Senior Reporter

Daimler Truck Eyes Pending Independent Status in Electric World

[Ensure you have all the info you need in these unprecedented times. Subscribe now.]

Daimler Truck reported it is on schedule to be listed as a public company on the Frankfurt Stock Exchange by the end of this year, and remains committed to replacing internal combustion engines globally with battery-electric and fuel cell electric powertrains and related software.

“Leading Daimler Truck to a publicly listed company has long been a personal mission for me,” Daimler Truck CEO Martin Daum said May 20 during the online Daimler Truck Strategy Day. “I believe it can operate most efficiently as an independent company and believe the scrutiny, intensity and discipline that capital markets will apply to us will be a profoundly good thing.”

Daimler Truck is the leader in the global commercial vehicle business in terms of sales, market share and global reach, according to the Stuttgart, Germany-based company. It generates about $48.8 billion in revenue and sells more than half a million trucks and buses in a typical year.

At the heart of the independent company will be electric vehicles, Daum said, with the eventual “ramp down” of internal combustion engines — which now are the foundation of its place as a global leader, including a 40% share of U.S. Class 8 retail sales through its most profitable unit, Daimler Trucks North America.

Zero-emission trucks will begin “a massive ramp up” in the 2025-2035 period, with the two types in a 50-50 vehicle mix, with a sorting out coming after that, Daum said. And he called a shift to autonomous trucks “the Holy Grail.”

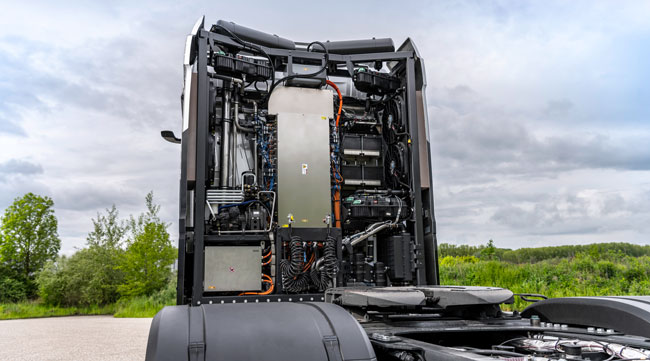

A look at the fuel cell inside Daimler's Mercedes-Benz GenH2 truck. (Daimler Truck AG)

Between now and 2025 Daimler will start with battery-electric trucks it can “deploy fast in small quantities,” he said.

For fuel cell trucks, deploying the hydrogen infrastructure will take longer, but ultimately there will be millions of fuel cell trucks, he said.

“Being the largest truck producer in the world, Daimler Truck clearly has the potential to perform on par with the most profitable truck manufacturers,” Roman Mathyssek, a consultant at Arthur D. Little, told Bloomberg News. “The carve-out of Daimler Truck should lead to more flexibility, speed and more direct accountability to financial markets.”

How to manage its scale effectively, Daum said, is one of the “real” challenges the truck maker will face as an independent. “We are serious about confronting our weaknesses,” he said.

While its North American operations remain the truck maker’s benchmark operation, the future means repairing the position of Mercedes-Benz trucks in Europe, correcting losses in Brazil and improving performance in Asia, according to the company.

Daum (Daimler Truck)

“We will reset profitability,” Daum said. “We will target the benchmark in each region. Every region must deliver competitive performance and we are willing to implement the measures necessary to achieve this goal.”

Under the reorganization, even DTNA intends to expand its market position and profitability, said DTNA CEO John O’Leary. He noted that despite a 58% share of the business from the nation’s largest fleets, he’s looking for more.

“We still have plenty of room for growth in the profitable small fleets and vocational segments” O’Leary said, where Daimler has a 33% and 28% share, respectively. “We are humble and still very hungry.”

O’Leary noted DTNA can maintain “positive cash flow and profitability even down to a 165,000 unit market, which hasn’t happened in our professional lifetimes.”

U.S. Class 8 retail sales in 2020 totaled 191,900, according to WardsAuto.com.

Asked by an analyst during the call about the vocational market, where DTNA holds the second-highest share, O’Leary said the company is preparing to “be chased rather than chase.”

Its vocational focus is coming at the perfect time as Congress debates comprehensive infrastructure proposals, O’Leary said. DTNA recently introduced its heavy-duty Western Star 49X model intended to increase its share in the vocational market.

RELATED: DTNA Launches EV Consulting Services, Chargers

Separately, on the same day as the online event, Daimler Truck and lithium-ion battery manufacturer and developer Contemporary Amperex Technology Co. announced CATL will be the supplier of lithium-ion battery packs for the Mercedes-Benz eActros longhaul battery-electric truck that is planned for series production in 2024.

Daum said the companies could later explore production in North America.

Also, Daimler and Shell New Energies NL reported they are cooperating on establishing a hydrogen fueling network between Rotterdam, Hamburg and Cologne by 2025 — with Shell building the stations and Daimler supplying the trucks. The commitments expand to 150 stations and 5,000 trucks by 2030.

Parent company Daimler AG announced the major reorganization Feb. 3. Under the plan, Daimler AG would rename itself Mercedes-Benz, and the truck and bus unit would become Daimler Truck AG. Like the truck unit, the car business would be individually traded.

Want more news? Listen to today's daily briefing below or go here for more info: