Senior Reporter

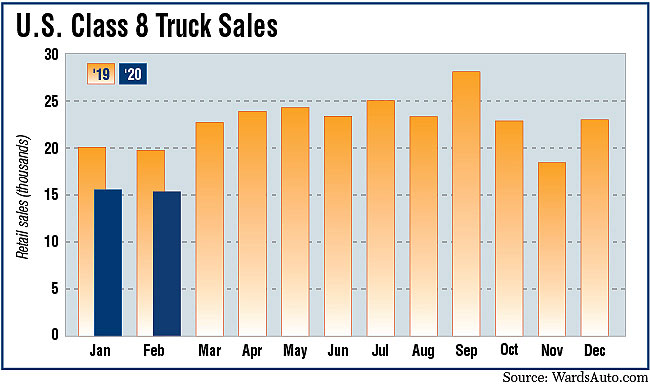

Class 8 Truck Sales Fall 22.1% in February

[Stay on top of transportation news: Get TTNews in your inbox.]

U.S. Class 8 retail sales in February dropped 22.1% to 15,460 compared with a year earlier, WardsAuto.com reported.

The exception was an increase at only a pair of truck makers, and they had the two smallest volumes.

A year earlier, Class 8 sales were 19,858, according to Wards.

“We have a book of business out there right now. Customers have raised their hands and said, “I want and need a truck and this is when I need it,’ ” said Steve Tam, vice president at ACT Research.

ACT believes customers will start changing their minds, reflecting the likelihood of a significant downside, he said. “This situation is just incredibly fluid. Extreme social distancing is occurring as we speak.”

As the coronavirus spreads in the United States, the freight market continues to slow down.

ACT is currently forecasting 2020 U.S. Class 8 retail sales to fall to 179,000, “but you could see North American numbers go below that level,” Tam said.

Sales were 276,348 in 2019.

Mack Trucks, a unit of Volvo Group, posted a 10% year-over-year gain with 1,279 trucks compared with 1,163, and that was good for an 8.3% market share.

“Mack Trucks’ positive February results were impacted by a shift in the Class 8 market mix toward vocational trucks, as well as strong interest in our advanced solutions that are lowering customers’ total cost of ownership by maximizing uptime, boosting fuel efficiency and driving productivity improvements,” said Jonathan Randall, Mack Trucks senior vice president of North American sales.

Western Star, a unit of Daimler Trucks North America, also posted a gain on sales of 459 trucks, up 18.9% compared with a year earlier when sales were 386. It earned a 3% share.

Host Seth Clevenger went to CES 2020 to look at the road ahead for electric-powered commercial vehicles. He spoke with Scott Newhouse of Peterbilt and Chris Nordh of Ryder System. Hear a snippet, above, and get the full program by going to RoadSigns.TTNews.com.

In related news, Western Star sold its 200,000th truck this month. It was upfitted as a vacuum excavator. It sold its 100,000th truck in February 2006 after 39 years in business.

Market leader Freightliner, also a DTNA brand, saw sales fall 27.1% to 5,844 compared with 8,018 a year earlier. It earned a 37.8% share.

Year-to-date-sales fell in much the same way, dropping 22.3% to 31,105 compared with 40,050 in the 2019 period. Again, Mack and Western Star were the only truck makers to post gains, respectively, of 3.4% and 4% compared with a year earlier.

One fleet executive said the carrier’s initial plans called for buying trucks toward the end of the year.

“I’m looking for late fourth-quarter delivery,” said Chase Adkins, corporate vice president at Sharp Transport Inc. “It won’t be a whole lot of trucks. That has a lot to do with how the economy deals with the coronavirus and how that affects rates and profitability, and really survival of some trucking companies.”

Sharp Transport, based in Ethridge, Tenn., is an over-the-road and dedicated carrier primarily running dry vans. It runs 130 trucks, including 105 company owned and 25 with owner-operators.

“But I think you put off purchasing new equipment whenever you are unsure of what the future may hold,” said Adkins. “So at this point I can’t say I’m certain on how that will go. If I had to make a decision today on agreeing to buy some equipment by the end of the year, I can’t say I would do it, yet.”

The goal is to be in that 150 to 200 truck range, he said. Sharp has been there before amid the ebbs and flows with customers and drivers, he said.

American Trucking Associations reported 91.3% of fleets are six or fewer trucks, and 97.4% operate fewer than 20.

“February’s volume wasn’t obviously great,” said Don Ake, vice president of commercial vehicles at FTR. “It could have been worse. February may have been impacted a little bit by coronavirus fears, but it more reflects the cautiousness of where the market started off for the year.”

Meanwhile, expect the second quarter to be tough inside and outside the industry, he said. “On the other hand goods still have to move. So trucks are still going to be needed. But we don’t know how confident the customers are going to be to buy them.”

International, the brand of Navistar Inc., sold 1,713 trucks compared with 2,739 a year earlier, for a 37.5% decline. It earned an 11.1% share.

During its most recent earnings call, Navistar reported production slots were filled for the second quarter, and the vocational, construction market is overall pretty good.

Volvo Trucks North America sold 1,326 trucks, down 23.9% compared with 1,743 a year earlier. It earned an 8.6% share.

Peterbilt Motors Co., a Paccar Inc. brand, sold 2,415 compared with 3,029 a year earlier, or a 20.3% drop. Its monthly share was 15.6%.

Kenworth Truck Co., also a Paccar brand, saw sales fall 12.8% to 2,424 compared with 2,780 a year earlier. It had a February share of 15.7%.

Want more news? Listen to today's daily briefing: