Senior Reporter

Class 8 Sales in May Jump 98.4% Year-Over-Year

[Stay on top of transportation news: Get TTNews in your inbox.]

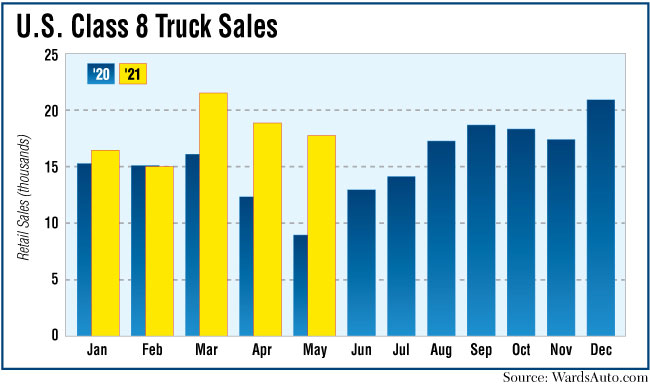

U.S. Class 8 retail sales in May cleared 18,000, WardsAuto.com reported, above replacement levels. Industry analysts said they were impressed with truck makers’ output given persistent supply chain constraints.

“It isn’t that the customers don’t want and need trucks. It’s we are figuring out how to deliver them,” said Steve Tam, vice president at ACT Research.

May sales rose 98.4% to 18,187 compared with 9,165 a year earlier. The total was above the accepted U.S. replacement level of 16,000 per month, or 190,000 per year.

A Peterbilt 579. Peterbilt Motors Co. improved a leading 162.1% to 2,933 sales. (Peterbilt Motors Co.)

“In the supply chain-constrained environment we are in, it’s not a bad number,” Tam said. “It’s phenomenal to me that we are able to do that despite the challenges we are facing.”

Tam said ACT’s full-year outlook is even better. It is forecasting U.S. Class 8 sales of 254,000 in 2021 as truck makers close the gaps in the supply chain throughout the remainder of the year, Tam said. “There’s absolutely no question the demand is there,” he said.

Year-to-date sales hit 91,714, according to Wards.

May’s total reflected truck makers getting the job done as best they could, said Don Ake, vice president of commercial vehicles at FTR. “There’s just not enough trucks available for sale to boost that monthly number up.”

Ake said demand for trucks is similar to what it was in May 2019, when sales reached 24,424, according to Wards. “In that context, May 2021 is a poor number,” he said.

Meanwhile, year-to-date sales are running 21% behind the comparable 2019 period, Ake said.

“That just proves how severe this supply chain issue is,” he said. “We’re stuck. Fleets have to adapt to this in that they desperately need the new trucks, and they can’t get them.”

They are leaving money on the table for the lack of trucks, he added. “The fleets can’t do anything about it. When you think about it, it’s extraordinary,” he said.

Still, he believes trucking can face the challenge. “People in our industry have seen this before. So we are better able to adapt because we have had to adapt before. This is nothing new to us. The severity is new to us, but the concept is not new to us.”

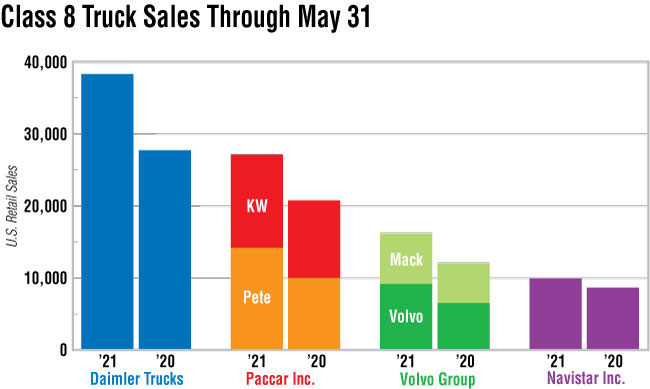

All truck makers but one, Western Star, notched year-over-year gains in May.

Dan Carrano, vice president of fleet maintenance at A. Duie Pyle Inc., said the carrier received new trucks in late April and early May after placing orders in November.

“We have received about 30 tractors, and have ordered more,” he said.

The West Chester, Pa.-based less-than-truckload carrier operates about 1,200 tractors and buys from Freightliner, Volvo Trucks North America and Peterbilt Motors Co.

“We identify what is the best dealer support for each service location,” he said. “So instead of stocking parts or operating three different brands out of one location, you are going to operate predominantly one brand. So you only have to stock one brand of parts and technicians become very proficient on working on one brand of truck. It’s proven to add efficiencies and lower maintenance costs.”

A. Duie Pyle Inc. ranks No. 70 on the Transport Topics Top 100 list of the largest for-hire carriers in North America.

Paccar Inc.’s two brands saw the biggest sales gains in May. Peterbilt Motors Co. improved a leading 162.1% to 2,933 sales, while Kenworth Truck Co. improved 128.6% on sales of 2,919.

Freightliner remained the market leader and improved 114.3% to 6,653 sales.

Western Star sold 447 trucks compared with 504 a year earlier, an 11.3% drop.

Freightliner and Western Star are units of Daimler Trucks North America.

Navistar Inc.’s International brand climbed 90.4 % to 2,277.

Mack Trucks was next, and improved 75.8% to 1,545 sales.

“The U.S. economy remains poised for growth, despite a dip in May retail spending, and Mack continues to see strong customer demand,” said Jonathan Randall, Mack Trucks senior vice president of North American sales and commercial operations. “Vocational demand remains strong, however on-highway demand seems to be driving much of the year-over-year Class 8 market growth.”

Randall said consumer spending, strong spot market rates and demand for drivers are compelling the need for new Class 8 trucks.

Volvo Trucks North America’s sales rose 30.4% to 1,413.

May sales, as with those in April, came in lower than expected due to the industry’s lingering supply chain challenges, and those disturbances are expected to persist for the immediate future, said Magnus Koeck, VTNA vice president of strategy.

“On top of that, the strike at our manufacturing plant in Dublin, Va., also affected our retail numbers negatively. However, our May numbers put us at a 10% year-to-date market share, a 0.6% improvement year-over-year,” he said.

He noted the company’s YTD market share in Canada is higher, 13.5%.

Mack and VTNA are brands of Volvo Group.

Class 8 sales in May also slipped from 19,312 in April.

Other truck makers either declined or did not respond to a request for comments.

Want more news? Listen to today's daily briefing below or go here for more info: