Senior Reporter

Dana Posts Solid Financials in Second Quarter

[Stay on top of transportation news: Get TTNews in your inbox.]

Dana Inc. reported large gains in second-quarter net income and revenue as strong customer demand for its products continued.

Net income for the period ended June 30 rose to $53 million, or 36 cents per diluted share, compared with a loss of $176 million, or negative $1.20, in the 2020 period. Revenue jumped to $2.2 billion compared with $1 billion a year earlier.

The Maumee, Ohio-based company’s customers “continue to see strong market demand that in many cases outpaced production as supply chain challenges continue to hamper their operations,” Chairman and CEO James Kamsickas said during a conference call with investors.

Kamsickas

“We’re taking the necessary actions to capitalize on this unique market dynamic of low inventory and high demand as a future opportunity,” he said, “for a stronger and longer duration recovery as the input challenges subside.”

Dana reported a backlog of new business of $500 million.

Year-over-year second-quarter sales by segment:

• Light-vehicle: $890 million compared with $337 million, or 40.4% of total revenue.

• Off-highway: $669 million compared with $398 million, 30.3% of the total.

• Commercial vehicle: $387 million compared with $203 million, 17.6% of the total.

• Power technologies: $259 million compared with $140 million, 11.7% of the total.

Industry Headwinds

Challenges facing Dana and similar companies, according to CEO James Kamsickas:

• Higher raw material costs.

• Semiconductor shortages affecting production for its customers.

• Logistics constraints.

• Higher transportation costs.

• Labor shortages related to COVID-19 restrictions.

The company said it was seeing “better recovery” in its heavy-vehicle business on commodities, and pointed out the commercial vehicle segment has the longest supply chain.

He noted light commercial vehicles in Europe and India present significant opportunities and lead the commercial vehicle segment shift to fully electrified platforms.

Still, Chief Financial Officer Jonathan Collins noted that big spending on electrification in the commercial vehicle space is the biggest constraint to margins.

Collins

“So much of the activity is very much concentrated in this segment, and a lot of the investments that we’re making are to deliver products for this year and many coming in the next year,” he said.

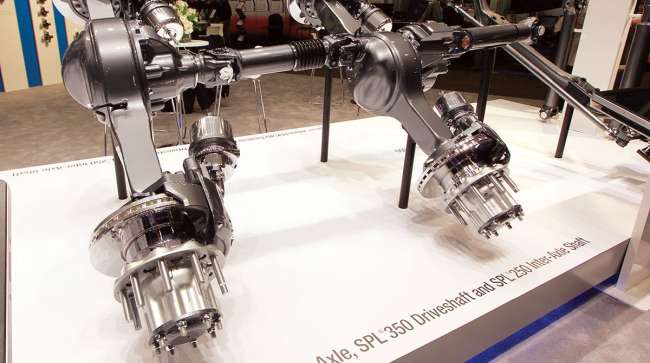

In the commercial vehicle markets, Dana’s primary business is driveline systems for medium- and heavy-duty trucks and buses, including the emerging market for hybrid and electric vehicles.

Dana’s key regional markets are North America, Brazil and Asia Pacific.

The company forecasts North American Class 8 production for all of 2021 will increase 46% over 2020, which was 38% lower than record production in 2019 — riding the improving economic outlook and cyclical demand.

Dana Q2 Earnings Report by Transport Topics on Scribd

Its North American medium-duty truck production outlook for 2021 is for an 11% increase in production over the prior year.

Dana is a leader in the design and manufacture of propulsion and energy-management solutions for all mobility markets across the globe. The company’s conventional and clean-energy solutions support nearly every vehicle manufacturer with drive and motion systems; electrodynamic technologies, including software and controls; and thermal, sealing, and digital solutions.

Want more news? Listen to today's daily briefing below or go here for more info: