Average Price of Diesel Slips 0.8¢ to $3.356 a Gallon

[Stay on top of transportation news: Get TTNews in your inbox.]

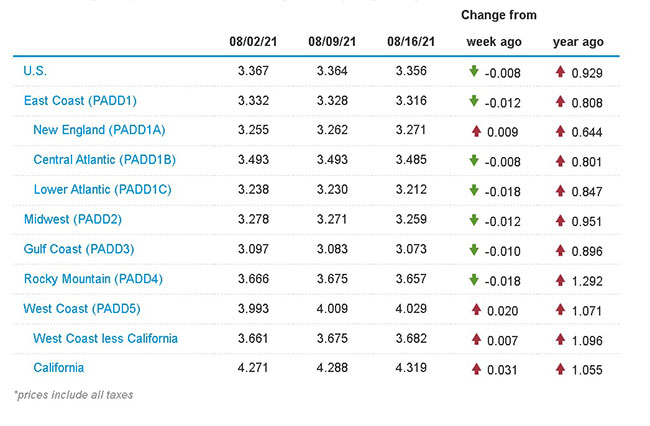

The national average price of diesel fuel dipped eight-tenths of a cent to $3.356 a gallon, according to Energy Information Administration data released Aug. 16.

Trucking’s main fuel dropped for the third time in the past four weeks after rising for 12 consecutive weeks, for a total of 23.2 cents, from May 3 to July 19. A gallon of diesel now costs 92.9 cents more than it did at this time in 2020.

Gasoline went in the opposite direction, with a slight 0.2 cent-increase to $3.174 a gallon on average.

How much impact does driver pay have in hiring drivers? And what else can fleets do to recruit and retain quality talent? Hear a snippet from DriverReach founder and CEO Jeremy Reymer, above, and listen to the full program at RoadSigns.TTNews.com.

Of the 10 regions in EIA’s weekly survey, the price of diesel went down in six and up in four. The Lower Atlantic and Rocky Mountain regions saw the biggest declines at 1.8 cents for both.

California saw the biggest increase at 3.1 cents to $4.319 a gallon.

“The trucking industry is very aware of the steady increase in diesel pricing per gallon since the beginning of the year,” Sherri Garner Brumbaugh, president of Garner Trucking Inc. and chairman of American Trucking Associations, told Transport Topics. “This cost increase will have an affect on the milk we buy, the clothes we will buy for our kids to go back to school, the tires we put on our vehicles. This economic impact at the pump will have a negative effect on all Americans, from our homes to how we get to work.”

Tom Kloza, founder and global head of energy analysis for Oil Price Information, said through much of the third quarter analysts had been split between those who think crude could peak at $80 a barrel and those who think it could hit $100. But the delta variant of the coronavirus has disrupted those predictions. He noted the market is taking a beating and that is going to put downward pressure on prices, particularly on gasoline.

“The last five years have seen August gasoline demand exceed July gasoline demand,” Kloza told TT. “We’re not going to see that this year.”

Kloza

Kloza expects gasoline demand may drop 6% or 7% in September. He added that while such a drop has been seen before, it is still steep — particularly with how hard refineries have been running.

“[Diesel] is weakened, but there’s a lot of people who are ready to buy diesel and sell gasoline futures,” Kloza said. “They’re betting that it’s going to be the strongest member of the barrels and gasoline might be the weakest. That’s sometimes a very good trade. But it’s really all about the delta variant and its impact.”

Kloza added the country doesn’t seem to be getting back to normal when it comes to the pandemic, which means disappointment on the demand side. But he noted some major disruption like a severe storm could disrupt the downward pressure on prices.

“The deterioration in the demand probably doesn’t have a lot to do with price,” Kloza said. “I think it’s the delta variant and the changes in behavior. Now it’s also the employment numbers. There are a lot of people that lost their jobs during COVID and have not regained their jobs, but there’s also a lot of people who took early retirement.”

Kloza added the workforce being smaller than it was prior to the pandemic means less driving. There are also more people working from home.

“I think, in some cases, we still have probably more lift coming in rates,” CFI President Greg Orr told TT. “I think as we roll into late Q3 and early Q4, with the amount of demand that is out there in key industries right now — along with the infrastructure bill and some of the other things that are getting passed — I just have a sneaking suspicion that we’re going to continue to see at least diesel prices continue to creep up.”

CFI is a truckload division of TFI International, which ranks No. 5 on the Transport Topics Top 100 list of the largest for-hire carriers in North America.

“We’ve got fuel surcharge programs at play,” Orr said. “I won’t call it protected, but we are in a position where we’re relatively secure unless we see very quick spikes. Meaning that if it goes up more than 5 or 6 cents at a time, that’s where the exposure comes in pretty quickly on the carrier side. So that’s definitely a risk.”

U.S. On-Highway Diesel Fuel Prices

EIA.gov

Want more news? Listen to today's daily briefing below or go here for more info: