was $$2.379, but remained 55.7 cents cheaper than the comparable week a year ago when the price was $2.914.

Diesel prices jumped in all regions, DOE said after its May 23 survey of fueling stations. The Gulf Coast had the lowest diesel price, $2.233, while California was highest at $2.673.

Meanwhile, the national average price for regular gasoline climbed 5.8 cents to $2.30 a gallon, DOE’s Energy Information Administration said. That was its highest price since Oct. 5 when it was $2.318.

Gasoline prices also rose in all regions, but the average remained 47.4 cents cheaper than a year ago, EIA said.

Trucking executives with intermodal operations cited diesel’s low price as a key factor in shifting intermodal freight to trucks and away from rail.

David Yeager, Hub Group chairman and CEO, addressed the issue of conversion of freight back to the highway from the rail during a recent earnings conference call.

“Well, certainly, fuel is a major impact on it,” he said. “It certainly reduces the motor carriers’ costs, and you combine that with the weak market we’re in. When freight has gotten soft, we’ve traditionally seen motor carriers come back in with aggressive pricing, and that’s what we’re seeing today.”

Hub Group, based in Oak Brook, Illinois, ranks No. 8 on the Transport Topics Top 100 list of the largest U.S. and Canadian for-hire carriers.

“The reduced fuel prices, combined with adequate truckload capacity, has created pressure on the intermodal volumes, particularly in shorter length of haul,” Jerry Moyes, founder and CEO of Swift Transportation Co., said during a conference call to discuss 2016 first-quarter earnings. “Notwithstanding this situation though, many shippers remain committed to intermodal, as rail service results have been strong.”

Phoenix-based Swift ranks No. 6 on the for-hire TT100.

The climb in crude prices has been a catalyst.

Crude oil futures on the New York Mercantile Exchange closed May 25 at $49.69. They have been climbing steadily since the May 9 closing price of $43.44.

The crude price rises as discoveries of new oil plummet, according to Bloomberg News.

Oil discoveries have fallen to a six-decade low as explorers cut billions of dollars of spending to ride out the biggest market slump in a generation, Bloomberg reported.

About 12.1 billion barrels of oil reserves were found in 2015, marking a fifth consecutive year of decline and the smallest volume since 1952, Oslo, Norway-based industry consultant Rystad Energy said, according to Bloomberg.

Evan Calio, an oil analyst with Morgan Stanley, wrote in a recent newsletter to investors that Morgan Stanley and Wall Street consensus expect U.S. production to grow by about 2 million barrels per day by 2020 from the end of 2016, and that would be about 90% of expected non-OPEC production over the period.

Meanwhile, EIA said distillate fuel supplies — which are an indication of demand and include ultra-low-sulfur diesel and home heating oil — averaged 4.1 million barrels per day over the past four weeks, down by 0.9% from the same period last year.

Gasoline supplies averaged 9.6 million barrels per day, up by 3.9% from the same period last year.

Inventories of the two fuels also moved in opposite directions.

Distillate fuel inventories decreased by 1.3 million barrels last week but remain well above the upper limit of the average range for this time of year, EIA said.

“This was more than the 1 million-barrel drop expected by the market today. This helped push up ULSD prices,” Steve Sly, president of analytics firm Stabilitas Energy Inc., said May 25, when the report was released.

Total motor gasoline inventories increased by 2 million barrels last week, EIA said.

That increase “was much higher than the 1.1 million-barrel drop expected by the market,” Sly said.

Overall, U.S. commercial crude oil inventories, excluding those in the Strategic Petroleum Reserve, decreased by 4.2 million barrels from the previous week to 537.1 million, EIA said.