Senior Reporter

Cummins Top Overall Supplier of Class 8 Engines in 2019

[Stay on top of transportation news: Get TTNews in your inbox.]

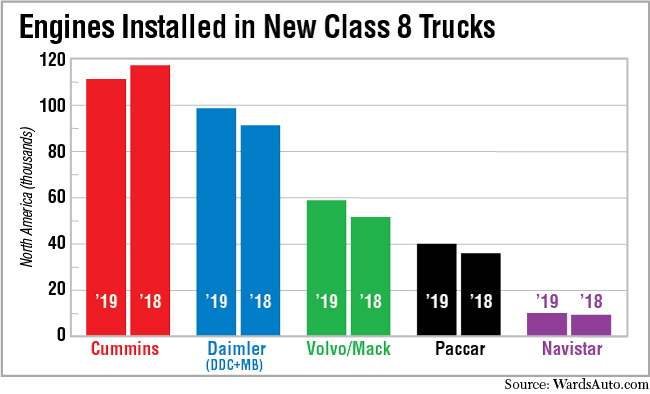

Independent engine maker Cummins Inc. supplied the most Class 8 diesel engines in 2019.

It was a mixed year that saw U.S. Class 8 retail sales climb to the highest level since 2006, but production slow and orders slide after a few months, WardsAuto.com reported.

At the same time, all truck makers sold more of their proprietary engines compared with a year earlier, except for a 37-unit decline at Mercedes-Benz. Mercedes-Benz sales in the U.S. fall under Daimler Trucks North America along with Detroit Diesel Corp.

In 2019, Cummins notched a leading 34.8% of the total, or 112,756 out of 323,225, according to Ward’s. That was down from a year earlier when Cummins earned a top share of 38.3% with 118,857 of the 309,701 total engines.

The report breaks Class 8 engines into two segments, Group 1, under 10 liters, and Group 2, 10 liters and over. Cummins’ dominance with its smaller L9 engine ensured it posted the overall lead.

Cummins had an 88% share, or 25,343 engines of the total 28,829 in the Group 1 category. Others with engines in the under 10-liter category included Detroit Diesel, 1,853; Paccar Inc., 1,379; Mercedes-Benz, 210; and Hino Motors Manufacturing U.S.A. Inc. with 40.

In this group, Freightliner used the most Cummins engines at 15,403. International, a brand of Navistar Inc., was next with 7,023.

Detroit, Mercedes-Benz and Hino posted improvements in Group 1 in 2019 compared with a year earlier, while Paccar’s total fell from 1,742 in 2018. International, a unit of Navistar Inc., had no engines in the category after posting four in 2018.

Paccar makes the MX engine and the Kenworth Truck Co. and Peterbilt Motors Co. truck brands.

The figures come from a Ward’s report on North American factory sales of heavy-duty trucks, including their engines, released Jan. 31.

The Ward’s data this period reflected reporting changes involving Mexico, which included only trucks to U.S. and Canada. Ward’s also reported the Freightliner data is incomplete for North America. Freightliner is a brand of DTNA.

Last year, DTNA said the numbers it submits to Ward’s exclude Mexico volumes, without further explanation.

Meanwhile, Cummins could not retain its lead from a year earlier in the Group 2 category of engines 10 liters and over, surrendering it to DTNA’s Detroit engines.

“Original equipment manufacturers prioritized production of their own engines when making cuts to production in the second half of the year,” as demand stalled, Cummins CEO Tom Linebarger said during the company’s latest earnings call.

In 2019, DTNA’s 10-liter and more engines hit 97,927, or 33.2% of the total 294,396 in the category. Of those, 9,131 went into DTNA’s Western Star brand. The rest went into its market-leading Freightliner brand, which also used 24 Mercedes-Benz engines.

A year earlier, DTNA’s Group 2 total was 90,827, or 32% of a total 283,210 Group 2 engines.

Richard Howard, DTNA’s senior vice president of sales and marketing for Freightliner and Detroit, emphasized the investments the company has made in integrated powertrain that pairs Freightliner or Western Star trucks with Detroit engines, and the resulting benefits.

Detroit makes 13-, 15- and 16-liter engines for Group 2.

“We revealed the all-new DD15 Gen 5 late last year at the North American Commercial Vehicle show and we begin production in January 2021 to continue to deliver on the promise of performance, efficiency and maximum uptime,” Howard said.

In 2019, Cummins earned a 29.6% share of Group 2 engines with 87,413. That compares with its year-earlier leading 33.9% share of the total 283,210, or 96,105 — its all-time record for the segment in terms.

Cummins supplies its Group 2 engines to all OEMS, with Kenworth its largest customer followed by Peterbilt, which, respectively, used 29,416 and 25,186 engines. International used 24,099. Freightliner used 6,264.

At the same time Paccar increased its own MX engines overall to 40,627 compared with 36,471 a year earlier.

“Last year, we finished at 43% for engine sales with our MX engines. So that’s great. It was 47% actually in the fourth quarter,” Paccar CEO Preston Feight said during its latest earnings call.

International’s own engines overall rose to 10,203 compared with 9,464 a year earlier.

Its own engine is the 13-liter A26.

In part two of a two-part exploration of autonomous technology today, our latest RoadSigns podcast revisits conversations with Chuck Price of TuSimple and Ognen Stojanovski of Pronto.ai. Hear them discuss a palatable Level 2 version of trucking autonomy. Listen to a snippet above, and to hear the full episode, go to RoadSigns.TTNews.com.

“We see real growth opportunities with weight sensitive regional haulers and bulk carriers. Our 13-liter engine is the lightest in industry,” Steve Gilligan, vice president of product and vocational marketing for the North American business unit of Navistar Inc., told Transport Topics.

Volvo engines — used exclusively in trucks from Volvo Trucks North America — increased sales to 33,391 compared with 29,468 a year earlier.

Mack engines — used exclusively in Mack Trucks — rose to 26,218 compared with 22,898 in the 2018 period.

“For more than a century, Mack’s philosophy has been ‘components designed to work together, simply work better,’ which is why all Mack heavy-duty trucks come standard with Mack MP series engines,” said Roy Horton, director of product strategy for Mack Trucks.

“In certain cases where we do not offer proprietary engine solutions, including natural gas-powered engines and engines for our medium-heavy duty models, we offer Cummins engine options to complement our offer. The increase in factory engine sales last year is a reflection of Mack delivering more trucks during 2019, with customers continuing to count on us for the proven performance and reliability of our Mack MP engines.”

Want more news? Listen to today's daily briefing: