Senior Reporter

August Class 8 Retail Sales Rise 2.8% Year-Over-Year

[Stay on top of transportation news: Get TTNews in your inbox.]

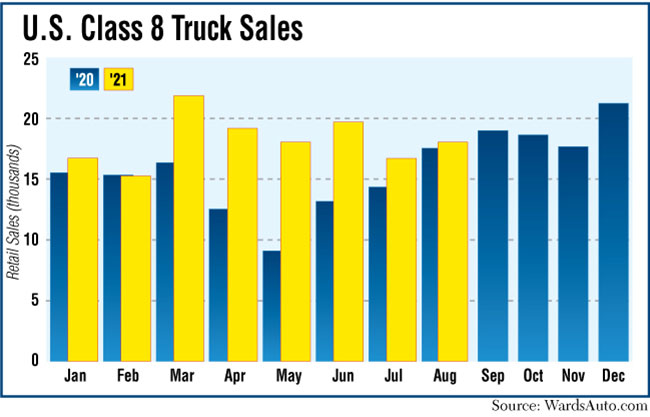

U.S. Class 8 retail sales in August inched slightly higher as truck makers posted mixed results compared with a year earlier, WardsAuto.com reported.

Class 8 sales bumped up 2.8% to 18,176 compared with 17,685 in the same 2020 period, according to Wards.

Through the first eight months of the year, Class 8 sales reached 146,552. That marks a 27.7% increase compared with a year earlier when sales were 114,795.

ACT Research Vice President Steve Tam told Transport Topics truck makers increased production in August compared with July. It was a “pretty decent uptick,” he said. “Some of those units probably made it across the sales finish line during the month as well.”

Longer term, ACT is lowering its 2021 Class 8 retail forecast to 231,500 units or so, an 18% increase year-over-year.

ACT’s prior sales forecast was 248,200, or a 27% year-over-year increase.

Class 8 sales in 2020 were 191,100, according to Wards.

All truck makers but two saw sales increase compared with a year earlier.

Freightliner, a unit of Daimler Trucks North America, remained the market leader with 6,646 sales, down 8.5% compared with 7,266 in the 2020 period. It earned a 36.6% share.

“Semiconductors continue to be the component with the greatest prolonged scarcity, but we’ve also seen short-lived constraints for plenty of other components,” David Carson, senior vice president of sales at DTNA, told TT.

“In contrast to past experience where we simply ordered and received parts, we’re now reaching far down into our supply chain to assist suppliers in planning for shortages, navigating constraints and working to help them keep the upstream flow of parts moving,” he added. “We’re also working closely with our dealers and customers to communicate clearly and frequently regarding the status of their orders. I’d like to emphasize that while I know no one wants to hear their truck won’t be ready exactly when they want it, our promise to every customer is to be completely straightforward about delivery times.”

Sales at Volvo Trucks North America, a unit of Volvo Group, dropped 36.2% to 1,193 compared with 1,871 a year earlier. VTNA’s August market share was 6.6%.

“We’re up and running in our manufacturing plant in Dublin, Va., after the strike during the summer and we are seeing our retail sales coming back as production is ramping up and we are currently hiring more employees,” Magnus Koeck, vice president of strategy at VTNA, told TT. “However, the general supply chain constraints, especially semiconductors, means the total market is coming in lower than anticipated, and we believe this will continue to be the situation going forward. It will take many months before we will see an improved balance between demand, supply and deliveries to the market.”

Mack Trucks, also a unit of Volvo Group, posted the largest jump in sales, 46.4%, as they reached 1,495 compared with 1,021 a year earlier. It earned an 8.2% share.

Mack Trucks posted the largest jump in sales, 46.4%. (Mack Trucks)

“Ongoing U.S. economic growth, largely from elevated consumer spending and residential construction activity, is fueling robust customer demand and growth for Mack,” Jonathan Randall, senior vice president of sales and commercial operations at Mack Trucks, told TT.

He said fleets are turning to new vocational and on-highway models to enhance fuel efficiency and uptime.

“Shortages continue to be a daily challenge,” Randall added, “but our purchasing and production teams are working hard to build as many trucks as we can, and minimize the impact on our customers as much as possible.”

International, a unit of Navistar Inc., had the second-highest sales in August with 2,867, compared with 2,279 a year earlier. That was a 25.8% increase. It notched a 15.8% share, also the second-highest.

Kenworth Truck Co. was on the heels of International, as its sales rose 20% to 2,861 units compared with 2,385 a year earlier. Its market share hit 15.7%.

Drivers want good health and education on emerging technologies. Paul Beavers of PCS Software and Dr. Bethany Dixon of Drivers Health Clinic share their insights. Hear a snippet above, and get the full program by going to RoadSigns.TTNews.com.

Sales at Peterbilt Motors Co. rose 7.3% to 2,605 compared with 2,428 in the 2020 period. It earned a 14.3% share.

Peterbilt and Kenworth are brands of Paccar Inc.

Western Star, a unit of DTNA, had a 17.3% jump in sales to 509 units compared with 434 a year earlier. It notched a 2.8% share.

Other truck makers were unavailable for comment.

Meanwhile, the Commerce Department reported U.S. retail sales in August climbed 0.7% following a downwardly revised 1.8% decrease in July. Excluding autos, sales advanced 1.8% in August, the largest gain in five months.

“While spending on goods was much stronger than we anticipated, that presumably will just add to the shortages seen in recent months, while the flatlining of spending in restaurants and bars suggest that the broader recovery in services consumption probably faltered,” Michael Pearce, senior U.S. economist at Capital Economics, said in a note.

The industry is heading into a “clearly historic” peak season, said ACT Research Vice President Tim Denoyer. “Unprecedented containership backlogs currently number about 125 at anchor at North American ports.”

Want more news? Listen to today's daily briefing below or go here for more info: