Senior Reporter

Class 8 Sales Increase 8.7% in July

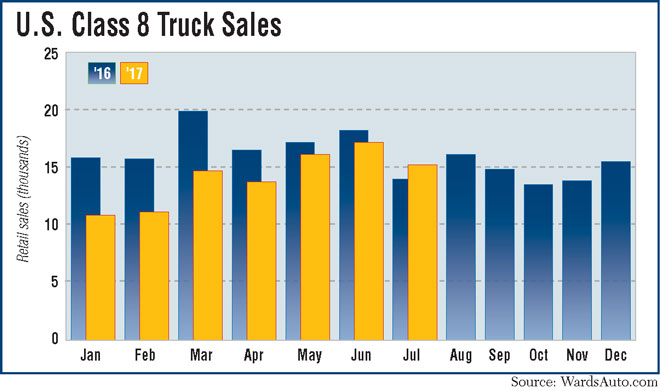

U.S. retail sales of Class 8 trucks rose in July, the first year-over-year gain since November 2015, amid reports carriers have begun expanding fleet size to meet rising demand now or to prepare for expected growth in 2018.

Class 8 sales jumped 8.7% to 15,317 in July, compared with 14,085 a year earlier, WardsAuto.com reported.

All truck makers except two posted higher sales in July, according to Ward’s — though only one improved in the seven-month period compared with the same time a year ago.

Year-to-date, sales fell 15.7% to 99,648, compared with 118,243 a year earlier, according to Ward’s.

“While July’s performance appears to help close the gap, our forecast is still calling for a decline in 2017 versus 2016,” ACT Research Co. Vice President Steve Tam said.

ACT forecasts U.S. retail sales to fall 5% to 186,100 this year, compared with 196,900 last year.

At the same time, fleets said they were adding trucks to accommodate growth.

“We have been going ‘guns out.’ We are extremely busy. We have buying power this year,” Peter Nativo, vice president of fleet solutions at Oakley Transport, told Transport Topics.

Oakley has added VNL models from Volvo Trucks North America. He said 20 are being built in August, 20 arrived in June plus the company “bought some in January and February, too. There was some replacement and some for growth.”

VTNA is a brand of Volvo Group.

Lake Wales, Fla.-based Oakley, which specializes in bulk liquid and food-grade transportation, operates 500 Class 8 trucks.

“A lot of these shippers are busy, and we are up on the rules [covering the sanitary transportation of human and animal food that took effect in April]. Also, we just got certified for ISO 22,000.2005 [a food management safety system], which I think is helping drive our business as well. There is a lot going on on the food side,” Nativo said.

A truckload carrier sees a capacity crunch coming soon and stronger markets, too.

“We are buying 60 trucks, about 10% of those are for growth. We take delivery of a few every week,” after placing the order in the spring, said Brian Matthews, vice president of operations at truckload carrier American Central Transport Inc.

“We anticipate a strong 2018, and this growth is gearing up for that. We are trying to get out in front of the potential better economic conditions and certainly a driver capacity crunch that may come from the electronic log device mandate [that takes effect Dec. 18],” Matthews said.

The Kansas City, Mo.-based fleet operates 325 trucks, and the latest additions include the Kenworth and Freightliner brands.

Kenworth Truck Co. is a unit of Paccar Inc. Freightliner is a brand of Daimler Trucks North America.

Meanwhile, Freightliner led with sales of 5,787 trucks, up 17.8% year-over-year and good for a 37.8% market share.

Western Star, DTNA’s niche brand, rose 14.8% to 442 trucks and a 2.9% share.

Kenworth sold 2,432 trucks, up 4.2% for a 15.9% share.

Peterbilt Motors Co., also a Paccar brand, rose 15.7% to 2,587 and a 16.9% share. Peterbilt was the sole truck maker to post a year-to-date gain, but it was just 0.7%

International Truck jumped 27.4% to 1,625 trucks, good for a 10.6% share.

International is a unit of Navistar International Corp.

International’s chief salesman wants his dealers to be quoting to all potential buyers looking at various brands.

“Someone who tells you, ‘We have a 75% closing rate on deals’ means that they are selling trucks to the same people over and over again, instead of being on all the deals,” said Jeff Sass, senior vice president, North America truck sales and marketing at Navistar International Corp.

The only declines were in the two Volvo Group brands.

VTNA dropped 17.9% to 1,282 trucks and an 8.4% share.

Mack Trucks fell 16.7% to 1,141, good for a 7.4% share. The company, however, pointed to its increase in year-over-year market share, to 9% from 8.8%.

Walsh

“Comparing July’s Class 8 retails sales to last year’s figures shows the smaller overall market we have been anticipating for 2017 at 225,000 trucks for North America [compared with 243,000 in 2016],” said John Walsh, vice president of global marketing and brand management for Mack Trucks.

Other truck makers did not respond by deadline to a request for comment.

Another industry observer said he has heard of numerous carriers over the past few weeks who are talking about buying trucks and growing the size of their fleet, but suggested dry van carriers especially would be better served by finding ways to achieve a lower operating ratio — expenses as a percentage of revenue.

“It’s just incredulous to me as soon as we get 60 good days, or more, [van carriers] begin to think about growing” their fleets, said Thomas Albrecht, principal of Sword and Sea Transport Advisors.