China Said to Be Back for US Soy as Trade Talks Scheduled

China is back in the market for U.S. soybeans after taking a holiday break as Washington and Beijing plan more trade discussions.

On Jan. 2, Cofco Corp., China’s biggest food company, was asking for prices, according to four traders familiar with the process, who asked not to be identified because talks are private. The inquiries were for February and March delivery, three of the traders said. While there’s market talk that some purchases have been concluded, both Cofco and state stockpiler Sinograin declined to comment.

The renewed interest comes as trade officials from the two countries are scheduled to sit down in Beijing the week of Jan. 7 for the first face-to-face negotiation since President Donald Trump and his counterpart Xi Jinping agreed to a 90-day truce to their trade war last month. The prospect of more buying sent futures in Chicago up 1.3% on Jan. 2.

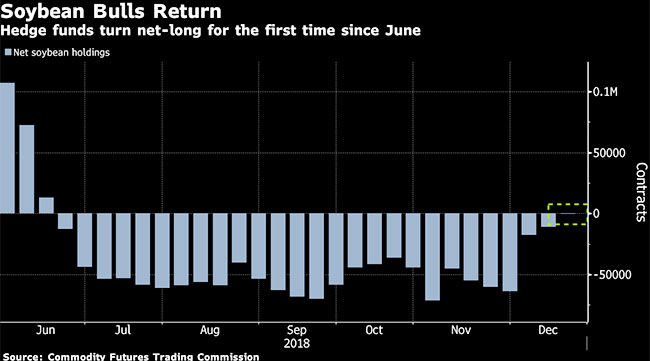

“It was a good start to 2019 for the beans,” Charlie Sernatinger, global head of grain futures for ED&F Man Capital Markets Inc. in Chicago, said in an e-mailed report. “Shorts covered off of talk that China was coming back in to buy U.S. cargoes and forecasts for Brazil went drier.”

Bloomberg News

China last made a big purchase of soybeans before Christmas, scooping up about 1.2 million metric tons for delivery by Aug. 31, according to the U.S. Department of Agriculture. That was on top of 1.56 million tons in the week ended Dec. 13. Cofco said it made two purchases, while Sinograin said it bought in batches “to implement the consensus achieved by state leaders.”

Bulk carrier Spitha is en route to China after loading soybean at the Export Grain Terminal in Longview, Wash., according to vessel tracking and USDA inspection data. EGT is a joint venture between Itochu Corp. and Bunge Ltd.

U.S.-China trade discussions are “coming along very well,” Trump said in a Cabinet meeting at the White House Jan. 2.

With the U.S. government shutdown, there won’t be any USDA confirmation if purchases are made. Despite speculation, traders said Jan. 3 that there were still no Chinese bids for other feed grains such as corn or sorghum.

“We heard indications out of China that buyers could come for U.S. corn in January, but we have yet to see confirmation,” said Arlan Suderman, chief commodities economist in Kansas City, Mo., for INTL FCStone. “Supplies are ample, but the balance sheet would quickly tighten if China re-enters the market with significant purchases.”