Bloomberg News

Citadel Acquires Yellow Debt Owned by Apollo, Other Lenders

[Stay on top of transportation news: Get TTNews in your inbox.]

An affiliate of Ken Griffin’s Citadel has acquired roughly $485 million in Yellow Corp. debt previously owned by Apollo Global Management Inc. and other senior lenders to the bankrupt trucking firm, according to a person familiar with the matter.

AUG. 19 UPDATE: Old Dominion tops Estes bid for Yellow terminals

The deal comes as Yellow seeks to secure a bankruptcy loan to fund its liquidation. Apollo and other senior lenders had offered to provide the company $142.5 million in new money to fund the trucking firm’s wind-down, but Yellow was approached with less expensive options after filing Chapter 11.

Apollo and other existing Yellow lenders won’t proceed with their proposed Chapter 11 loan as a result of the Citadel deal, the person said. A Yellow lawyer said last week it is considering alternative bankruptcy loans from hedge fund MFN Partners LP, the company’s largest shareholder, and rival trucking company Estes Express Lines.

Estes Express Lines ranks No. 14 on the Transport Topics Top 100 list of the largest for-hire carriers in North America. Estes Express Lines ranks No. 5 among the largest LTL carriers. Before shutting its doors July 30, Yellow ranked just ahead of Estes as the third-largest less-than-truckload carrier. Yellow also ranked No. 13 on the for-hire TT 100.

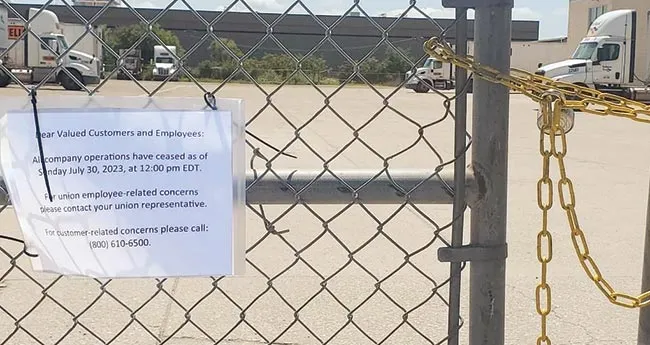

A posted notice informs customers and employees that Yellow Corp. ceased operations as of July 30.

(TT File Photo)

A Citadel spokesman declined to comment. Lawyers representing Citadel Credit Master Fund filed court papers Aug. 15 in Yellow’s bankruptcy. A representative for Apollo declined to comment.

The Financial Times first reported that Citadel acquired Yellow debt owned by Apollo and other lenders.

Yellow has said the alternative bankruptcy loans it’s considering are less expensive and will give the company more time to sell its valuable real estate portfolio and vast fleet of trucks and trailers. The Chapter 11 loan offered by funds managed by Apollo and other existing lenders carried 17% interest and higher fees.

The case is Yellow Corp. 23-11069, US Bankruptcy Court District of Delaware (Wilmington).

Want more news? Listen to today's daily briefing below or go here for more info: