Senior Reporter

April US Class 8 Sales Clear 19,000, but Production Slows

[Stay on top of transportation news: Get TTNews in your inbox.]

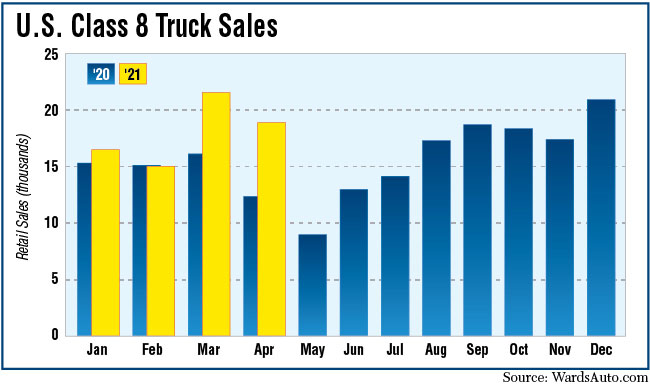

U.S. Class 8 retail sales jumped 52.8% compared with a year earlier to 19,312, WardsAuto.com reported, but others called it a disappointing number because it illustrated production slowed despite high demand.

In the 2020 period, sales were 12,637, according to Wards. That month saw freight plummet, the accelerating spread of the novel coronavirus and the temporary shutdown at all truck plants for various weeks.

Meanwhile, year-to-date sales rose 22.1% to 73,534 compared with 60,219 a year earlier.

The well-publicized, ongoing supply chain difficulties plus anecdotal reports of partially built trucks and slowing production have presented headwinds.

Tam

“It continues to be a situation of fleets not being able to take delivery when they would prefer to take delivery — as opposed to fleets not wanting trucks,” ACT Research Vice President Steve Tam told Transport Topics.

As for prices of new trucks, Dan Clark, head of BMO Transportation Finance said, “No doubt it’s a perfect storm for commercial vehicle equipment prices.

“In addition to standard supply and demand laws putting upward pressure on pricing for scarce new trucks, there is no doubt inflation within the truck manufacturing supply chain, and truck makers have a golden opportunity to justify and pass on to truck buyers the upward pressure they see on a myriad of scarce components — lumber, resins, rubber, steel, semiconductors and the rest.”

All truck makers posted double-digit gains except for the smallest, Western Star, which saw sales fall by 27 trucks year over year to 477. Western Star is a brand of Daimler Trucks North America.

Howard

DTNA’s Freightliner brand remained the market leader with sales in April of 7,065, a 63.7% increase compared with 4,315 in the 2020 period.

“We continue to communicate frequently and transparently with both our dealers and our customers to ensure they have the latest information regarding their order deliveries in these dynamic times,” said Richard Howard, DTNA senior vice president of on-highway sales. “Our suppliers and factories are doing a phenomenal job producing trucks for our fantastic customers.”

RELATED: Strike ends at VTNA Virginia plant

Volvo Trucks North America made the biggest leap, climbing 103.4% to 1,934 sales from 951 a year earlier.

Koeck

“In April, the total U.S. market was a little lower than expected, and we lost two weeks of production due to the strike at our plant in Dublin, Va.,” said Magnus Koeck, VTNA vice president of Strategy. “We’re looking forward to strong deliveries in May and June.”

Mack Trucks saw sales increase 55.1% to 1,649 compared with 1,063 in the 2020 period.

“Improved fuel efficiency, along with our comprehensive suite of uptime and connectivity services, nets bottom line improvements for our customers, which, while always important, is heightened even more so at this time,” said Jonathan Randall, Mack senior vice president of North American sales.

VTNA and Mack are brands of Volvo Group.

Ake

“April’s production was disappointing because we saw it go down from March on a per-day level, and it was down around 8% per day,” said Don Ake, FTR vice president of commercial vehicles. “They built fewer trucks, so they were able to sell fewer trucks. Everything today is supply chain-influenced.”

The truck makers are managing this as best they can, Ake added, “but realize it is a very complex, difficult situation to try to schedule production and run an efficient plant under the supply chain restrictions. In the industry, we have never seen the supply chain this disrupted.”

New Legend Inc., a Phoenix-based regional hauler, purchased 50 Freightliner Cascadia day cabs in April, 15 for replacement and 35 for growth, New Legend Director of Marketing Jani Inman said.

“The company’s owner, Sunny Samara, used to be a driver so he invests extra in the safety and comfort features for our drivers. Including: Detroit Assurance 5.0 with safety lane departure and blind-spot assist, automatic transmissions, LED lights, auxiliary power units and fridges.”

The year is 2039. Zero-emission, electric heavy-duty trucks roll past you on the highway. Charging ports are now commonplace at terminals and truck stops. Diesel-powered vehicles are becoming a thing of the past. You sit and wonder: How did we get here? Here, in 2021, Daimler Trucks North America's head of eMobility speaks to RoadSigns. Hear a snippet above, and get the full program by going to RoadSigns.TTNews.com.

Looking ahead, the company recently placed an order for 50 eCascadia trucks for use in Southern California as it prepares to switch all of its local running lanes to an entirely all-electric fleet by 2023.

Peterbilt Motors Co. saw sales rise 92.5% to 2,990 compared with 1,553 a year earlier.

Kenworth Truck Co. posted a sales increase of 31.2%, climbing to 3,005 compared with 2,290 a year earlier.

Peterbilt and Kenworth are brands of Paccar Inc.

International , a brand of Navistar Inc., saw sales rise 11.8% to 2,192 compared with 1,961 a year earlier.

“[Meanwhile,] despite all the gnashing of teeth about inflation, it hasn’t slowed consumption down, at least to this point. But it certainly has the ability to,” Tam said. “So the freight outlook remains positive.”

U.S. consumer prices climbed in April by the most since 2009, intensifying the already-heated debate about how long inflationary pressures will last, according to Bloomberg News.

Other truck makers declined or did not respond to a request for comment.

Want more news? Listen to today's daily briefing below or go here for more info: