3PLs Enjoy Solid 4Q Revenues

Third-party logistics firms saw total shipments rise in the fourth quarter of 2017, sending revenue and invoice amount-per shipment values jumping, but not enough to improve profits, according to the 3PL Market Report from the Transportation Intermediaries Association.

There were 1.4 million shipments in the quarter, up 7.8% from the fourth quarter of 2016, while revenue increased 17% to $2.8 billion, and the invoice amount-per-shipment rose 8.5% to $1,951. Profit margins fell 100 basis points to 14.6% from 15.6% a year ago.

Firms with annual revenue of less than $16 million saw their shipments jump nearly 28% and their revenue rise 7.8% while their margins rose 1.2%.

TIA is the trade association of the 3PL industry. It compiled the quarterly report using monthly data contributed by 36 TIA members. The quarterly comparisons includes only participating firms that submitted consistent data for both time periods.

The drop in margins reflects that costs were rising faster than the revenues billed to customers, noted Mark Cristos, Matson Logistics vice president, TIA secretary and market report chairman.

Fuel costs were up 40 cents a gallon, or nearly 14% year-over-year. And many 3PLs were whipsawed, paying more to get trucks from carriers while their revenues were stuck at locked-in contract rates negotiated earlier in the year from their shipper clients, he said.

“Carriers raised prices due to the great volume and tightening capacity. That lowered profit margins for brokers,” Cristos said.

Despite these challenges, the rise in volume was welcomed.

“We had a very good fourth quarter. There’s a huge service need in the market,” said Ryan Daube, CEO of AFN Logistics in Niles, Ill. AFN ranks No. 34 on the list of leading freight brokerage firms of the Transport Topics Top 50 Logistics Companies in North America.

Finding enough trucks became an issue in the quarter for AFN with the electronic logging device mandate and driver hour-of-service limits hurting capacity, Daube said.

The three primary modes of shipment — truckload, less-than-truckload and intermodal — saw increases in shipments in the quarter, with TL volume rising 7%, LTL up 14.6% and intermodal growing 3.2%. These modes account for 97% of 3PL shipment activity covered by the TIA study.

The TL segment had a solid quarter with total shipments rising 7%, the invoice amount per load gaining nearly 10% to $1,679 and a profit margin of 14.8%.

TL companies with annual revenues more than $100 million saw total loads rise 9% and their invoice amount per load go up more than 5% to $1,674. In comparison, TL firms with revenues of less than $16 million saw virtually no change in total number of loads and profit margin per load.

In the LTL arena, smaller firms experienced a dramatic drop of 480 basis points in their margins as total shipments jumped 50%. The profit margin per load dropped more than 13% to $150.

The intermodal segment recorded a modest 3.2% increase in shipments, but the invoice amount per load fell more than 6% and profit margins declined to 8.6%.

Much of that drop was due to locked-in contract rates, said Frank McGuigan, CEO of Dallas-based Transplace.

“In response, some brokers went to their [shipper] customers and asked for relief,” McGuigan said. “Some shippers agreed to pay more for shipping as long as the rate increase was reasonable and the broker could guarantee capacity.”

With that kind of flexibility in place, “I expect intermodal margins to improve this year and broker margins this year to be very positive,” he said. Transplace ranks No. 46 on the Top 50 logistics companies list.

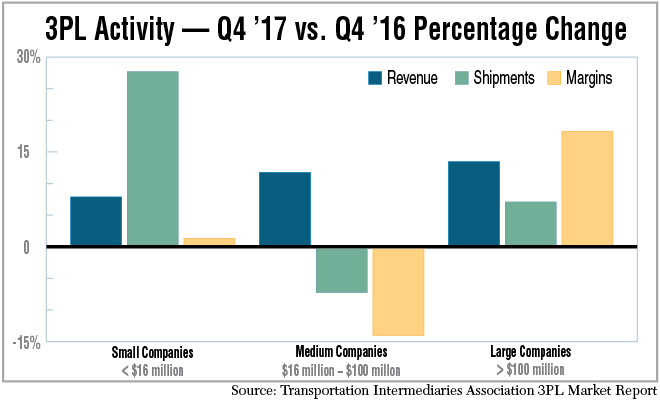

In a comparison of firms by size, TIA found that those with annual revenues of more than $100 million surpassed smaller firms. Larger 3PLs saw revenues rise 13.4%, shipments grow 7% and margins jump 18.2% in fourth-quarter 2017. Firms with revenues between $16 million and $100 million saw revenues rise nearly 12%, but the number of shipments fell 7.4%. Firms with revenues of less than $16 million saw revenues rise about 7.8% as shipments jumped almost 28%, but margins managed only a 1.2% increase.

Rome, Ga.-based Scott Logistics recorded a revenue rise of more than 37% in the fourth quarter compared with the previous year, and its gross profit margin percentage increased to 14.4%, according to President Jay Matthews.

“We feel that this increase is attributable principally to shippers’ reaction to increased demand in the marketplace, largely fueled by the natural disasters that occurred last fall,” Matthews said.

He predicts that demand, coupled with the ELD mandate, will continue to disrupt capacity for the rest of the year.