Staff Reporter

Daimler Truck Q1 Sales Jump

[Stay on top of transportation news: Get TTNews in your inbox.]

A 15% year-over-year jump in sales at Daimler Truck powered a jump in revenue and profit in the first three months of 2023, it said May 9, adding that North American sales rose 12% compared with the year-ago period.

Leinfelden-Echterdingen, Germany-headquartered Daimler Truck posted a net profit of $871 million, or 98.6 cents per share, in the first quarter of 2023, compared with $301.3 million, 34 cents, in the year-ago period. Daimler Truck reports in euros.

However, Daimler Truck fell slightly short of consensus analyst earnings per share expectations of $1.01, but beat the consensus forecast for revenue of $13.39 billion.

Revenue at the parent company of Freightliner and Western Star totaled $14.46 billion in the most recent quarter, compared with $11.6 billion in the first quarter of 2022, it said. The company’s revenue was aided by a stabilization of global supply chains compared with the year-ago period, it added.

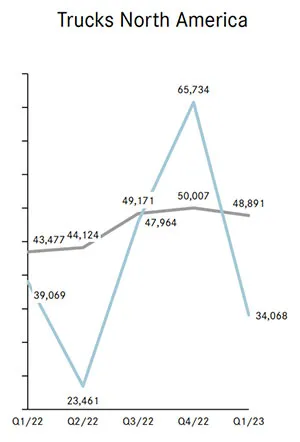

Incoming orders and unit sales. (Daimler Truck)

Globally, Daimler Truck’s sales totaled 125,172 units in the most recent quarter, compared with 109,286 in the year-ago period, it said.

Daimler Truck North America’s sales in the quarter totaled 48,891 vehicles, it said, adding that the margins increased on those sales. The unit’s first-quarter revenue totaled $6.35 billion, a 27% jump year-over-year, while its return on sales rose to 11.6% from 8.4% a year earlier. DTNA continued to see supply chain interruptions in the first quarter, its parent company said.

The company said it had a 43.5% share of market in North America in the first three months of 2023. The company’s 2022 earnings indicate a North American market share of 39.3% for the calendar year for Classes 6-8 and a 40% share of the Class 8 market alone. No breakdown was provided by class for the most recent quarter.

DTNA’s incoming orders in the most recent quarter totaled 34,068, compared with 39,069 in the year-ago period. Daimler Truck expects DTNA’s 2023 sales to be between 190,000 and 210,000, compared with 187,000 in 2022, it said.

The first quarter of 2023 was a “strong and clean” quarter “without any special effects,” Daimler Truck Chief Financial Officer Jochen Goetz said during the company’s earnings call on May 9, adding that North America continues to see strong demand.

That said, the number of supply problems increased as the first quarter ended, including cyberattacks, which is why Daimler Truck has not upped its overall market sales guidance — which for North America is 280,000-320,000 — as Goetz said some of its competitors have.

Daimler Truck has yet to open its order book for 2024, said Goetz. The company wants the “latest and greatest” inflation information before opening 2024 order books so it can plan prices better, he said. The company is going to wait a couple of months before doing so, he said.

Another key factor, Goetz said, would be raw material prices. Steel prices have fallen, but are likely to increase in the second quarter, he said, although overall costs are set to decrease in the coming quarter. Daimler Truck could trim its raw material surcharge if steel prices continue to soften, he added.

Want more news? Listen to today's daily briefing above or go here for more info

When it comes to new orders, pent-up demand is set to remain the case in North America in 2023 and in 2024, Goetz said during the call, noting conversations at ACT Expo in the first week of May with two of its top 10 customers. Those customers told Daimler Truck they will have significantly higher demand in 2024 than DTNA could deliver in 2023, he said.

There will also be significant demand for medium-duty electric trucks in the coming months in the United States, especially in California, Goetz said, noting that this was why the company had launched its Freightliner eM2 truck in Anaheim, Calif., at ACT.

North American owner-operators are set to be more affected by capital expenditure constraints as a result of inflationary pressures, Goetz told analysts, but DTNA has more medium-sized and big fleets in its customer ranks. He implied such crimping of purchases may affect the company’s competitors more than DTNA.