Bloomberg News

Boeing Overtakes Airbus in Plane Deliveries

[Stay on top of transportation news: Get TTNews in your inbox.]

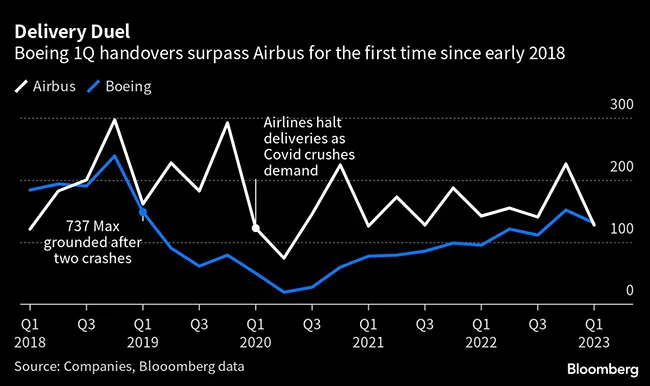

Boeing Co. delivered more jets in a single quarter than its archrival Airbus SE for the first time since mid-2018, a sign that the U.S. manufacturer’s production is getting back on track following years of disruptions.

The U.S. planemaker said April 11 that it delivered 130 aircraft in the first quarter, 37% more than a year ago, as it built cash-cow 737 jetliners at a steady cadence and cleared already-built Max and 787 Dreamliners from its storage yards. Airbus handed over 127 jets, a 9% drop from a year earlier, as it encountered parts shortages.

Boeing shipped 64 jets in March — nearly half its quarterly total — including 53 planes from its 737 family. It also recorded 60 new orders against 22 cancellations for the month.

That topped the 61 aircraft delivered in March by Airbus, the world’s biggest planemaker, whose factories are set to produce more jets each month.

Boeing shares rose 0.9% in late-morning trading in New York, while Airbus stock was little changed in Paris.

According to Bloomberg Intelligence, Boeing last out-delivered Airbus nearly five years ago as the European manufacturer faced engine shortages for its money-generating A320neo family. This time around, a dip in handovers to China’s airlines likely clipped Airbus’ results, said George Ferguson, an analyst with BI.

Both planemakers have struggled to keep pace with surging demand for fuel-efficient new jetliners in the wake of the COVID-19 pandemic. Boeing and Airbus are grappling with disrupted shipments from their constellation of suppliers and their own shortfalls as they work to speed output.

Boeing delivered a 767-300 freighter to FedEx Corp. and 11 of its 787 Dreamliners during the quarter after pausing handovers to deal with manufacturing lapses. The planemaker also shipped 113 jets from its 737 family, most of them Max models.

Now that its 737 factory south of Seattle has settled into a 31-jet-a-month rhythm, Boeing is laying plans to hike output there by 23% by midyear, Bloomberg reported earlier this month.

Company executives are likely to provide more guidance on the so-called rate break when Boeing reports earnings later this month, Credit Suisse analyst Scott Deuschle said in a report April 10. He raised Boeing’s target price by $20 to $220 on improving production and deliveries — and also cited the probability that the company unveils a significant number of new jet orders during the Paris Air Show in June.

Airbus still landed more jet sales during the first quarter, tallying 142 after cancellations. Boeing had 120 gross orders and netted 107 sales, including cancellations and an accounting provision for at-risk deals.

Want more news? Listen to today's daily briefing above or go here for more info

Last week, Airbus CEO Guillaume Faury said the planemaker planned to ramp up production at its China assembly line from four planes a month to six later this year. The company has been adapting the factory in Tianjin so it can build the larger A321 model.

Boeing, meanwhile, is adding a fourth 737 Max production line at its factory in Everett, Wash. — the first time the narrowbody has been built outside its traditional base in Renton, Wash.

— With assistance from Siddharth Philip and Anthony Palazzo.