160 US Carrier Bankruptcies Idle 4,510 Trucks in 4th Quarter

This story appears in the March 20 print edition of Transport Topics.

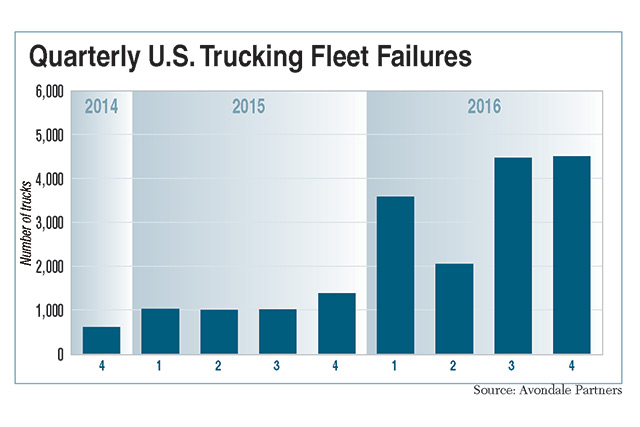

The freight-hauling capacity of at least 4,510 heavy-duty U.S. trucks evaporated during the last three months of 2016 as 160 fleets shuttered their doors and quit the industry, according to a study by investment firm Avondale Partners.

The fourth-quarter result was sharply higher than the 90 firms with 1,380 trucks that closed during the same time in 2015, but Donald Broughton, the author of the report, said the overall failure rate in 2015 was uncommonly low.

The fourth quarter was similar to the 2016 third quarter, when 185 carriers with 4,475 trucks went under. Broughton said the failure rate throughout 2016 was low by historical standards, although higher than the previous year. The fleets that closed during the fourth quarter — through bankruptcy or other means — had an average size of 28 trucks, he said.

Although recent employment reports have heralded some desirable developments in construction and manufacturing, key customer segments for trucking, the Avondale report was not optimistic about the truckload sector. Broughton described an industry that is stuck in an uncomfortable position.

“Persistent cost inflation [for new equipment], relatively tepid demand and soft pricing for two straight years left many marginal carriers on the edge of exiting the industry — while most large carriers were seeing operating income from their trucking divisions decline over this timeframe,” he said. “The mounting pressure brought on by increased regulations [including electronic logging devices and hours of service] has begun to push many of these fleets into outright failure, rather than the slow death of trading ‘three for two,’ or more gracefully exiting via selling to a competitor.”

Throughout his report Broughton placed much emphasis on the federal regulatory change coming in December that mandates the recording of driver hours of service with ELDs. He said the ELD rule is “wholesale” or widespread enforcement of hours of service, as compared with the less concentrated, less-rigorous “retail” effort that has been used.

Broughton also said the current failure rate probably should be higher, but used-truck prices have kept some carriers in business longer than they might otherwise like.

“The drop in used equipment values means it is more difficult for carriers to exit the industry in a graceful manner,” he said.

Bob Costello, chief economist for American Trucking Associations, agreed that carrier failures soon could increase.

“I’m thinking this situation is ripe for acceleration with firms leaving the industry. We could see more cashing out,” Costello said, referring to owners selling off assets and going out of business.

Costello also mentioned ELDs as a reason for exits, perhaps at the end of this year or in January 2018, and said high insurance rates for liability coverage is another big issue. Costello also agreed with Broughton on fewer opportunities for “graceful” exits.

“The big fleets are not necessarily going to be willing to buy those smaller companies,” he said.

ACT Research Co. economist Jim Meil said he is optimistic about truck freight in coming quarters because “we’re starting to see a revival in U.S. manufacturing.” Therefore, the need for trucking services will not decline soon.

Broughton’s point, though, is that the shape of trucking needs to change so that those services can be provided in a way that is profitable for the owners of tractors and trailers.

“Despite a fairly healthy recovery in demand, rates and equipment values [from the bottom of the Great Recession], few truckers are producing a return on invested capital that is greater than their cost of debt, and even fewer are making a ROIC that exceeds their cost of capital,” he said of the truckload industry, trucking’s dominant sector.

The profitability problem can be cured, he said, with either a sharp increase in demand for trucking services or carriers with pricing power that can get better rates.

As for the present, he told Avondale clients, “Our confidence in trucking stocks is lower in the short to intermediate term due to the low level of pricing power continuing to fall short of cost inflation.”

Broughton has been studying trucking company failures for almost 20 years. In the early 2000s, he showed how they correlated with the price of diesel fuel.

Spiking prices would lead to a jump in failures about nine months later. Plunges in fuel prices led to sharp reductions in failures shortly thereafter.

While he said fuel prices still are tremendously important for truckload carriers — especially large, sudden changes — Broughton said he is paying close attention to labor issues.

“The driver is the new driver” of success or failure for a carrier, he quipped. Broughton said truckload carriers face significant competition from construction companies and manufacturers for labor, and that many of those people probably would prefer those two industries to truck driving.

Recruiting and retaining a large stable of drivers will remain a critical challenge for fleet executives trying to offer shippers a reliable supply of freight-hauling capacity, he said.